Offering Details

Back

Under Review / Silverleaf Resources Inc.

Silverleaf Resources Inc.

Property Divestiture

Property DivestitureBid Deadline: December 7, 2023

12:00 PM

Download Full PDF - Printable

OVERVIEW

SILVERLEAF HAS SOLD ITS INTERESTS IN THE STEELE AREA AND A PORTION OF ITS INTERESTS IN THE CLARESHOLM AREA OF ALBERTA.

Silverleaf Resources Inc. (“Silverleaf” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the sale of all of its oil and natural gas interests located in the Chin Coulee, Claresholm, Edson, Gilby, Morley, Steele and Twining as well as certain minor areas of Alberta (the “Properties”).

Average daily production net to Silverleaf from the Properties for the months of July and August 2023 was approximately 488 boe/d, consisting of approximately 1.6 MMcf/d of natural gas and 225 bbl/d of oil and natural gas liquids.

Operating income net to Silverleaf from the Properties for the months of July and August 2023 averaged approximately $332,000 per month, or $4.0 million on an annualized basis.

As of October 7, 2023, the Properties had a deemed net asset value of $7.2 million (deemed assets of $12.3 million and deemed liabilities of $5.1 million), with an LMR ratio of 2.43.

Silverleaf has identified approximately 25 re-completion/workover opportunities in existing producing wells on the Properties which is anticipated to add production of approximately 50 bbl/d of oil and 500 Mcf/d of natural gas.

Silverleaf Resources Inc. (“Silverleaf” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the sale of all of its oil and natural gas interests located in the Chin Coulee, Claresholm, Edson, Gilby, Morley, Steele and Twining as well as certain minor areas of Alberta (the “Properties”).

Average daily production net to Silverleaf from the Properties for the months of July and August 2023 was approximately 488 boe/d, consisting of approximately 1.6 MMcf/d of natural gas and 225 bbl/d of oil and natural gas liquids.

Operating income net to Silverleaf from the Properties for the months of July and August 2023 averaged approximately $332,000 per month, or $4.0 million on an annualized basis.

As of October 7, 2023, the Properties had a deemed net asset value of $7.2 million (deemed assets of $12.3 million and deemed liabilities of $5.1 million), with an LMR ratio of 2.43.

Silverleaf has identified approximately 25 re-completion/workover opportunities in existing producing wells on the Properties which is anticipated to add production of approximately 50 bbl/d of oil and 500 Mcf/d of natural gas.

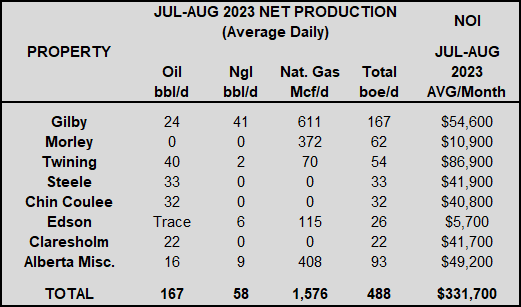

Production Overview

Average daily production net to Silverleaf from the Properties for the months of July and August 2023 was approximately 488 boe/d, consisting of approximately 1.6 MMcf/d of natural gas and 225 bbl/d of oil and natural gas liquids as outlined below.

Average daily production net to Silverleaf from the Properties for the months of July and August 2023 was approximately 488 boe/d, consisting of approximately 1.6 MMcf/d of natural gas and 225 bbl/d of oil and natural gas liquids as outlined below.

Operating income net to Silverleaf from the Properties for the months of July and August 2023 averaged approximately $332,000 per month, or $4.0 million on an annualized basis.

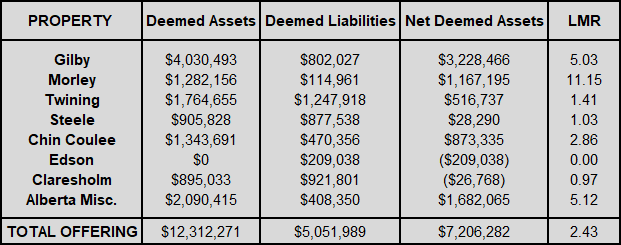

LMR Summary

The LMR for each of the Properties as of October 7, 2023 is summarized below.

The LMR for each of the Properties as of October 7, 2023 is summarized below.

Summary of LMR by Property

As of October 7, 2023, the Properties had a deemed net asset value of $7.2 million (deemed assets of $12.3 million and deemed liabilities of $5.1 million), with an LMR ratio of 2.43.

Seismic Overview

The Company does not have an interest in any seismic data relating to the Properties.

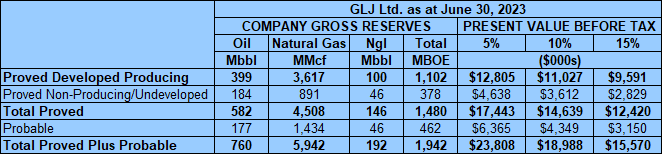

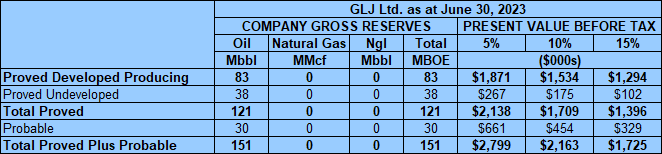

Reserves Overview

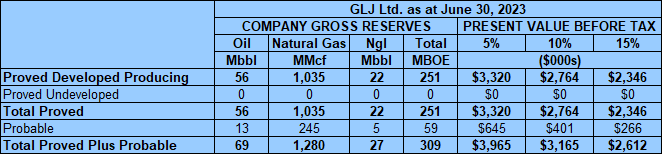

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimated that, as at June 30, 2023, the Properties contained remaining proved plus probable reserves of 952,000 barrels of oil and natural gas liquids and 5.9 Bcf of natural gas (1.9 million boe), with an estimated net present value of $19.0 million using forecast pricing at a 10% discount.

Seismic Overview

The Company does not have an interest in any seismic data relating to the Properties.

Reserves Overview

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimated that, as at June 30, 2023, the Properties contained remaining proved plus probable reserves of 952,000 barrels of oil and natural gas liquids and 5.9 Bcf of natural gas (1.9 million boe), with an estimated net present value of $19.0 million using forecast pricing at a 10% discount.

