Offering Details

Back

Under Review / Canadian Spirit Resources Inc.

Canadian Spirit Resources Inc.

Strategic Alternatives Process

Strategic Alternatives ProcessBid Deadline: February 22, 2024

12:00 PM

Download Full PDF - Printable

OVERVIEW

Canadian Spirit Resources Inc. Announces Sale of East Block Montney Lands.

Canadian Spirit Resources Inc. (“Canadian Spirit” or the “Company”) has engaged Sayer Energy Advisors to assist it with a strategic alternatives process. The Company is open to reviewing all alternatives including, but not limited to, a corporate transaction resulting in the direct or indirect sale or disposition of all or substantially all of the shares of the Company or the sale of the majority of Canadian Spirit’s oil and natural gas assets, in whole or in part, or a joint venture covering all or a majority of the assets of Canadian Spirit.

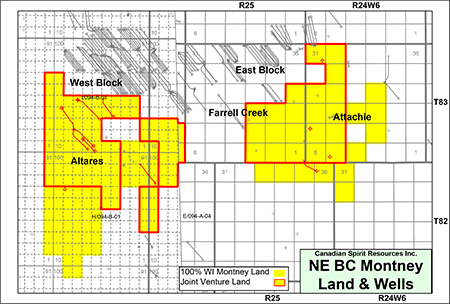

Canadian Spirit is a publicly-traded entity listed on the TSX-V under the ticker symbol SPI, with operated and non-operated working interests located in the Altares, Attachie and Farrell Creek areas of northeastern British Columbia (the “Properties”).

The Company holds various operated and non-operated working interests in approximately 77 sections of land. The Properties are prospective for the Montney and includes Montney rights in approximately 75 sections of land.

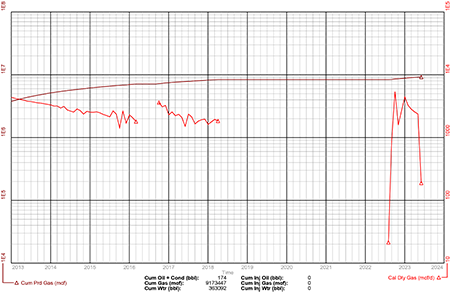

Canadian Spirit’s production was shut-in in June 2023 due to low natural gas prices at Station 2. Production was re-activated on November 17, 2023.

Prior to shutting in production, Canadian Spirit’s average daily net sales production for the first four months of 2023 was approximately 1.1 MMcf/d of natural gas (179 boe/d). Current production since reactivation is approximately 685 Mcf/d of natural gas (114 boe/d).

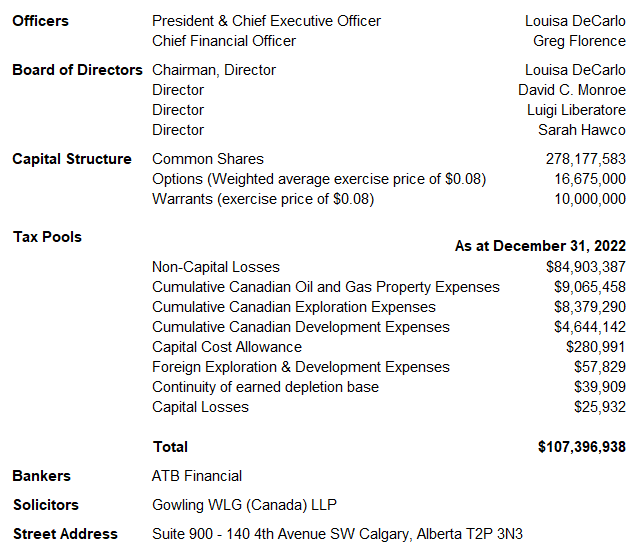

As at September 30, 2023, the Company had a nominal working capital deficit of $62,628. As at December 31, 2022, Canadian Spirit had total unused Canadian income tax pools of approximately $107.4 million, including $84.9 million of non-capital losses.

As of December 6, 2023, Canadian Spirit’s PCA score was calculated to be 35.04.

The Company has total royalty credits of approximately $3.5 million.

The Company also holds a 25% working interest in a water pipeline and has a water license with British Columbia Hydro and Power Authority for fresh water supply.

Additional corporate information relating to Canadian Spirit will be provided to parties upon execution of a confidentiality agreement.

