Offering Details

Back

Under Review / Tetonka Resources Inc.

Tetonka Resources Inc.

Property Divestiture

Property DivestitureBid Deadline: March 28, 2024

12:00 PM

Download Full PDF - Printable

OVERVIEW

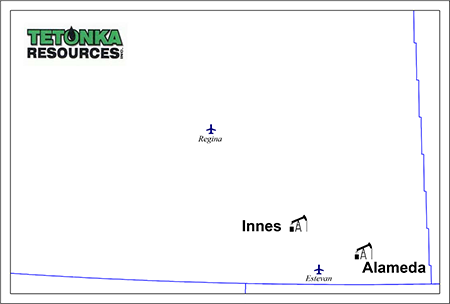

Tetonka Resources Inc. (“Tetonka” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the sale of certain non-core oil and natural gas interests located in the Alameda and Innes areas of southeastern Saskatchewan (the “Properties”).

Average daily production net to Tetonka from the Properties in 2023 was approximately 12 barrels of oil per day.

Operating income net to Tetonka from the Properties for the fourth quarter of 2023 was approximately $31,000, or $124,000 on an annualized basis.

As of December 28, 2023, the Properties had a deemed net asset value of $560,693 (deemed assets of $721,193 and deemed liabilities of $160,500), with an LMR ratio of 4.49.

Further information relating to the Properties will be available in the virtual data room to parties that execute a confidentiality agreement.

Average daily production net to Tetonka from the Properties in 2023 was approximately 12 barrels of oil per day.

Operating income net to Tetonka from the Properties for the fourth quarter of 2023 was approximately $31,000, or $124,000 on an annualized basis.

As of December 28, 2023, the Properties had a deemed net asset value of $560,693 (deemed assets of $721,193 and deemed liabilities of $160,500), with an LMR ratio of 4.49.

Further information relating to the Properties will be available in the virtual data room to parties that execute a confidentiality agreement.

Production Overview

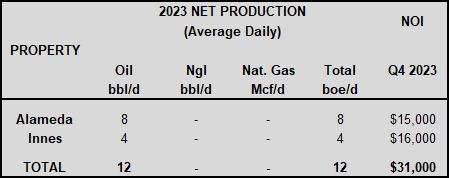

Average daily production net to Tetonka from the Properties in 2023 was approximately 12 barrels of oil per day.

Operating income net to Tetonka from the Properties for the fourth quarter of 2023 was approximately $31,000, or $124,000 on an annualized basis.

Average daily production net to Tetonka from the Properties in 2023 was approximately 12 barrels of oil per day.

Operating income net to Tetonka from the Properties for the fourth quarter of 2023 was approximately $31,000, or $124,000 on an annualized basis.

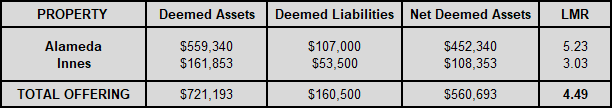

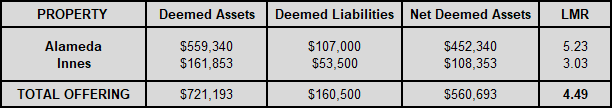

LMR Summary

The LMR for each of the Properties as of December 28, 2023 is summarized below.

The LMR for each of the Properties as of December 28, 2023 is summarized below.

Summary of LMR by Property

As of December 28, 2023, the Properties had a deemed net asset value of $560,693 (deemed assets of $721,193 and deemed liabilities of $160,500), with an LMR ratio of 4.49.