Marketing Overview

Silverleaf has purchase contracts in place with Acme Energy Marketing Ltd. for natural gas, oil and natural gas liquids.

Well List

Click here to download the complete well list in Excel.

Silverleaf has purchase contracts in place with Acme Energy Marketing Ltd. for natural gas, oil and natural gas liquids.

Well List

Click here to download the complete well list in Excel.

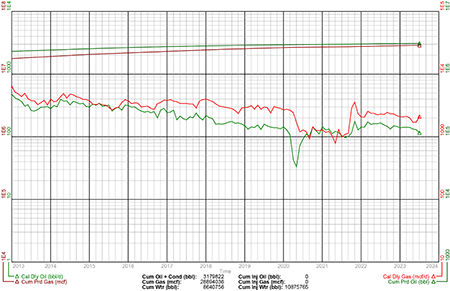

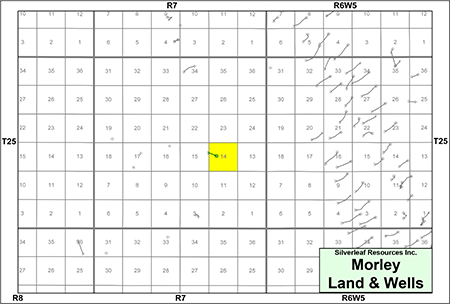

GILBY

Township 39-45, Range 28 W4 - 3 W5

In the Gilby area, Silverleaf holds various working interests in 7.5 sections of Crown and Freehold land. The Gilby property is producing oil and natural gas from the Ellerslie Glauconitic formations of the Mannville Group, and from the Fernie/Nordegg formations.

Average daily production net to Silverleaf from Gilby for the months of July and August 2023 was 167 boe/d, consisting of 611 Mcf/d of natural gas and 65 bbl/d of oil and natural gas liquids.

Operating income net to Silverleaf from Gilby for the months of July and August 2023 averaged approximately $54,600 per month, or $655,200 on an annualized basis.

In the Gilby area, Silverleaf holds various working interests in 7.5 sections of Crown and Freehold land. The Gilby property is producing oil and natural gas from the Ellerslie Glauconitic formations of the Mannville Group, and from the Fernie/Nordegg formations.

Average daily production net to Silverleaf from Gilby for the months of July and August 2023 was 167 boe/d, consisting of 611 Mcf/d of natural gas and 65 bbl/d of oil and natural gas liquids.

Operating income net to Silverleaf from Gilby for the months of July and August 2023 averaged approximately $54,600 per month, or $655,200 on an annualized basis.

Gilby Upside

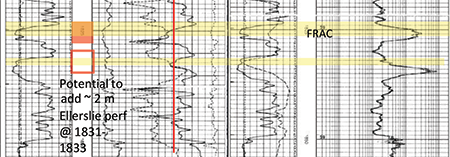

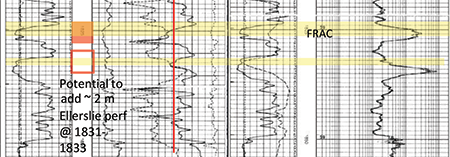

At Gilby, Silverleaf has identified several recompletion opportunities in the Viking, Ellerslie and Glauconitic formations in the wells SRI Gilby 100/12-06-042-03W5/00, SRI Cygnet 100/10-24-039-28W4/00, SRI Joffre 100/10-11-040-28W4/00, SRI Joffre 100/03-13-040-28W4/00, SRI Joffre 100/04-13-040-28W4/00, and SRI Joffre 100/08-13-040-28W4/00.

At Gilby, Silverleaf has identified several recompletion opportunities in the Viking, Ellerslie and Glauconitic formations in the wells SRI Gilby 100/12-06-042-03W5/00, SRI Cygnet 100/10-24-039-28W4/00, SRI Joffre 100/10-11-040-28W4/00, SRI Joffre 100/03-13-040-28W4/00, SRI Joffre 100/04-13-040-28W4/00, and SRI Joffre 100/08-13-040-28W4/00.

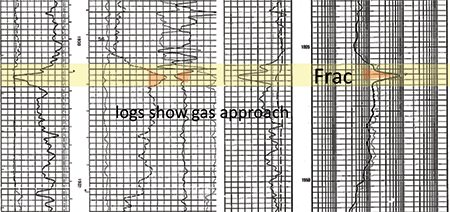

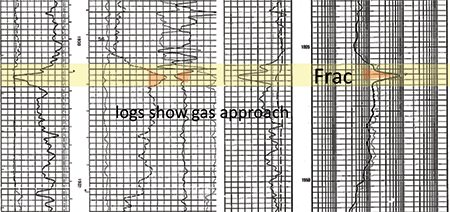

SRI Gilby 100/12-06-042-03W5/00

Viking Formation Type Log

SRI Joffre 100/04-13-040-28W4/00

Ellerslie Formation Type Log

Viking Formation Type Log

SRI Joffre 100/04-13-040-28W4/00

Ellerslie Formation Type Log

Further details on the recompletion opportunities will be available in the virtual data room for parties that execute a confidentiality agreement.

Gilby Facilities

At Gilby, Silverleaf has working interests in the following facilities.

Gilby Facilities

At Gilby, Silverleaf has working interests in the following facilities.

Gilby Marketing

Silverleaf has a one-month evergreen purchase contract in place with Acme Energy Marketing Ltd. for natural gas, oil and natural gas liquids.

The Company trucks its oil from Gilby to the Medicine River Oil Recyclers Ltd. Eckville Facility.

Natural gas from Gilby is delivered to Nova Gas Transmission Ltd. Gilby South Pacific #1084 receipt point.

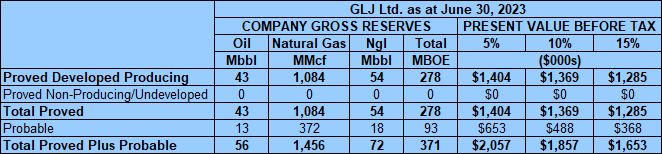

Gilby Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimated that, as at June 30, 2023, the Gilby property contained remaining proved plus probable reserves of 128,000 barrels of oil and natural gas liquids and 1.5 Bcf of natural gas (371,000 boe), with an estimated net present value of $1.9 million using forecast pricing at a 10% discount.