Canadian Spirit Resources Inc. (“Canadian Spirit” or the “Company”) has engaged Sayer Energy Advisors to assist it with a strategic alternatives process. The Company is open to reviewing all alternatives including, but not limited to, a corporate transaction resulting in the direct or indirect sale or disposition of all or substantially all of the shares of the Company or the sale of the majority of Canadian Spirit’s oil and natural gas assets, in whole or in part, or a joint venture covering all or a majority of the assets of Canadian Spirit.

Canadian Spirit is a publicly-traded entity listed on the TSX-V under the ticker symbol SPI, with operated and non-operated working interests located in the Altares, Attachie and Farrell Creek areas of northeastern British Columbia (the “Properties”).

The Company holds various operated and non-operated working interests in approximately 77 sections of land. The Properties are prospective for the Montney and includes Montney rights in approximately 75 sections of land.

Canadian Spirit’s production was shut-in in June 2023 due to low natural gas prices at Station 2. Production was re-activated on November 17, 2023.

Prior to shutting in production, Canadian Spirit’s average daily net sales production for the first four months of 2023 was approximately 1.1 MMcf/d of natural gas (179 boe/d). Current production since reactivation is approximately 685 Mcf/d of natural gas (114 boe/d).

As at September 30, 2023, the Company had a nominal working capital deficit of $62,628. As at December 31, 2022, Canadian Spirit had total unused Canadian income tax pools of approximately $107.4 million, including $84.9 million of non-capital losses.

As of December 6, 2023, Canadian Spirit’s PCA score was calculated to be 35.04.

The Company has total royalty credits of approximately $3.5 million.

The Company also holds a 25% working interest in a water pipeline and has a water license with British Columbia Hydro and Power Authority for fresh water supply.

Additional corporate information relating to Canadian Spirit will be provided to parties upon execution of a confidentiality agreement.

Corporate Overview

Canadian Spirit is a publicly-traded entity listed on the TSX-V under the ticker symbol SPI, with operated and non-operated working interests located in the Altares, Attachie and Farrell Creek areas of British Columbia.

As at September 30, 2023, the Company had a nominal working capital deficit of $62,628. As at December 31, 2022, Canadian Spirit had total unused Canadian income tax pools of approximately $107.4 million, including $84.9 million of non-capital losses.

Additional corporate information relating to Canadian Spirit will be provided to parties upon execution of a confidentiality agreement.

Canadian Spirit is a publicly-traded entity listed on the TSX-V under the ticker symbol SPI, with operated and non-operated working interests located in the Altares, Attachie and Farrell Creek areas of British Columbia.

As at September 30, 2023, the Company had a nominal working capital deficit of $62,628. As at December 31, 2022, Canadian Spirit had total unused Canadian income tax pools of approximately $107.4 million, including $84.9 million of non-capital losses.

Additional corporate information relating to Canadian Spirit will be provided to parties upon execution of a confidentiality agreement.

NE BC PROPERTIES

Township 81-83, Range 24 W6 - NTS 94-B-01

In northeastern British Columbia, Canadian Spirit holds various operated and non-operated working interests in approximately 77 sections of land. The Properties are prospective for the Montney and includes Montney rights in approximately 75 sections of land.

The Company has a joint venture agreement in place with Pacific Canbriam Energy Limited which operates a portion of the Altares property as outlined below. The wells located in the northwestern portion of Altares are operated by Pacific Canbriam where Canadian Spirit holds a working interest of 35%. The joint venture lands are outlined in red on the following map. Production from Altares is primarily from the Montney Formation.

Production at Altares was shut-in in June 2023 due to low natural gas prices at Station 2. Production was re-activated on November 17, 2023.

Prior to shutting in production, Canadian Spirit’s average daily net sales production for the first four months of 2023 was approximately 1.1 MMcf/d of natural gas (179 boe/d). Current production since reactivation is approximately 685 Mcf/d of natural gas (114 boe/d).

In northeastern British Columbia, Canadian Spirit holds various operated and non-operated working interests in approximately 77 sections of land. The Properties are prospective for the Montney and includes Montney rights in approximately 75 sections of land.