Reserves Overview

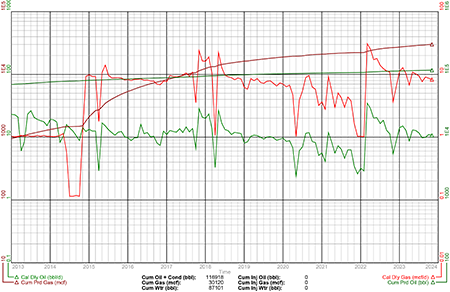

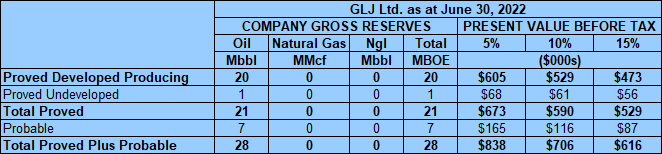

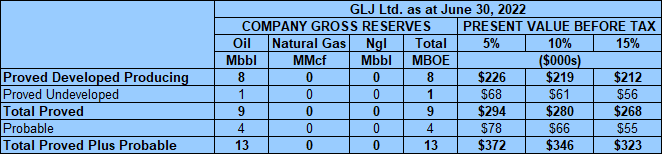

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2022 using GLJ’s forecast pricing as of July 1, 2022.

GLJ estimated that, as at June 30, 2022, the Properties contained remaining proved plus probable reserves of 28,000 barrels of oil, with an estimated net present value of $706,000 using forecast pricing at a 10% discount.

Reserves Overview

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2022 using GLJ’s forecast pricing as of July 1, 2022.

GLJ estimated that, as at June 30, 2022, the Properties contained remaining proved plus probable reserves of 28,000 barrels of oil, with an estimated net present value of $706,000 using forecast pricing at a 10% discount.

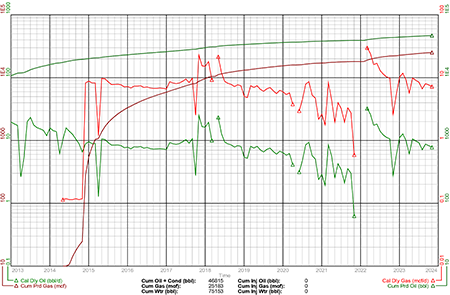

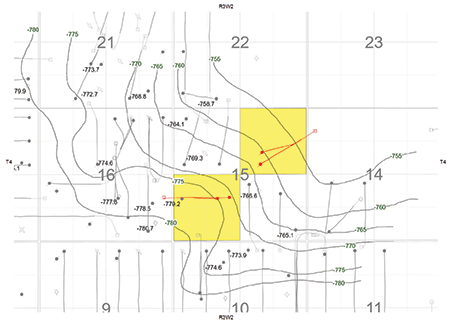

ALAMEDA

Township 4, Range 3 W2

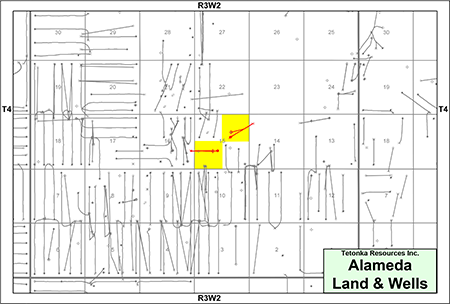

At Alameda, Tetonka holds working interests in two quarter sections of land, including a 65% working interest in P&NG to the base of the Midale Beds on the northeast quarter of Section 15-004-03W2 and a 53.75% working interest in the southwest quarter of Section 15-004-03W2.

The property consists of operated oil production from the Midale Formation.

Average daily production net to Tetonka from Alameda in 2023 was approximately eight barrels of oil per day.

Operating income net to Tetonka from Alameda for the fourth quarter of 2023 was approximately $15,000 or $60,000 on an annualized basis.

At Alameda, Tetonka holds working interests in two quarter sections of land, including a 65% working interest in P&NG to the base of the Midale Beds on the northeast quarter of Section 15-004-03W2 and a 53.75% working interest in the southwest quarter of Section 15-004-03W2.

The property consists of operated oil production from the Midale Formation.

Average daily production net to Tetonka from Alameda in 2023 was approximately eight barrels of oil per day.

Operating income net to Tetonka from Alameda for the fourth quarter of 2023 was approximately $15,000 or $60,000 on an annualized basis.