Silverleaf has a one-month evergreen purchase contract in place with Acme Energy Marketing Ltd. for natural gas, oil and natural gas liquids.

The Company trucks its oil from Gilby to the Medicine River Oil Recyclers Ltd. Eckville Facility.

Natural gas from Gilby is delivered to Nova Gas Transmission Ltd. Gilby South Pacific #1084 receipt point.

Gilby Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimated that, as at June 30, 2023, the Gilby property contained remaining proved plus probable reserves of 128,000 barrels of oil and natural gas liquids and 1.5 Bcf of natural gas (371,000 boe), with an estimated net present value of $1.9 million using forecast pricing at a 10% discount.

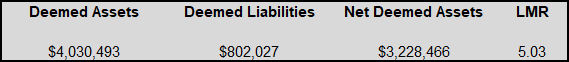

Gilby LMR as of October 7, 2023

As of October 7, 2023, the Gilby property had a deemed net asset value of $3.2 million (deemed assets of $4.0 million and deemed liabilities of $802,027), with an LMR ratio of 5.03.

As of October 7, 2023, the Gilby property had a deemed net asset value of $3.2 million (deemed assets of $4.0 million and deemed liabilities of $802,027), with an LMR ratio of 5.03.

Gilby Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

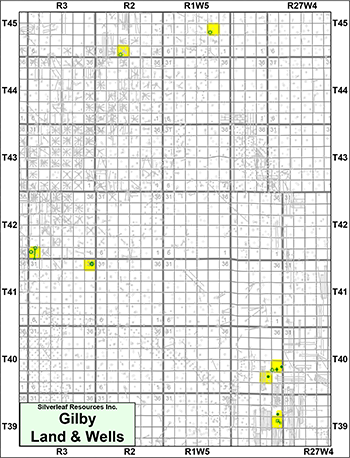

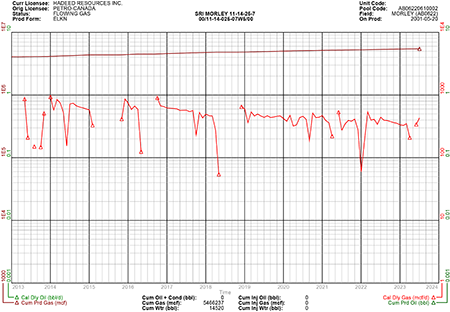

MORLEY

Township 25, Range 7 W5

In the Morley area, Silverleaf holds a 100% working interest in one section of land with one low-decline natural gas well SRI Morley 00/11-14-025-07W5/0 producing from the Mount Head/Rundle Formation.

Average daily production net to Silverleaf from Morley for the months of July and August 2023 was approximately 372 Mcf/d of natural gas per day (62 boe/d).

Operating income net to Silverleaf from Morley for the months of July and August 2023 averaged approximately $10,900 per month, or $130,800 on an annualized basis.

In the Morley area, Silverleaf holds a 100% working interest in one section of land with one low-decline natural gas well SRI Morley 00/11-14-025-07W5/0 producing from the Mount Head/Rundle Formation.

Average daily production net to Silverleaf from Morley for the months of July and August 2023 was approximately 372 Mcf/d of natural gas per day (62 boe/d).

Operating income net to Silverleaf from Morley for the months of July and August 2023 averaged approximately $10,900 per month, or $130,800 on an annualized basis.

Morley Upside

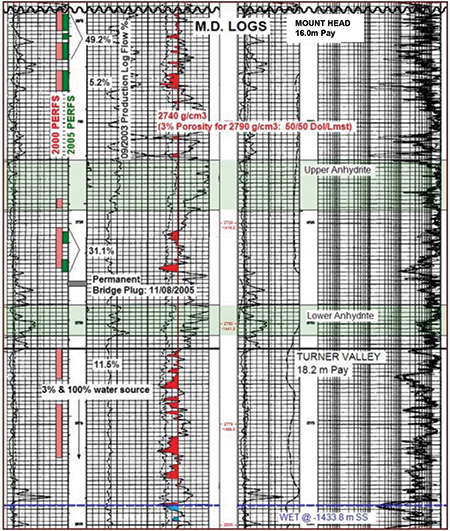

The following logs for the well SRI MORLEY 11-14-025-07W5 show 16 metres of net pay in the Mount Head Formation and over 18 metres of net pay in the Turner Valley Formation using a porosity cut off of 3%.

The following logs for the well SRI MORLEY 11-14-025-07W5 show 16 metres of net pay in the Mount Head Formation and over 18 metres of net pay in the Turner Valley Formation using a porosity cut off of 3%.

Morley Facilities

At Morley, Silverleaf has a 100% working interest in the following facility.

At Morley, Silverleaf has a 100% working interest in the following facility.

Morley Marketing

Silverleaf has a one-month evergreen purchase contract in place with Acme Energy Marketing Ltd. for natural gas.

Natural gas from Morley is pipeline connected into Pieridae Energy Limited operated infrastructure and processed at Pieridae’s Jumping Pound facility.

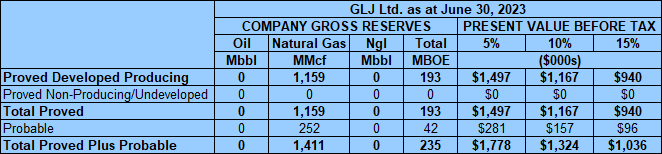

Morley Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimated that, as at June 30, 2023, the Morley property contained remaining proved plus probable reserves of 1.4 Bcf of natural gas (235,000 boe), with an estimated net present value of $1.3 million using forecast pricing at a 10% discount.

Silverleaf has a one-month evergreen purchase contract in place with Acme Energy Marketing Ltd. for natural gas.

Natural gas from Morley is pipeline connected into Pieridae Energy Limited operated infrastructure and processed at Pieridae’s Jumping Pound facility.

Morley Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimated that, as at June 30, 2023, the Morley property contained remaining proved plus probable reserves of 1.4 Bcf of natural gas (235,000 boe), with an estimated net present value of $1.3 million using forecast pricing at a 10% discount.