The Company has a joint venture agreement in place with Pacific Canbriam Energy Limited which operates a portion of the Altares property as outlined below. The wells located in the northwestern portion of Altares are operated by Pacific Canbriam where Canadian Spirit holds a working interest of 35%. The joint venture lands are outlined in red on the following map. Production from Altares is primarily from the Montney Formation.

Production at Altares was shut-in in June 2023 due to low natural gas prices at Station 2. Production was re-activated on November 17, 2023.

Prior to shutting in production, Canadian Spirit’s average daily net sales production for the first four months of 2023 was approximately 1.1 MMcf/d of natural gas (179 boe/d). Current production since reactivation is approximately 685 Mcf/d of natural gas (114 boe/d).

Canadian Spirit’s production was shut-in in June 2023 due to low natural gas prices at Station 2. Production was re-activated on November 17, 2023.

NE BC Upside

Montney Formation

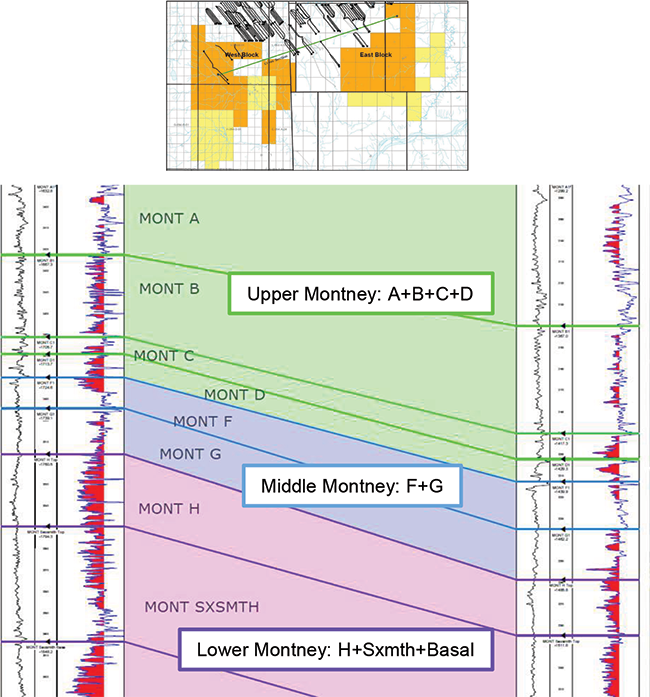

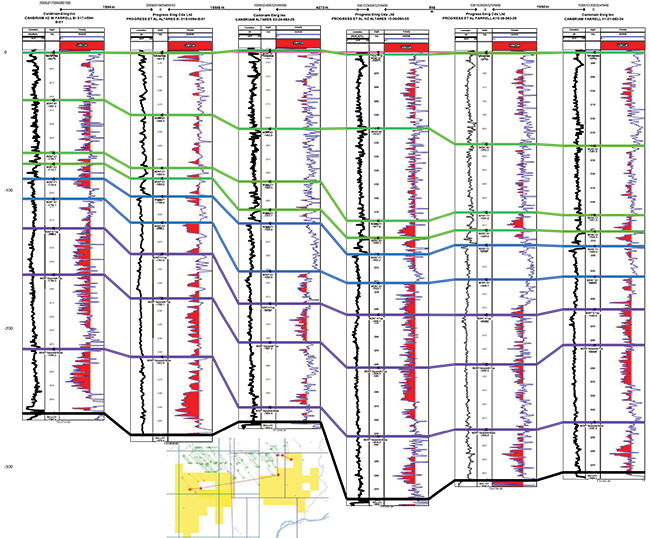

The Montney Formation is the main producing formation and consists of thick laminated packages of shale, sand and siltstones which were deposited in a shallow marine environment. The Montney is found at a depth of approximately 2,100 metres, unconformably overlying the Belloy Formation. The Montney is overlain by the Doig Formation. Canadian Spirit’s lands are located in the thickest part of the regional Montney deposits.

The Montney is packaged into the Upper, Middle and Lower Montney intervals and is estimated to contain approximately 100 Bcf of original natural gas in place per section. The main targets are comprised of the Upper and Lower Montney zones.

The Upper Montney interval over Canadian Spirit’s land is mapped as the Montney A, B, C and D with approximately 150 metres of combined thickness and porosity greater than five percent.

The Lower Montney zone is mapped as the Montney F, G, H and Sexsmith intervals with a combined 120 metres of thickness and porosity between three and five percent.

