Offering Details

Back

Under Review / Prairie Thunder Resources Ltd.

Prairie Thunder Resources Ltd.

Property Divestiture

Property DivestitureBid Deadline: April 25, 2024

12:00 PM

Download Full PDF - Printable

OVERVIEW

Prairie Thunder Resources Ltd. (“Prairie Thunder” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the sale of its oil and natural gas interests located in the Grande Prairie area of Alberta (the “Property”).Average daily production net to Prairie Thunder from Grande Prairie for the fourth quarter of 2023 was approximately 181 boe/d, consisting of 639 Mcf/d of natural gas and 75 bbl/d of oil and natural gas liquids.

Operating income net to Prairie Thunder from Grande Prairie for the fourth quarter of 2023 averaged approximately $93,000 per month, or $1.1 million on an annualized basis.

Overview Map Showing the Location of the Divestiture Property

GRANDE PRAIRIE

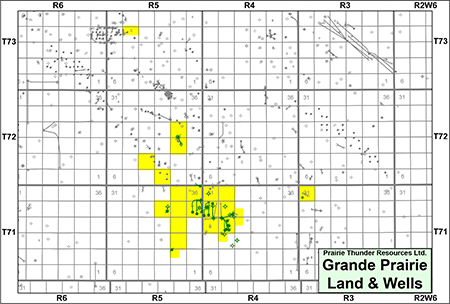

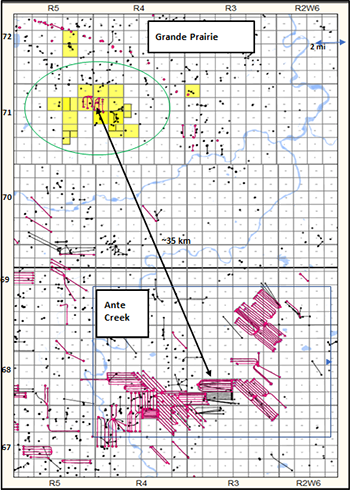

Township 71-73, Range 3-5 W6At Grande Prairie, Prairie Thunder holds primarily a 100% working interest in 19.5 sections of land. The Property is producing oil and natural gas from the Montney and Dunvegan formations. The Property has great potential for development of the Montney reservoir, comparable to nearby analogue pools such as Ante Creek.

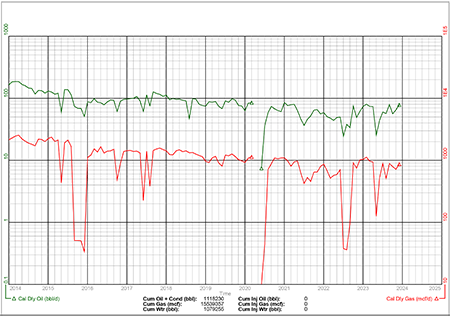

Average daily production net to Prairie Thunder from Grande Prairie for the fourth quarter of 2023 was approximately 181 boe/d, consisting of 639 Mcf/d of natural gas and 75 bbl/d of oil and natural gas liquids.

Operating income net to Prairie Thunder from Grande Prairie for the fourth quarter of 2023 averaged approximately $93,000 per month, or $1.1 million on an annualized basis.

Grande Prairie, Alberta – Gross Production Group Plot of

Prairie Thunder’s Oil & Natural Gas Wells

The Montney pools at Ante Creek are analogues to the Property. With significant potential to advance development similar to Ante Creek.

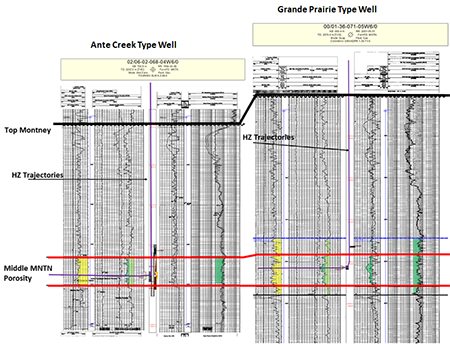

The cross-section below shows the correlation between the Montney Formation in a typical well log from the analogous Ante Creek development area and the Montney reservoir at Grande Prairie.

