Offering Details

Back

Under Review / Rex Energy Ltd.

Rex Energy Ltd.

Strategic Alternatives Process

Strategic Alternatives ProcessBid Deadline: November 30, 2023

12:00 PM

Download Full PDF - Printable

OVERVIEW

Rex Energy Ltd. (“Rex” or the “Company”) has engaged Sayer Energy Advisors to assist it with a strategic alternatives process. The Company is open to reviewing all alternatives including, but not limited to, a sale of the shares of the Company, a sale of the assets of the Company, or a sale of a portion of the shares outstanding.

Rex is a wholly-owned subsidiary of publicly-traded Whitebark Energy Limited, which trades on the Australian Stock Exchange under the ticker symbol (ASX: WBE), with operated working interests located in the Wizard Lake area of Alberta (the “Property”).

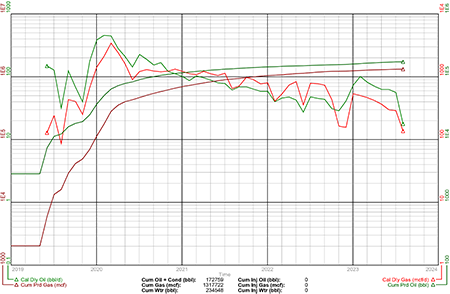

Average daily sales production net to Rex from the Property for the first half of 2023 was approximately 147 boe/d, consisting of 89 bbl/d of oil and natural gas liquids and 350 Mcf/d of natural gas. Average daily production was affected by Rex’s most prolific producing well at 103/12-04-048-27W4/0 being down for a most of the second quarter of 2023. Current production is approximately 100 boe/d, consisting of 50 bbl/d of oil and 300 Mcf/d of natural gas.

Operating income net to Rex from Wizard Lake for the first half of 2023 averaged approximately $45,000 per month, or $540,000 on an annualized basis.

Rex has approximately $1.25 million of debt and total unused Canadian income tax pools of approximately $27.4 million, including $15.3 million of non-capital losses.

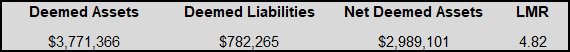

As of October 7, 2023, Rex had total net deemed assets of $3.0 million, (deemed assets of $3.8 million and net deemed liabilities of $782,265), with an LMR ratio of 4.82.

Additional corporate information relating to Rex will be provided to parties upon execution of a confidentiality agreement.

Rex is a wholly-owned subsidiary of publicly-traded Whitebark Energy Limited, which trades on the Australian Stock Exchange under the ticker symbol (ASX: WBE), with operated working interests located in the Wizard Lake area of Alberta (the “Property”).

Average daily sales production net to Rex from the Property for the first half of 2023 was approximately 147 boe/d, consisting of 89 bbl/d of oil and natural gas liquids and 350 Mcf/d of natural gas. Average daily production was affected by Rex’s most prolific producing well at 103/12-04-048-27W4/0 being down for a most of the second quarter of 2023. Current production is approximately 100 boe/d, consisting of 50 bbl/d of oil and 300 Mcf/d of natural gas.

Operating income net to Rex from Wizard Lake for the first half of 2023 averaged approximately $45,000 per month, or $540,000 on an annualized basis.

Rex has approximately $1.25 million of debt and total unused Canadian income tax pools of approximately $27.4 million, including $15.3 million of non-capital losses.

As of October 7, 2023, Rex had total net deemed assets of $3.0 million, (deemed assets of $3.8 million and net deemed liabilities of $782,265), with an LMR ratio of 4.82.

Additional corporate information relating to Rex will be provided to parties upon execution of a confidentiality agreement.

Corporate Overview

Rex is a wholly-owned subsidiary of publicly-traded Whitebark Energy Limited, which trades on the Australian Stock Exchange under the ticker symbol (ASX: WBE). Rex has approximately $1.25 million of debt and total unused Canadian income tax pools of approximately $27.4 million, including $15.3 million of non-capital losses.

The Company has a cash bond of approximately $180,000 with Leduc County.

Additional corporate information relating to Rex will be provided to parties upon execution of a confidentiality agreement.