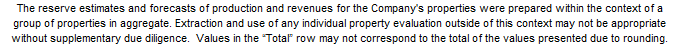

Alameda Upside

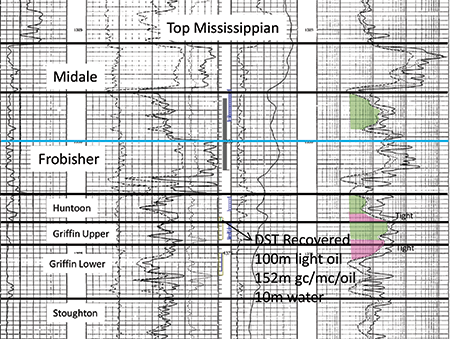

The Company has identified the opportunity for horizontal drilling in the Frobisher (Griffin) Formation on its lands at Alameda as shown on the following well logs.

The Company has identified the opportunity for horizontal drilling in the Frobisher (Griffin) Formation on its lands at Alameda as shown on the following well logs.

Spartan Alameda West 121/08-16-004-03W2/0

Frobisher (Griffin) Formation Type Log

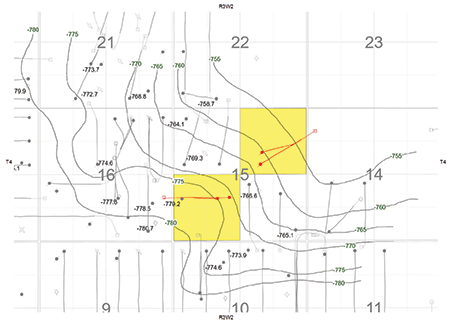

Alameda - Frobisher (Griffin) Structure Map

Frobisher (Griffin) Formation Type Log

Alameda - Frobisher (Griffin) Structure Map

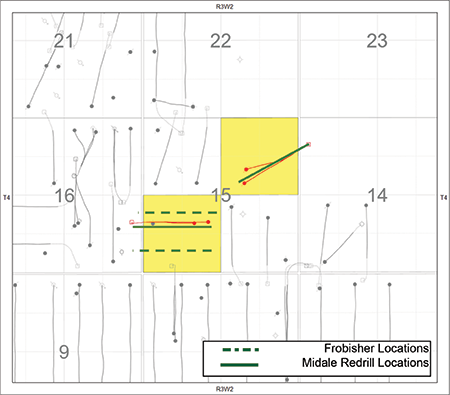

The Company has identified two horizontal Frobisher drilling locations at Alameda as shown in dashed green on the following map. The Company has also identified two locations which could be re-drilled in the Midale Formation or the Frobisher Formation as shown in solid green on the following map. The initial wells were not appropriately drilled and completed to optimize production from the Midale.

Alameda Seismic

In the Alameda area, Tetonka has certain trade 3D seismic data as shown on the following plat. More details relating to the seismic will be available in the virtual data room for parties that execute a confidentiality agreement.

In the Alameda area, Tetonka has certain trade 3D seismic data as shown on the following plat. More details relating to the seismic will be available in the virtual data room for parties that execute a confidentiality agreement.

Alameda Facilities

Tetonka does not have ownership in any facilities at Alameda.

Alameda Marketing

Tetonka has an evergreen purchase agreement in place with Trafigura Canada Limited for light sour blend crude at the Kingston Westspur Pipeline from the Steelman Terminal at 005-03W2.

Alameda Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2022 using a GLJ’s forecast pricing as at July 1, 2022.

GLJ estimates that, as at June 30, 2022, the Alameda property contained remaining proved plus probable reserves of 13,000 barrels of oil, with an estimated net present value of $346,000 using forecast pricing at a 10% discount.

Tetonka does not have ownership in any facilities at Alameda.

Alameda Marketing

Tetonka has an evergreen purchase agreement in place with Trafigura Canada Limited for light sour blend crude at the Kingston Westspur Pipeline from the Steelman Terminal at 005-03W2.

Alameda Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2022 using a GLJ’s forecast pricing as at July 1, 2022.

GLJ estimates that, as at June 30, 2022, the Alameda property contained remaining proved plus probable reserves of 13,000 barrels of oil, with an estimated net present value of $346,000 using forecast pricing at a 10% discount.

Alameda LMR as of December 28, 2023

As of December 28, 2023, the Alameda property had a deemed net asset value of $452,340 (deemed assets of $559,340 and deemed liabilities of $107,000), with an LMR ratio of 5.23.

As of December 28, 2023, the Alameda property had a deemed net asset value of $452,340 (deemed assets of $559,340 and deemed liabilities of $107,000), with an LMR ratio of 5.23.

