Offering Details

Back

Under Review / Teine Energy Ltd.

Teine Energy Ltd.

Property Divestiture

Property DivestitureBid Deadline: April 18, 2024

12:00 PM

Download Full PDF - Printable

OVERVIEW

Teine Energy Ltd. (“Teine” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the sale of certain non-core oil and natural gas interests located in the Pembina area of Alberta (the “Property”). The Property consists of operated, 100% working interest in Duvernay acreage and production. Teine is selling the Property in order to focus its operations on its core areas.

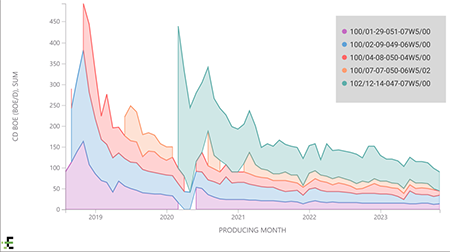

Average daily production net to Teine from the Property for calendar year 2023 was approximately 117 boe/d, consisting of 99 barrels of oil and natural gas liquids per day and 107 Mcf/d of natural gas.

Operating income net to Teine from the Property for the year ended December 31, 2023 was approximately $2.5 million.

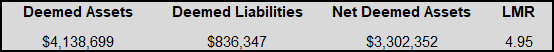

As of February 3, 2024, the Property had a deemed net asset value of $3.3 million (deemed assets of $4.1 million and deemed liabilities of $836,347), with an LMR ratio of 4.95.

Average daily production net to Teine from the Property for calendar year 2023 was approximately 117 boe/d, consisting of 99 barrels of oil and natural gas liquids per day and 107 Mcf/d of natural gas.

Operating income net to Teine from the Property for the year ended December 31, 2023 was approximately $2.5 million.

As of February 3, 2024, the Property had a deemed net asset value of $3.3 million (deemed assets of $4.1 million and deemed liabilities of $836,347), with an LMR ratio of 4.95.

PEMBINA

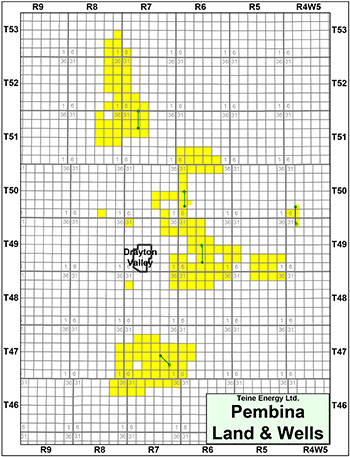

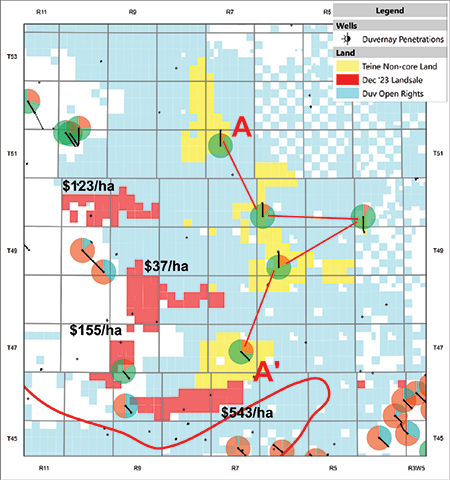

Township 46-53, Range 4-8 W5

Teine holds a 100% working interest in the Property, which consists of approximately 177 sections of Crown land, on which there are five wells currently drilled into the Duvernay Formation.

Average daily production net to Teine from the Property for the calendar year 2023 was approximately 117 boe/d, consisting of 99 barrels of oil and natural gas liquids per day and 107 Mcf/d of natural gas.

Operating income net to Teine from the Property for the year ended December 31, 2023 was approximately $212,000 per month or $2.5 million on an annualized basis.

Teine holds a 100% working interest in the Property, which consists of approximately 177 sections of Crown land, on which there are five wells currently drilled into the Duvernay Formation.

Average daily production net to Teine from the Property for the calendar year 2023 was approximately 117 boe/d, consisting of 99 barrels of oil and natural gas liquids per day and 107 Mcf/d of natural gas.

Operating income net to Teine from the Property for the year ended December 31, 2023 was approximately $212,000 per month or $2.5 million on an annualized basis.