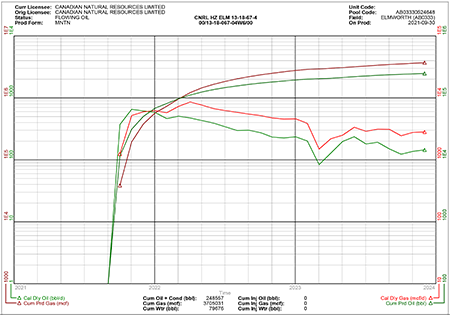

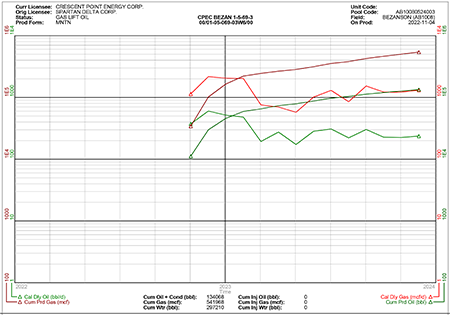

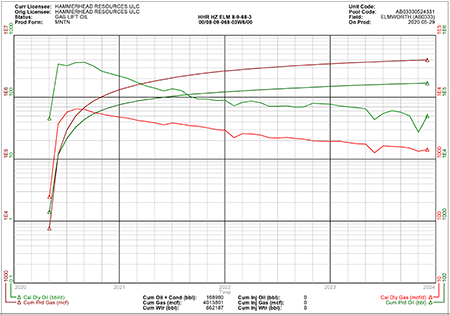

Productive Montney wells from the Ante Creek analogue pools have been analyzed and several examples are shown as follows.

Grande Prairie Reserves

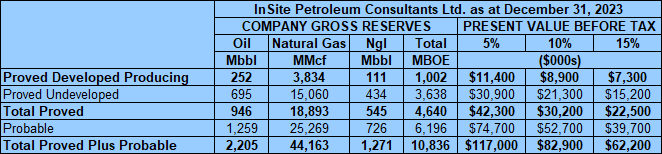

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Property (the “InSite Report”) as part of the Company’s year end reporting. The InSite Report is effective January 1, 2024 using InSite’s December 31, 2023 forecast pricing.

InSite estimates that, as at December 31, 2023, the Grande Prairie property contained remaining proved plus probable reserves of 44.2 Bcf of natural gas and 3.5 million barrels of oil and natural gas liquids (10.8 million boe), with an estimated net present value of $82.9 million using forecast pricing at a 10% discount.

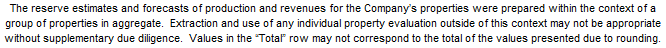

Prairie Thunder has seven horizontal drilling locations booked in the InSite Report. The locations consist of six Montney locations and one Dunvegan location which have all been assigned proved undeveloped reserves.

Grande Prairie Facilities

At Grande Prairie, Prairie Thunder owns interests in several single and multi-well batteries as well as a compressor station located at 03-23-072-05W6M. Details on the Company’s facilities will be made available to parties that execute a confidentiality agreement.

Grande Prairie Marketing

Prairie Thunder’s operated oil production from Grande Prairie is currently trucked from the multi-well battery at 07-20-071-04W6M. Production goes to either Secure Energy Services Inc.’s La Glace terminal at 16-07-073-08W6 or to Pivotal Energy Partners Inc.’s Clairmont terminal at 01-09-073-05W6.

Natural gas is connected to Canadian Natural Resources Limited’s Teepee Creek natural gas plant at 07-02-074-04W6.

Seismic Overview

The Company does not have an interest in any seismic data relating to its interests at Grande Prairie.

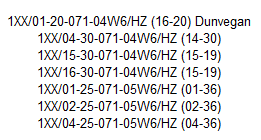

Grande Prairie LMR as of January 6, 2024

As of January 6, 2024, the Grande Prairie property had a deemed net asset value of $2.0 million (deemed assets of $4.9 million and deemed liabilities of $2.9 million), with an LMR ratio of 1.70.

Grande Prairie Well List

Click here to download the complete well list in Excel.

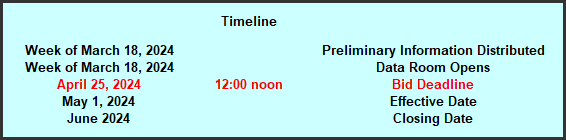

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Property until 12:00 pm on Thursday April 25, 2024.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude a

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday April 25, 2024.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Property with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (brye@sayeradvisors.com) or fax (403.266.4467).Included in the confidential information is the following: summary land information, the InSite Report, LMR information, most recent net operations summary and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Property please contact Ben Rye, Tom Pavic or Sydney Birkett at 403.266.6133.