Alameda Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

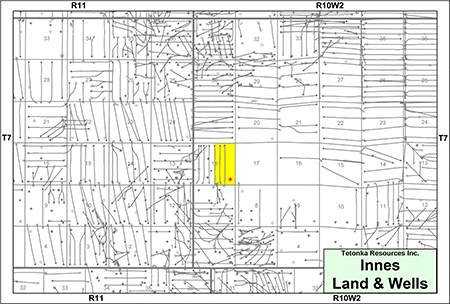

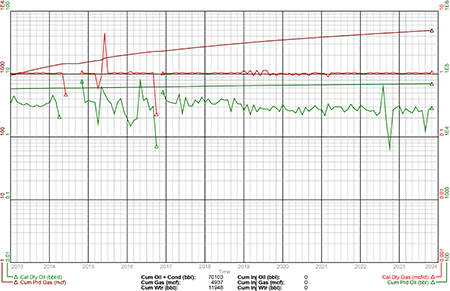

INNES

Township 7, Range 10 W2

At Innes, Tetonka holds working interests ranging from 80-100% in one half section of land with P&NG rights to the base of the Midale Formation. The Company has production from the Midale formation from the well JoeandCo Midale 101/01-18-007-10W2/2.

There is offsetting development of the Bakken Formation at Innes, primarily from Crescent Point Energy Corp. and Saturn Oil & Gas Inc.

Average daily production net to Tetonka from Innes for the year 2023 was approximately four barrels of oil per day.

Operating income net to Tetonka from Innes for the fourth quarter of 2023 was approximately $16,000 or $64,000 on an annualized basis.

At Innes, Tetonka holds working interests ranging from 80-100% in one half section of land with P&NG rights to the base of the Midale Formation. The Company has production from the Midale formation from the well JoeandCo Midale 101/01-18-007-10W2/2.

There is offsetting development of the Bakken Formation at Innes, primarily from Crescent Point Energy Corp. and Saturn Oil & Gas Inc.

Average daily production net to Tetonka from Innes for the year 2023 was approximately four barrels of oil per day.

Operating income net to Tetonka from Innes for the fourth quarter of 2023 was approximately $16,000 or $64,000 on an annualized basis.

Innes Upside

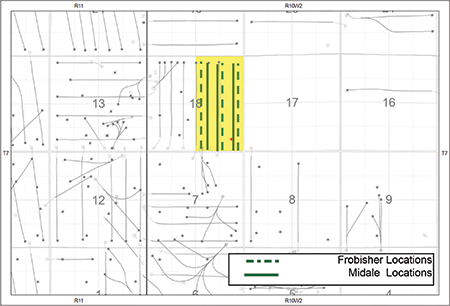

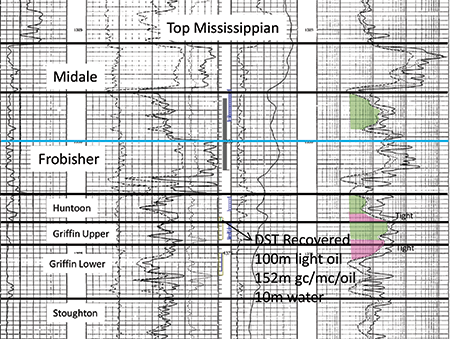

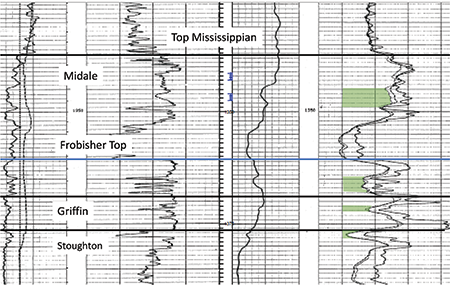

The Company has identified a number horizontal drilling opportunities in the Frobisher (Griffin) Formation on its lands at Innes as shown on the following well logs.

The Company has identified a number horizontal drilling opportunities in the Frobisher (Griffin) Formation on its lands at Innes as shown on the following well logs.