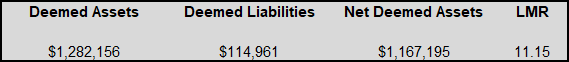

Morley LMR as of October 7, 2023

As of October 7, 2023, the Morley property had a deemed net asset value of $1.2 million (deemed assets of $1.3 million and deemed liabilities of $114,961), with an LMR ratio of 11.15.

As of October 7, 2023, the Morley property had a deemed net asset value of $1.2 million (deemed assets of $1.3 million and deemed liabilities of $114,961), with an LMR ratio of 11.15.

Morley Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

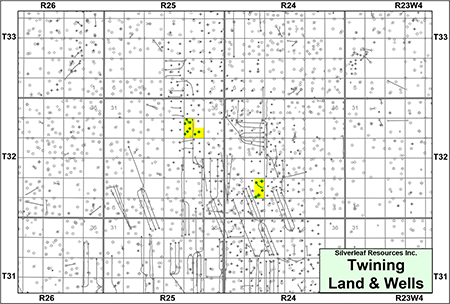

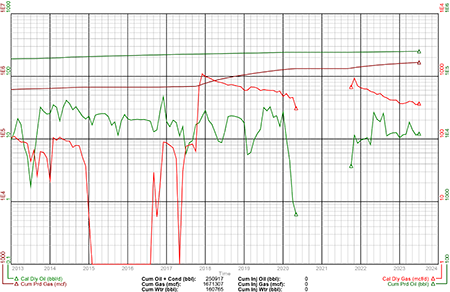

TWINING

Township 32, Range 24-25 W4

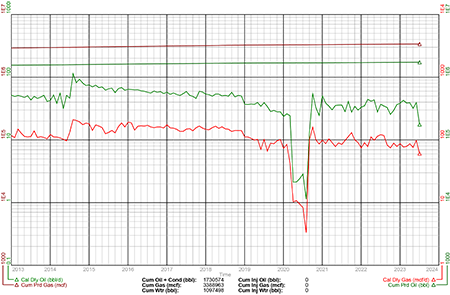

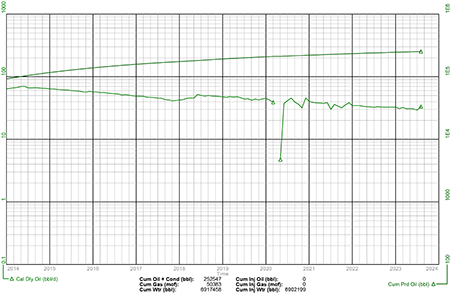

In the Twining area, Silverleaf holds a 100% working interest in 1.25 sections of Freehold land. The Twining property is producing 25° API oil from the Peksiko Formation.

Average daily production net to Silverleaf from Twining for the months of July and August 2023 was approximately 54 boe/d, consisting of 42 bbl/d of oil and natural gas liquids and 70 Mcf/d of natural gas.

Operating income net to Silverleaf from Twining for the months of July and August 2023 averaged approximately $86,900 per month, or $1.0 million on an annualized basis.

In the Twining area, Silverleaf holds a 100% working interest in 1.25 sections of Freehold land. The Twining property is producing 25° API oil from the Peksiko Formation.

Average daily production net to Silverleaf from Twining for the months of July and August 2023 was approximately 54 boe/d, consisting of 42 bbl/d of oil and natural gas liquids and 70 Mcf/d of natural gas.

Operating income net to Silverleaf from Twining for the months of July and August 2023 averaged approximately $86,900 per month, or $1.0 million on an annualized basis.

Twining Upside

At Twining, Silverleaf has identified six recompletion opportunities in the Pekisko Formation in the wells SRI Twining 100/15-08-032-24W4/00, SRI Twining 100/02-26-032-25W4/00, SRI Twining 100/05-26-032-25W4/00, SRI Twining 100/06-26-032-25W4/00, SRI Twining 100/12-26-032-25W4/00 and SRI Twining 100/13-26-032-25W4/00.

A number of operators have recently been exploiting the Pekisko in the Twining Rundle “A” Pool with horizontal wells, which demonstrate that additional reserves can be recovered through infill drilling. The Company also has two proved undeveloped horizontal Pekisko drilling locations booked in the GLJ Report on Section 26-032-25W4.

Twining Geology

The Pekisko Formation is a thick carbonate platform consisting of a shallowing upwards succession. Following deposition, there has been diagenetic alteration to the carbonates which influences reservoir distribution and regional continuity. The reservoir at Twining is dominantly a crinodal grainstone.

The Pekisko Formation overlies the Banff Formation and is overlain by the Shunda Formation. Along the subcrop edge, the Pekisko is overlain unconformably by Jurassic or Cretaceous clastics.

The Twining Rundle “A” Pool was discovered in 1952 and has since been developed with 488 wells which have produced over 43 million barrels of 25° API oil from the Pekisko Formation. Less than 5% of the 933 million barrels of oil originally in place has been produced to date.

The average reservoir depth is 1,750 metres, with an average reservoir thickness of 40 metres with 11-18 metres of net pay. In recent years, numerous horizontal and vertical wells have been drilled in the pool.

Production from the pool to date has been only primary recovery. Additional opportunity may exist for secondary recovery within the pool. Possible secondary recovery options include waterflood using existing vertical wellbores, polymer flood and solution gas injection. In order to best exploit the benefits of this, a larger land position would be ideal.

Further details on the recompletion opportunities will be available in the virtual data room for parties that execute a confidentiality agreement.

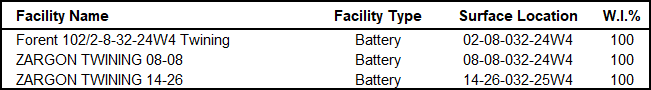

Twining Facilities

At Twining, Silverleaf has a 100% working interest in the following facilities.

At Twining, Silverleaf has identified six recompletion opportunities in the Pekisko Formation in the wells SRI Twining 100/15-08-032-24W4/00, SRI Twining 100/02-26-032-25W4/00, SRI Twining 100/05-26-032-25W4/00, SRI Twining 100/06-26-032-25W4/00, SRI Twining 100/12-26-032-25W4/00 and SRI Twining 100/13-26-032-25W4/00.