Duvernay Geology

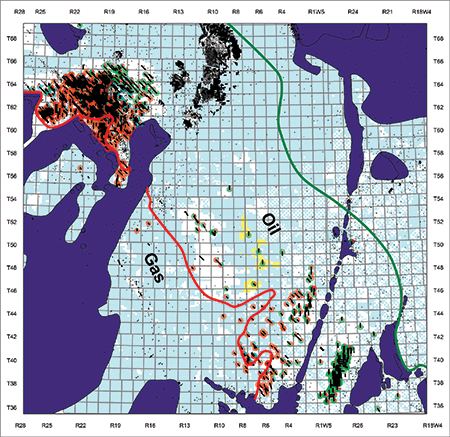

Regionally the Devonian Duvernay Formation is a low energy accumulation deposited in a basinal setting bound by the Devonian Leduc Reef build ups. The Duvernay Formation typically consists of stacked tight basinal carbonate beds and organic-rich shales with limestone matrix log porosities up to 15%, which are the main target for resource development.

The Duvernay sits above the non-productive clay rich shales of the Majeau Lake Formation and is overlain by the non-productive clay rich shales of the Ireton Formation. Aerially south of Township 055, the Duvernay is split into the East and West Shale Basins separated by the Rimbey-Meadowbrook Leduc reef trend. The Property lies within the Bigoray and Pembina strike areas within the West Shale Basin.

Teine holds over 45,000 hectares (177 sections) of largely continuous land through this highly prospective regional fairway.

Regionally the Devonian Duvernay Formation is a low energy accumulation deposited in a basinal setting bound by the Devonian Leduc Reef build ups. The Duvernay Formation typically consists of stacked tight basinal carbonate beds and organic-rich shales with limestone matrix log porosities up to 15%, which are the main target for resource development.

The Duvernay sits above the non-productive clay rich shales of the Majeau Lake Formation and is overlain by the non-productive clay rich shales of the Ireton Formation. Aerially south of Township 055, the Duvernay is split into the East and West Shale Basins separated by the Rimbey-Meadowbrook Leduc reef trend. The Property lies within the Bigoray and Pembina strike areas within the West Shale Basin.

Teine holds over 45,000 hectares (177 sections) of largely continuous land through this highly prospective regional fairway.

The 102/12-14-047-07W5 horizontal well on the south block is in the volatile oil window targeting the Duvernay A in the lower half of the overall Duvernay package. A microseismic data set was acquired during the completion of this well and is available. It showed significant reservoir stimulation and fracture growth through the vertical section. The 102/12-14-047-07W5 well to date has produced 90,000 barrels of oil and 209 MMcf of natural gas.

The remaining four wells were drilled in the black oil window targeting the Duvernay C & D units in the upper half of the Duvernay. Together these wells to date have produced 225,000 barrels of oil and 182 MMcf of natural gas.

The remaining four wells were drilled in the black oil window targeting the Duvernay C & D units in the upper half of the Duvernay. Together these wells to date have produced 225,000 barrels of oil and 182 MMcf of natural gas.

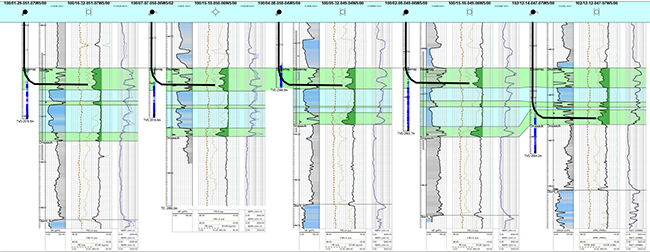

Each of the Company’s horizontal wells on the Property has an associated vertical stratigraphic test on the padsites.

The following cross section A - A’ presents these stratigraphic test wells from north to south along with indicating the stratigraphic position of each associated horizontal well. The Teine wells have total Duvernay thicknesses ranging from 31-40, resistivities up to 1,000 ohms and porosities of up to 21% (limestone matrix logs Ø). All of the acreage is over-pressured. The observed pressure gradients range from 12 kpa/m at 100/05-32-049-04W5 to 15 kpa/m at 102/12-12-047-07W5.The following cross section A - A’ presents these stratigraphic test wells from north to south along with indicating the stratigraphic position of each associated horizontal well. The Teine wells have total Duvernay thicknesses ranging from 31-40, resistivities up to 1,000 ohms and porosities of up to 21% (limestone matrix logs Ø). All of the acreage is over-pressured. The observed pressure gradients range from 12 kpa/m at 100/05-32-049-04W5 to 15 kpa/m at 102/12-12-047-07W5.