WIZARD LAKE

Township 48, Range 27 W4

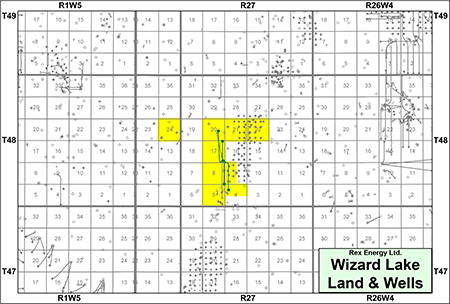

At Wizard Lake, Rex holds a Freehold lease in P&NG rights from surface to basement on 5.25 sections of land as well as a 100% working interest in certain mineral rights in approximately 2.75 sections of Crown land. The target at Wizard Lake is a heavy oil pool with several wells drilled horizontally into the Rex Member of the Mannville Group.

The Company believes there is room for further development of the Property with a total of 24 additional horizontal locations. Five of these locations are booked in the Company’s third-party reserve report and the existing infrastructure is in place to handle the anticipated added production volumes from five to eight additional wells.

Average daily sales production net to Rex from the Property for the first half of 2023 was approximately 147 boe/d, consisting of 89 bbl/d of oil and natural gas liquids and 350 Mcf/d of natural gas. Current production is approximately 100 boe/d, consisting of 50 bbl/d of oil and 300 Mcf/d of natural gas.

Operating income net to Rex from Wizard Lake for the first half of 2023 averaged approximately $45,000 per month, or $540,000 on an annualized basis.

Operating income is anticipated to increase by over $300,000 per year once certain equipment lease to own loans are paid out.

The Company has a 2.0% overriding royalty in place with Source Rock Royalties Ltd. on the Property.

At Wizard Lake, Rex holds a Freehold lease in P&NG rights from surface to basement on 5.25 sections of land as well as a 100% working interest in certain mineral rights in approximately 2.75 sections of Crown land. The target at Wizard Lake is a heavy oil pool with several wells drilled horizontally into the Rex Member of the Mannville Group.

The Company believes there is room for further development of the Property with a total of 24 additional horizontal locations. Five of these locations are booked in the Company’s third-party reserve report and the existing infrastructure is in place to handle the anticipated added production volumes from five to eight additional wells.

Average daily sales production net to Rex from the Property for the first half of 2023 was approximately 147 boe/d, consisting of 89 bbl/d of oil and natural gas liquids and 350 Mcf/d of natural gas. Current production is approximately 100 boe/d, consisting of 50 bbl/d of oil and 300 Mcf/d of natural gas.

Operating income net to Rex from Wizard Lake for the first half of 2023 averaged approximately $45,000 per month, or $540,000 on an annualized basis.

Operating income is anticipated to increase by over $300,000 per year once certain equipment lease to own loans are paid out.

The Company has a 2.0% overriding royalty in place with Source Rock Royalties Ltd. on the Property.

To date, a total of four wells have been drilled into the Rex Member in the “Upper Mannville B Pool” at Wizard Lake.

The first well drilled into the pool by the previous operator at 100/16-17-048-27W4/0 was drilled with a lateral length of 1,200 metres and completed with a 27-stage frac. This well was drilled in December 2018 and brought on production in January 2019.

The first well was followed up by drilling a farmout well at 100/01-08-048-27W4/0 in mid-2019 to delineate the pool. A third well was drilled at 103/12-04-048-27W4/0 in November 2019.

Rex drilled the most recent horizontal well Rex Energy HZ WizardLK 02/07-20-048-27W4/00 in late 2022.

The first well drilled into the pool by the previous operator at 100/16-17-048-27W4/0 was drilled with a lateral length of 1,200 metres and completed with a 27-stage frac. This well was drilled in December 2018 and brought on production in January 2019.

The first well was followed up by drilling a farmout well at 100/01-08-048-27W4/0 in mid-2019 to delineate the pool. A third well was drilled at 103/12-04-048-27W4/0 in November 2019.

Rex drilled the most recent horizontal well Rex Energy HZ WizardLK 02/07-20-048-27W4/00 in late 2022.

Production from Wizard Lake was suspended temporarily for workovers. As of October 16, 2023 production from the Property is back on stream averaging approximately 100 boe/d, consisting of 50 bbl/d of oil and 300 Mcf/d of natural gas from three of the four wells. The Company expects the 103/12-04-048-27W4/0 well to be back online imminently.

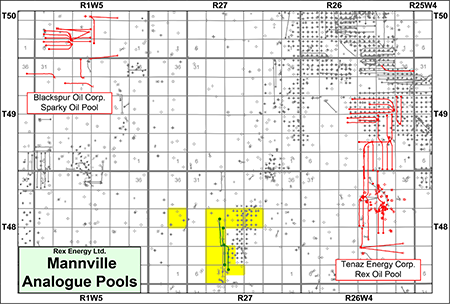

Several operators have been developing Mannville pools in the area including Blackspur Oil Corp. and Tenaz Energy Corp. The following map shows the continued development of analogue Mannville oil pools in the area.