A number of operators have recently been exploiting the Pekisko in the Twining Rundle “A” Pool with horizontal wells, which demonstrate that additional reserves can be recovered through infill drilling. The Company also has two proved undeveloped horizontal Pekisko drilling locations booked in the GLJ Report on Section 26-032-25W4.

Twining Geology

The Pekisko Formation is a thick carbonate platform consisting of a shallowing upwards succession. Following deposition, there has been diagenetic alteration to the carbonates which influences reservoir distribution and regional continuity. The reservoir at Twining is dominantly a crinodal grainstone.

The Pekisko Formation overlies the Banff Formation and is overlain by the Shunda Formation. Along the subcrop edge, the Pekisko is overlain unconformably by Jurassic or Cretaceous clastics.

The Twining Rundle “A” Pool was discovered in 1952 and has since been developed with 488 wells which have produced over 43 million barrels of 25° API oil from the Pekisko Formation. Less than 5% of the 933 million barrels of oil originally in place has been produced to date.

The average reservoir depth is 1,750 metres, with an average reservoir thickness of 40 metres with 11-18 metres of net pay. In recent years, numerous horizontal and vertical wells have been drilled in the pool.

Production from the pool to date has been only primary recovery. Additional opportunity may exist for secondary recovery within the pool. Possible secondary recovery options include waterflood using existing vertical wellbores, polymer flood and solution gas injection. In order to best exploit the benefits of this, a larger land position would be ideal.

Further details on the recompletion opportunities will be available in the virtual data room for parties that execute a confidentiality agreement.

Twining Facilities

At Twining, Silverleaf has a 100% working interest in the following facilities.

Twining Marketing

The Company’s oil production is pipelined directly into the 14-26-032-25W4 central battery. Pipeline spec oil is trucked to the Medicine River Oil Recyclers Ltd. sales terminal at Eckville.

Salt water is trucked to Aqt Water Management Inc.’s facility located at Torrington.

Natural gas from Twining is conserved.

Twining Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimated that, as at June 30, 2023, the Twining property contained remaining proved plus probable reserves of 328,000 barrels of oil and natural gas liquids and 753 MMcf of natural gas (454,000 boe), with an estimated net present value of $6.4 million using forecast pricing at a 10% discount.

The Company’s oil production is pipelined directly into the 14-26-032-25W4 central battery. Pipeline spec oil is trucked to the Medicine River Oil Recyclers Ltd. sales terminal at Eckville.

Salt water is trucked to Aqt Water Management Inc.’s facility located at Torrington.

Natural gas from Twining is conserved.

Twining Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimated that, as at June 30, 2023, the Twining property contained remaining proved plus probable reserves of 328,000 barrels of oil and natural gas liquids and 753 MMcf of natural gas (454,000 boe), with an estimated net present value of $6.4 million using forecast pricing at a 10% discount.

Twining LMR as of October 7, 2023

As of October 7, 2023, the Twining property had a deemed net asset value of $516,737 (deemed assets of $1.8 million and deemed liabilities of $1.2 million), with an LMR ratio of 1.41.

As of October 7, 2023, the Twining property had a deemed net asset value of $516,737 (deemed assets of $1.8 million and deemed liabilities of $1.2 million), with an LMR ratio of 1.41.

Twining Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

CHIN COULEE

Township 7, Range 15 W4

At Chin Coulee, Silverleaf holds a 100% working interest in one section of land. The Chin Coulee property is producing oil from the Jurassic Sawtooth Formation of the lower Ellis Group.

Average daily production net to Silverleaf from Chin Coulee for the months of July and August 2023 was approximately 32 bbl/d of heavy oil.

Operating income net to Silverleaf from Chin Coulee for the months of July and August 2023 averaged approximately $40,800 per month, or $489,600 on an annualized basis.

At Chin Coulee, Silverleaf holds a 100% working interest in one section of land. The Chin Coulee property is producing oil from the Jurassic Sawtooth Formation of the lower Ellis Group.

Average daily production net to Silverleaf from Chin Coulee for the months of July and August 2023 was approximately 32 bbl/d of heavy oil.

Operating income net to Silverleaf from Chin Coulee for the months of July and August 2023 averaged approximately $40,800 per month, or $489,600 on an annualized basis.

Chin Coulee Upside

The Sawtooth H Pool over Silverleaf’s lands is a sandstone reservoir with average porosity of 21% and permeability containing 17.8° API oil. The Company has identified up to 4.4 metres of net pay in the Sawtooth Formation on its lands.

At Chin Coulee, Silverleaf has identified one vertical Sawtooth drilling location at 01-33-007-15W4 which has been included in the GLJ Report with assigned proved undeveloped and proved plus probable reserves.

The Company has also identified two recompletion opportunities in the Sawtooth Formation in the wells Varenna Chinco 100/13-27-007-15W4/00 and Varenna Chinco 100/04-34-007-15W4/00 at Chin Coulee.

Further details on the recompletion opportunities will be available in the virtual data room for parties that execute a confidentiality agreement.

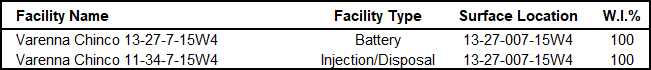

Chin Coulee Facilities

At Chin Coulee, Silverleaf has a 100% working interest in the following facilities.

The Sawtooth H Pool over Silverleaf’s lands is a sandstone reservoir with average porosity of 21% and permeability containing 17.8° API oil. The Company has identified up to 4.4 metres of net pay in the Sawtooth Formation on its lands.

At Chin Coulee, Silverleaf has identified one vertical Sawtooth drilling location at 01-33-007-15W4 which has been included in the GLJ Report with assigned proved undeveloped and proved plus probable reserves.

The Company has also identified two recompletion opportunities in the Sawtooth Formation in the wells Varenna Chinco 100/13-27-007-15W4/00 and Varenna Chinco 100/04-34-007-15W4/00 at Chin Coulee.

Further details on the recompletion opportunities will be available in the virtual data room for parties that execute a confidentiality agreement.

Chin Coulee Facilities

At Chin Coulee, Silverleaf has a 100% working interest in the following facilities.