The following cross section A - A’ presents these stratigraphic test wells from north to south along with indicating the stratigraphic position of each associated horizontal well. The Teine wells have total Duvernay thicknesses ranging from 31-40, resistivities up to 1,000 ohms and porosities of up to 21% (limestone matrix logs Ø). All of the acreage is over-pressured. The observed pressure gradients range from 12 kpa/m at 100/05-32-049-04W5 to 15 kpa/m at 102/12-12-047-07W5.The following cross section A - A’ presents these stratigraphic test wells from north to south along with indicating the stratigraphic position of each associated horizontal well. The Teine wells have total Duvernay thicknesses ranging from 31-40, resistivities up to 1,000 ohms and porosities of up to 21% (limestone matrix logs Ø). All of the acreage is over-pressured. The observed pressure gradients range from 12 kpa/m at 100/05-32-049-04W5 to 15 kpa/m at 102/12-12-047-07W5.

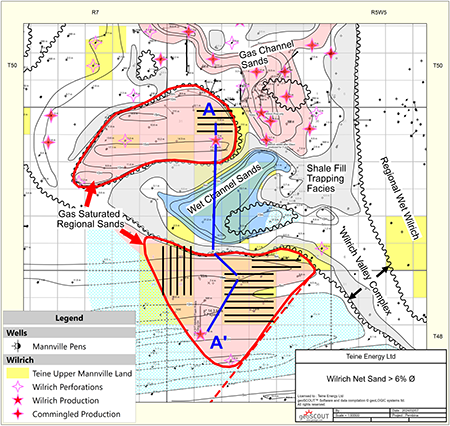

Wilrich Natural Gas Inventory

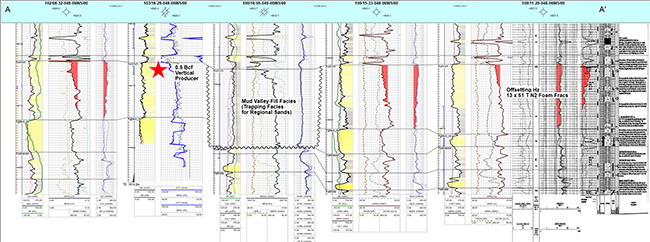

Teine has mapped several sections of gas pay in the regional Wilrich Member sands on the Property. The east west oriented sands are cut by a broad SSE-NNW trending channel complex. The margins of this valley complex are persistently shale filled providing the up-dip trap for the gas in the regional sands, which are otherwise regionally wet in this area (6% Net Sand Map shown).

There are several completions in both the Wilrich regional and channel sands in the area as indicated by the various stars. Most of the Wilrich production is commingled with underlying Glauconitic sandstone production, which is also trapped by the deep cutting Wilrich valley complex. In a few cases it can be found producing on its own. One example is the 103/16-29-049-06W5 well shown as the second well on the cross section below which produced almost 0.5 Bcf from the target sand.

The Company has identified 19 horizontal locations on the Property targeting resource ranging from 5 Bcf/section to over 11 Bcf/section.

Teine has mapped several sections of gas pay in the regional Wilrich Member sands on the Property. The east west oriented sands are cut by a broad SSE-NNW trending channel complex. The margins of this valley complex are persistently shale filled providing the up-dip trap for the gas in the regional sands, which are otherwise regionally wet in this area (6% Net Sand Map shown).

There are several completions in both the Wilrich regional and channel sands in the area as indicated by the various stars. Most of the Wilrich production is commingled with underlying Glauconitic sandstone production, which is also trapped by the deep cutting Wilrich valley complex. In a few cases it can be found producing on its own. One example is the 103/16-29-049-06W5 well shown as the second well on the cross section below which produced almost 0.5 Bcf from the target sand.