JoeandCo Midale 101/01-18-007-10W2/02

Frobisher (Griffin) Formation Type Log

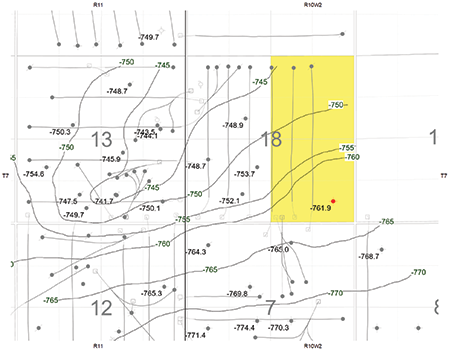

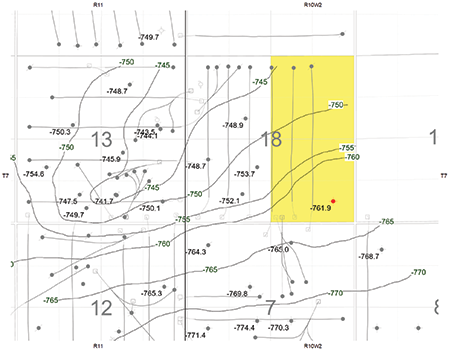

Innes - Frobisher (Griffin) Structure Map

Frobisher (Griffin) Formation Type Log

Innes - Frobisher (Griffin) Structure Map

The Company has identified three horizontal Frobisher drilling locations at Innes as shown in dashed green on the following map. The Company has also identified three horizontal Midale drilling locations as shown in solid green on the following map.

Innes Facilities

Tetonka does not have ownership in any facilities at Innes.

Innes Marketing

Tetonka has an evergreen purchase agreement in place with Trafigura for light sour blend crude at the Kingston Sask Pipeline from 11-02-005-12W2.

Innes Reserves

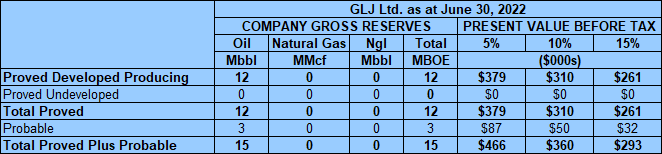

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2022 using a GLJ’s forecast pricing as at July 1, 2022.

GLJ estimates that, as at June 30, 2022, the Innes property contained remaining proved plus probable reserves of 15,000 barrels of oil, with an estimated net present value of $360,000 using forecast pricing at a 10% discount.

Tetonka does not have ownership in any facilities at Innes.

Innes Marketing

Tetonka has an evergreen purchase agreement in place with Trafigura for light sour blend crude at the Kingston Sask Pipeline from 11-02-005-12W2.

Innes Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2022 using a GLJ’s forecast pricing as at July 1, 2022.

GLJ estimates that, as at June 30, 2022, the Innes property contained remaining proved plus probable reserves of 15,000 barrels of oil, with an estimated net present value of $360,000 using forecast pricing at a 10% discount.

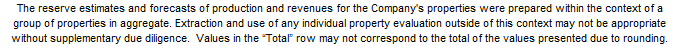

Innes LMR as of December 28, 2023

As of December 28, 2023, the Innes property had a deemed net asset value of $108,353 (deemed assets of $161,853 and deemed liabilities of $53,500), with an LMR ratio 3.03.

As of December 28, 2023, the Innes property had a deemed net asset value of $108,353 (deemed assets of $161,853 and deemed liabilities of $53,500), with an LMR ratio 3.03.

Innes Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

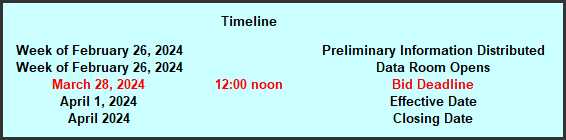

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Properties until 12:00 pm on Thursday March 28, 2024.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transactions with the parties submitting the most acceptable proposals at the conclusion of the process.

transactions with the parties submitting the most acceptable proposals at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday March 28, 2024.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Properties with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (brye@sayeradvisors.com) or fax (403.266.4467).Included in the confidential information is the following: summary land information, the GLJ Report, LMR information, most recent net operations summary and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Ben Rye, Tom Pavic or Sydney Birkett at 403.266.6133.