The downhole pumping systems on Silverleaf’s wells at Chin Coulee are progressive cavity screw pumps.

Chin Coulee Marketing

Silverleaf has a one-month evergreen purchase contract in place with Inter Pipeline Canadian Marketing Ltd. for oil.

Oil production from Chin Coulee is flow-lined into a central battery, from which the oil is then trucked to sales at the Milk River terminal.

Produced water at Chin Coulee is disposed back into the reservoir at the Company’s dedicated water injection well at 13-27-007-15W4.

Chin Coulee Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimates that, as at June 30, 2023, the Chin Coulee property contained remaining proved plus probable reserves of 151,000 barrels of oil, with an estimated net present value of $2.2 million using forecast pricing at a 10% discount.

Chin Coulee Marketing

Silverleaf has a one-month evergreen purchase contract in place with Inter Pipeline Canadian Marketing Ltd. for oil.

Oil production from Chin Coulee is flow-lined into a central battery, from which the oil is then trucked to sales at the Milk River terminal.

Produced water at Chin Coulee is disposed back into the reservoir at the Company’s dedicated water injection well at 13-27-007-15W4.

Chin Coulee Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimates that, as at June 30, 2023, the Chin Coulee property contained remaining proved plus probable reserves of 151,000 barrels of oil, with an estimated net present value of $2.2 million using forecast pricing at a 10% discount.

Chin Coulee LMR as of October 7, 2023

As of October 7, 2023, the Chin Coulee property had a deemed net asset value of $873,335 (deemed assets of $1.3 million and deemed liabilities of $470,356), with an LMR ratio of 2.86.

As of October 7, 2023, the Chin Coulee property had a deemed net asset value of $873,335 (deemed assets of $1.3 million and deemed liabilities of $470,356), with an LMR ratio of 2.86.

Chin Coulee Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

EDSON

Township 54-55, Range 17-18 W5

At Edson, Silverleaf holds various working interests in four sections of land. The Edson property is producing oil from the Cardium Formation and natural gas from the Jurassic Rock Creek Formation.

Average daily production net to Silverleaf from Edson for the months of July and August 2023 was approximately 26 boe/d, consisting of 115 Mcf/d of natural gas and six bbl/d of oil and natural gas liquids.

Operating income net to Silverleaf from Edson for the months of July and August 2023 averaged approximately $5,700 per month, or $68,400 on an annualized basis.

Both of Silverleaf’s operated wells at Edson are currently shut-in due to capacity issues at Westbrick Energy Ltd.’s compressor plant at 10-30-055-17W5. Both the 103/05-07-055-17W5/00 and 100/10-08-055-17W5/00 wells can be restarted as soon as capacity issues are resolved at the compressor plant. Silverleaf anticipates that once capacity issues are resolved production from the two wells would be approximately 26 bbl/d of oil and natural gas liquids and 1.2 MMcf/d of natural gas.

Silverleaf holds working interest ranging from 20%-40% in three wells operated by Long Run Exploration Ltd. and a 25% working interest in one Westbrick operated well at 102/05-07-055-17W5/00 which has been abandoned with phase II environmental site assessment in progress.

At Edson, Silverleaf holds various working interests in four sections of land. The Edson property is producing oil from the Cardium Formation and natural gas from the Jurassic Rock Creek Formation.

Average daily production net to Silverleaf from Edson for the months of July and August 2023 was approximately 26 boe/d, consisting of 115 Mcf/d of natural gas and six bbl/d of oil and natural gas liquids.

Operating income net to Silverleaf from Edson for the months of July and August 2023 averaged approximately $5,700 per month, or $68,400 on an annualized basis.

Both of Silverleaf’s operated wells at Edson are currently shut-in due to capacity issues at Westbrick Energy Ltd.’s compressor plant at 10-30-055-17W5. Both the 103/05-07-055-17W5/00 and 100/10-08-055-17W5/00 wells can be restarted as soon as capacity issues are resolved at the compressor plant. Silverleaf anticipates that once capacity issues are resolved production from the two wells would be approximately 26 bbl/d of oil and natural gas liquids and 1.2 MMcf/d of natural gas.

Silverleaf holds working interest ranging from 20%-40% in three wells operated by Long Run Exploration Ltd. and a 25% working interest in one Westbrick operated well at 102/05-07-055-17W5/00 which has been abandoned with phase II environmental site assessment in progress.

Edson Upside

At Edson, Silverleaf has identified a recompletion opportunity in the Bluesky Formation in the well SRI Edson 103/05-07-055-17W5/00.

Further details on the recompletion opportunities will be available in the virtual data room for parties that execute a confidentiality agreement.

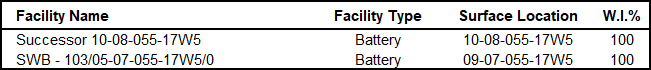

Edson Facilities

At Edson, Silverleaf has a 100% working interest in the following facilities.

At Edson, Silverleaf has identified a recompletion opportunity in the Bluesky Formation in the well SRI Edson 103/05-07-055-17W5/00.

Further details on the recompletion opportunities will be available in the virtual data room for parties that execute a confidentiality agreement.

Edson Facilities

At Edson, Silverleaf has a 100% working interest in the following facilities.

Edson Marketing

Silverleaf has a one-month evergreen purchase contract in place with Acme Energy Marketing Ltd. for oil, natural gas liquids and natural gas.

Natural gas produced from Silverleaf’s operated wells is pipeline connected to Westbrick’s infrastructure and compressor plant.

Both of Silverleaf’s operated wells at Edson are currently shut-in due to capacity issues at Westbrick’s compressor plant. The three Long Run operated wells are tied in to 13-19-054-17W5.

Edson Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimated that, as at June 30, 2023, the Edson Property contained remaining proved plus probable reserves of 72,000 barrels of oil and natural gas liquids and 1.0 Bcf of natural gas (245,000 boe), with an estimated net present value of $1.4 million using forecast pricing at a 10% discount.

Silverleaf has a one-month evergreen purchase contract in place with Acme Energy Marketing Ltd. for oil, natural gas liquids and natural gas.

Natural gas produced from Silverleaf’s operated wells is pipeline connected to Westbrick’s infrastructure and compressor plant.