The Company has identified 19 horizontal locations on the Property targeting resource ranging from 5 Bcf/section to over 11 Bcf/section.

Pembina Seismic

The Company does not have ownership in any seismic data relating to the Property. Microseismic has been conducted during the completion of the 102/12-14-047-07W5/00 well. The microseismic shows full reservoir stimulation and fracture growth through the vertical section. Further information and data will be available upon execution of a confidentiality agreement.

Pembina Facilities

Teine does not have ownership in any facilities relating to the Property.

Pembina Marketing

Oil is produced to single well batteries and trucked directly to terminal.

Natural gas and liquids are tied into a third party with interruptible service as follows:

102/12-14-047-07W5: tied into Bonterra Energy Corporation’s Pembina plant at 10-10-047-07W5

100/02-09-049-06W5: tied into Ricochet Oil Corp.’s Berrymore plant at 15-15-049-06W5

100/07-07-050-04W5: tied into Obsidian Energy Ltd.’s Lobstick plant at 09-17-050-07W5

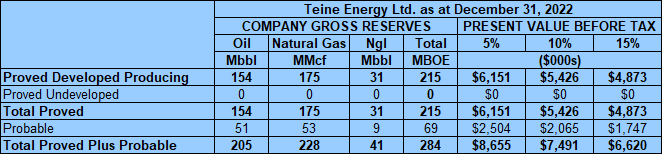

Pembina Reserves

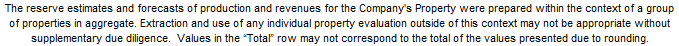

Teine prepared a reserves evaluation of the Property which has been verified by a third party (the “Reserve Report”). The Reserve Report is effective December 31, 2022 using Sproule Associates Limited’s forecast pricing as at December 31, 2022.

The Company estimates that, as at December 31, 2022, the Property contained remaining proved plus probable reserves of 246,000 barrels of oil and natural gas liquids and 228 MMcf of natural gas, with an estimated net present value of $7.5 million using forecast pricing at a 10% discount.

The Company does not have ownership in any seismic data relating to the Property. Microseismic has been conducted during the completion of the 102/12-14-047-07W5/00 well. The microseismic shows full reservoir stimulation and fracture growth through the vertical section. Further information and data will be available upon execution of a confidentiality agreement.

Pembina Facilities

Teine does not have ownership in any facilities relating to the Property.

Pembina Marketing

Oil is produced to single well batteries and trucked directly to terminal.

Natural gas and liquids are tied into a third party with interruptible service as follows:

102/12-14-047-07W5: tied into Bonterra Energy Corporation’s Pembina plant at 10-10-047-07W5

100/02-09-049-06W5: tied into Ricochet Oil Corp.’s Berrymore plant at 15-15-049-06W5

100/07-07-050-04W5: tied into Obsidian Energy Ltd.’s Lobstick plant at 09-17-050-07W5

Pembina Reserves

Teine prepared a reserves evaluation of the Property which has been verified by a third party (the “Reserve Report”). The Reserve Report is effective December 31, 2022 using Sproule Associates Limited’s forecast pricing as at December 31, 2022.

The Company estimates that, as at December 31, 2022, the Property contained remaining proved plus probable reserves of 246,000 barrels of oil and natural gas liquids and 228 MMcf of natural gas, with an estimated net present value of $7.5 million using forecast pricing at a 10% discount.

Pembina LMR as of February 3, 2024

As of February 3, 2024, the Property had a deemed net asset value of $3.3 million (deemed assets of $4.1 million and deemed liabilities of $836,347), with an LMR ratio of 4.95.

As of February 3, 2024, the Property had a deemed net asset value of $3.3 million (deemed assets of $4.1 million and deemed liabilities of $836,347), with an LMR ratio of 4.95.

Pembina Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

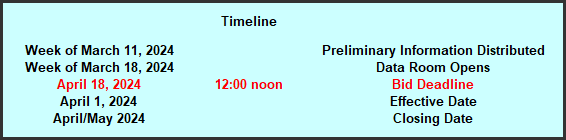

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Property until 12:00 pm on Thursday April 18, 2024.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude a

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday April 18, 2024.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Property with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).Included in the confidential information is the following: summary land information, the Reserve Report, LMR information, most recent net operations summary and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Property please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.