The following well logs for the well Canlin WizardLK 02/12-04-048-27W4/00 show 18 metres of net pay in the Rex sand channel at Wizard Lake.

Further geological details will be available in the virtual data room for parties that execute a confidentiality agreement.

Wizard Lake Facilities

Rex holds a 100% working interest in the Wizard Lake facilities consisting of the 11-17-048-27W4 multi-well battery, the 6” natural gas conservation pipeline from 11-17-048-27W4 to 05-19-048-27W4, and a satellite (test separator and header) at the 01-17-048-27W4 well pad.

Rex has loans/lease to own arrangements for several pieces of equipment at Wizard Lake including:

- Tank loan for 11-17 Tanks with Bennington Financial Corp. for $11,327/month (18 months remaining);

- Hydraulic pumping unit loan for pumping units at 01-17 with Ecoquip Artificial Lift Ltd. for $13,517/month (18 months remaining);

- Lease to own agreement for compressor at 01-17 with Alco Inc. for $2,098/month (42 months remaining)

- Genset rental of $3,675/month

- Genset R&M savings

- Fuel gas savings

Wizard Lake Marketing

Emulsion is handled at the 103/11-17-048-27W4 Rex battery. Water is trucked to the 103/16-16-048-27W4 water disposal well owned by TWP50 Resources Ltd. Clean oil is hauled to Rush Energy Services Inc. at Breton at 10-35-47-4W5.

The natural gas is delivered to Petrus Resources Ltd.’s natural gas plant located at 07-14-049-01W5 for processing. 175 e3m3/month of natural gas is marketed by Petrus, along with natural gas liquids. Any additional volumes are sold to BP Canada Energy Marketing Corp.

Wizard Lake Reserves

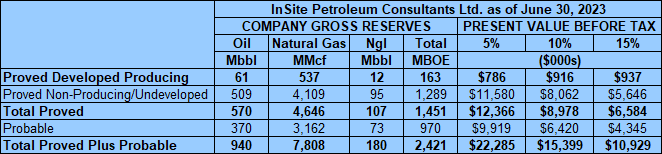

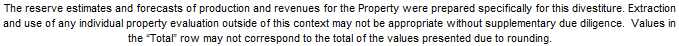

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Property (the “InSite Report”). The InSite Report is effective June 30, 2023 using InSite’s June 30, 2023 forecast pricing.

InSite estimated that, as of June 30, 2023, the Property contained remaining proved plus probable reserves of 1.1 million barrels of oil and natural gas liquids and 7.8 Bcf of natural gas (2.4 million boe), with an estimated net present value of $15.4 million using forecast pricing at a 10% discount.

Wizard Lake Upside

Optimizations

The Company believes that both the 103/12-04-048-27W4 and 100/07-20-048-27W4 wells would benefit from cleanouts as neither well has had horizontal cleanouts done in the past. Both of these wells have sand in the horizontal sections that are impeding productivity. This is evidenced by both wells having had rod fall issues on occasion in the past, as sand has periodically been produced with the oil. Proven non-producing reserves associated with these cleanouts are included in the InSite Report.

Water Disposal Flowline

There are also proven non-producing reserves assigned in the InSite Report associated with the installation of a water disposal pipeline from the 11-17-48-27W4 battery to TWP50’s 16-16-48-27W4 disposal well.

Wizard Lake LMR as of October 7, 2023

As of October 7, 2023, Rex had total net deemed assets of $3.0 million, (deemed assets of $3.8 million and net deemed liabilities of $782,265), with an LMR ratio of 4.82.

PROCESS & TIMELINE

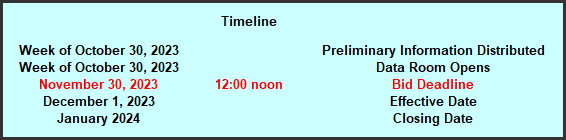

Sayer Energy Advisors is accepting proposals relating to this process until 12:00 pm on Thursday November 30, 2023.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

Sayer Energy Advisors is accepting proposals from interested parties until

noon on Thursday November 30, 2023.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Company with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).Included in the confidential information is the following: summary land information, the InSite Report, LMR information, most recent net operating statements and other relevant corporate and technical information.

Download Confidentiality Agreement

To receive further information on the Company please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.