Both of Silverleaf’s operated wells at Edson are currently shut-in due to capacity issues at Westbrick’s compressor plant. The three Long Run operated wells are tied in to 13-19-054-17W5.

Edson Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimated that, as at June 30, 2023, the Edson Property contained remaining proved plus probable reserves of 72,000 barrels of oil and natural gas liquids and 1.0 Bcf of natural gas (245,000 boe), with an estimated net present value of $1.4 million using forecast pricing at a 10% discount.

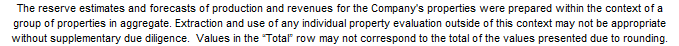

Edson LMR as of October 7, 2023

As of October 7, 2023, the Edson property had a deemed net asset value of ($209,038) (deemed assets of $0 and deemed liabilities of $209,038), with an LMR ratio of 0.00.

As of October 7, 2023, the Edson property had a deemed net asset value of ($209,038) (deemed assets of $0 and deemed liabilities of $209,038), with an LMR ratio of 0.00.

Edson Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

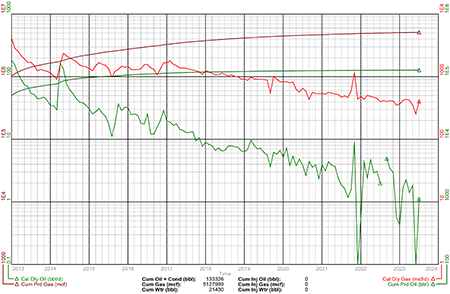

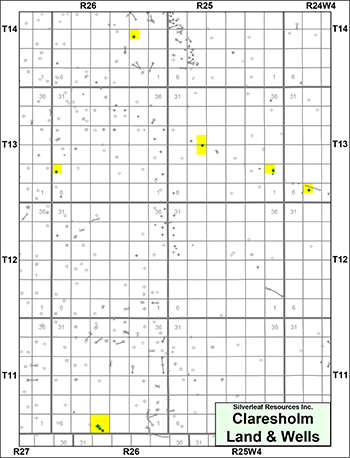

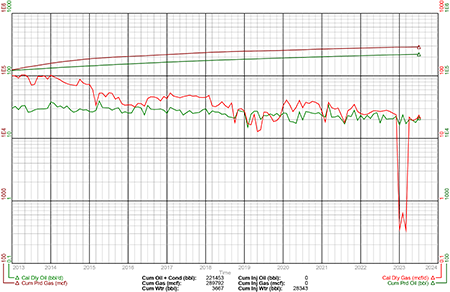

CLARESHOLM

SILVERLEAF HAS SOLD A PORTION OF ITS INTERESTS IN THE CLARESHOLM AREA OF ALBERTA.

Township 11-14, Range 24-26 W4

At Claresholm, Silverleaf holds a 100% working interest in 2.5 sections of land. The Claresholm property is producing oil from the Barons Sand and Bow Island formations of the Colorado Group. The wells at Claresholm exhibit low decline production with long life and low operating costs. The wells are equipped with conventional beam pump jacks with insert pumps downhole.

Average daily production net to Silverleaf from Claresholm for the months of July and August 2023 was approximately 22 bbl/d of oil.

Operating income net to Silverleaf from Claresholm for the months of July and August 2023 averaged approximately $41,700 per month, or $500,400 on an annualized basis.

Township 11-14, Range 24-26 W4

At Claresholm, Silverleaf holds a 100% working interest in 2.5 sections of land. The Claresholm property is producing oil from the Barons Sand and Bow Island formations of the Colorado Group. The wells at Claresholm exhibit low decline production with long life and low operating costs. The wells are equipped with conventional beam pump jacks with insert pumps downhole.

Average daily production net to Silverleaf from Claresholm for the months of July and August 2023 was approximately 22 bbl/d of oil.

Operating income net to Silverleaf from Claresholm for the months of July and August 2023 averaged approximately $41,700 per month, or $500,400 on an annualized basis.

Claresholm Upside

At Claresholm, Silverleaf has identified four recompletion opportunities in the Barons/Bow Island Formation in the wells SRI EastM 100/02-04-011-26W4/00, SRI EastM 100/06-04-011-26W4/00, SRI Clares 100/11-05-013-24W4/00 and SRI Clares 100/11-12-013-25W4/00.

Further details on the recompletion opportunities will be available in the virtual data room for parties that execute a confidentiality agreement.

Claresholm Facilities

At Claresholm, Silverleaf has a 100% working interest in the following facilities.

At Claresholm, Silverleaf has identified four recompletion opportunities in the Barons/Bow Island Formation in the wells SRI EastM 100/02-04-011-26W4/00, SRI EastM 100/06-04-011-26W4/00, SRI Clares 100/11-05-013-24W4/00 and SRI Clares 100/11-12-013-25W4/00.

Further details on the recompletion opportunities will be available in the virtual data room for parties that execute a confidentiality agreement.

Claresholm Facilities

At Claresholm, Silverleaf has a 100% working interest in the following facilities.

Claresholm Marketing

Silverleaf has a one-month evergreen purchase contract in place with Acme Energy Marketing Ltd. for oil and natural gas liquids.

The Company trucks its oil from single well batteries at Claresholm to the Inter Pipeline Ltd. Hays truck terminal or Gibson Energy Inc.’s Hussar truck terminal.

No water is produced from Claresholm.

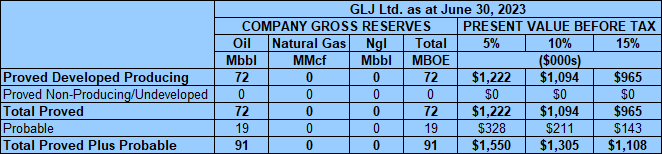

Claresholm Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimates that, as at June 30, 2023, the Claresholm property contained remaining proved plus probable reserves of 91,000 barrels of oil, with an estimated net present value of $1.3 million using forecast pricing at a 10% discount.

Silverleaf has a one-month evergreen purchase contract in place with Acme Energy Marketing Ltd. for oil and natural gas liquids.

The Company trucks its oil from single well batteries at Claresholm to the Inter Pipeline Ltd. Hays truck terminal or Gibson Energy Inc.’s Hussar truck terminal.

No water is produced from Claresholm.

Claresholm Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimates that, as at June 30, 2023, the Claresholm property contained remaining proved plus probable reserves of 91,000 barrels of oil, with an estimated net present value of $1.3 million using forecast pricing at a 10% discount.

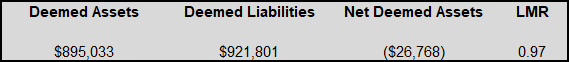

Claresholm LMR as of October 7, 2023

As of October 7, 2023, the Claresholm property had a deemed net asset value of ($26,768) (deemed assets of $895,033 and deemed liabilities of $921,801), with an LMR ratio of 0.97.

As of October 7, 2023, the Claresholm property had a deemed net asset value of ($26,768) (deemed assets of $895,033 and deemed liabilities of $921,801), with an LMR ratio of 0.97.

Claresholm Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

ALBERTA MISCELLANEOUS PROPERTIES

Silverleaf holds various working interests in lands and wells in the Hayter, Kaybob South, and Thorsby areas of Alberta (the “Alberta Miscellaneous Properties”).

Average daily production net to Silverleaf from the Alberta Miscellaneous Properties for the months of July and August 2023 was approximately 93 boe/d, consisting of 408 Mcf/d of natural gas and 25 bbl/d of oil and natural gas liquids.

Operating income net to Silverleaf from the Alberta Miscellaneous Properties for the months of July and August 2023 averaged approximately $49,200 per month, or $590,400 on an annualized basis.

Average daily production net to Silverleaf from the Alberta Miscellaneous Properties for the months of July and August 2023 was approximately 93 boe/d, consisting of 408 Mcf/d of natural gas and 25 bbl/d of oil and natural gas liquids.

Operating income net to Silverleaf from the Alberta Miscellaneous Properties for the months of July and August 2023 averaged approximately $49,200 per month, or $590,400 on an annualized basis.

Alberta Miscellaneous Upside

At Hayter, Silverleaf has identified recompletion opportunities in the Cummings and GP formations in the well Bow River Hayter 102/12-22-040-01W4/00.

At Thorsby, Silverleaf has identified a recompletion opportunity in the Glauconitic Formation in the well SRI Thorsby 103/11-18-049-01W5/00.

At Hayter, Silverleaf has identified recompletion opportunities in the Cummings and GP formations in the well Bow River Hayter 102/12-22-040-01W4/00.

At Thorsby, Silverleaf has identified a recompletion opportunity in the Glauconitic Formation in the well SRI Thorsby 103/11-18-049-01W5/00.

Alberta Miscellaneous Facilities

Silverleaf has working interests in the following facilities associated with the Alberta Miscellaneous Properties.

Silverleaf has working interests in the following facilities associated with the Alberta Miscellaneous Properties.

Alberta Miscellaneous Marketing

The well 100/14-23-058-21W5/00 produces 40° API light oil. Emulsion produced from the well is trucked to Secure Energy Services Inc.’s Fox Creek facility for treating and sales. Natural gas from this well is delivered to Nova Gas Transmission Ltd. 2035 Kaybob South #3 terminal.

The well 102/12-22-040-01W4 produces 14.3° API oil at single oil battery located at 13-22-040-01W4. Pipeline spec oil is shipped to Teine Energy Ltd.’s Chauvin terminal, while produced water is trucked out for disposal.

Natural gas from Thorsby is pipeline connected to Petrus Resources Corp. operated infrastructure and it is delivered to Nova Gas Transmission Ltd. 30284 Huggett APN receipt point.

Alberta Miscellaneous Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimated that, as at June 30, 2023, the Alberta Miscellaneous Properties contained remaining proved plus probable reserves of 96,000 barrels of oil and natural gas liquids and 1.3 Bcf of natural gas (309,000 boe), with an estimated net present value of $3.2 million using forecast pricing at a 10% discount.

The well 100/14-23-058-21W5/00 produces 40° API light oil. Emulsion produced from the well is trucked to Secure Energy Services Inc.’s Fox Creek facility for treating and sales. Natural gas from this well is delivered to Nova Gas Transmission Ltd. 2035 Kaybob South #3 terminal.

The well 102/12-22-040-01W4 produces 14.3° API oil at single oil battery located at 13-22-040-01W4. Pipeline spec oil is shipped to Teine Energy Ltd.’s Chauvin terminal, while produced water is trucked out for disposal.

Natural gas from Thorsby is pipeline connected to Petrus Resources Corp. operated infrastructure and it is delivered to Nova Gas Transmission Ltd. 30284 Huggett APN receipt point.

Alberta Miscellaneous Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties (the “GLJ Report”). The GLJ Report is effective June 30, 2023 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s July 1, 2023 forecast pricing (“3C Average”).

GLJ estimated that, as at June 30, 2023, the Alberta Miscellaneous Properties contained remaining proved plus probable reserves of 96,000 barrels of oil and natural gas liquids and 1.3 Bcf of natural gas (309,000 boe), with an estimated net present value of $3.2 million using forecast pricing at a 10% discount.

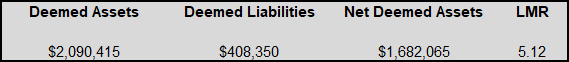

Alberta Miscellaneous LMR as of October 7, 2023

As of October 7, 2023, the Alberta Miscellaneous Properties had a deemed net asset value of $1.7 million (deemed assets of $2.1 million and deemed liabilities of $408,350), with an LMR ratio of 5.12.

As of October 7, 2023, the Alberta Miscellaneous Properties had a deemed net asset value of $1.7 million (deemed assets of $2.1 million and deemed liabilities of $408,350), with an LMR ratio of 5.12.

Alberta Miscellaneous Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

PROCESS & TIMELINE

Sayer Energy Advisors is accepting offers to acquire the Properties until 12:00 pm on Thursday December 7, 2023.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude a

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

Sayer Energy Advisors is accepting offers from interested parties until

noon on Thursday December 7, 2023.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Properties with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (brye@sayeradvisors.com) or fax (403.266.4467).Included in the confidential information is the following: detailed land information, LMR information, the GLJ Report, most recent net operations summary and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Ben Rye, Tom Pavic or Sydney Birkett at 403.266.6133.