NE BC Upside

Montney Formation

The Montney Formation is the main producing formation and consists of thick laminated packages of shale, sand and siltstones which were deposited in a shallow marine environment. The Montney is found at a depth of approximately 2,100 metres, unconformably overlying the Belloy Formation. The Montney is overlain by the Doig Formation. Canadian Spirit’s lands are located in the thickest part of the regional Montney deposits.

The Montney is packaged into the Upper, Middle and Lower Montney intervals and is estimated to contain approximately 100 Bcf of original natural gas in place per section. The main targets are comprised of the Upper and Lower Montney zones.

The Upper Montney interval over Canadian Spirit’s land is mapped as the Montney A, B, C and D with approximately 150 metres of combined thickness and porosity greater than five percent.

The Lower Montney zone is mapped as the Montney F, G, H and Sexsmith intervals with a combined 120 metres of thickness and porosity between three and five percent.

The following cross section of the Montney reservoir shows significant thickness and continuous net pay over the Company’s acreage with development potential within multiple horizons.

Gething Formation

The Company also identified the Gething Formation as prospective for CBM on its lands.

Further geological details relating to the Gething and Montney potential will be available in the virtual data room for parties that execute a confidentiality agreement.

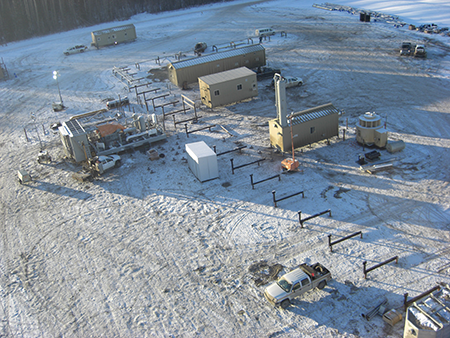

Canadian Spirit Facilities

Canadian Spirit holds a 35% working interest in the sweet natural gas production facilities at B-017-/94-B-01 consisting of an inlet separator, dehydrator and compressor as well as a natural gas gathering system operated by Pacific Canbriam. The Montney joint venture facilities are scalable to 60 MMcf/d.

The Company also identified the Gething Formation as prospective for CBM on its lands.

Further geological details relating to the Gething and Montney potential will be available in the virtual data room for parties that execute a confidentiality agreement.

Canadian Spirit Facilities

Canadian Spirit holds a 35% working interest in the sweet natural gas production facilities at B-017-/94-B-01 consisting of an inlet separator, dehydrator and compressor as well as a natural gas gathering system operated by Pacific Canbriam. The Montney joint venture facilities are scalable to 60 MMcf/d.

The Company also holds a 25% working interest in a water pipeline and has a water license with British Columbia Hydro and Power Authority for fresh water supply. The water pipeline license allows for the withdrawl of a maximum of 10,000 m3 per day of water from the Williston Reservoir for natural gas well stimulation and fracturing.

Further details relating to Canadian Spirit’s facilities and equipment will be available in the virtual data room for parties that execute a confidentiality agreement.

Canadian Spirit Marketing

Canadian Spirit has a natural gas purchase agreement in place with BP Canada Energy Group ULC for its operated production where the Company sells its natural gas into the Westcoast Energy Inc. (Enbridge) pipeline at the T-North delivery point.

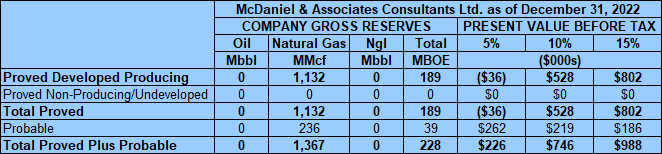

Canadian Spirit Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of Canadian Spirit (the “McDaniel Report”) as part of the Company’s year-end reporting. The McDaniel Report is effective December 31, 2022 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2023 forecast pricing (“3C Average”).

McDaniel estimated that, as of December 31, 2022, Canadian Spirit had remaining proved plus probable reserves of 1.4 Bcf of natural gas (228,000 boe), with an estimated net present value of $746,000 using forecast pricing at a 10% discount.

Further details relating to Canadian Spirit’s facilities and equipment will be available in the virtual data room for parties that execute a confidentiality agreement.

Canadian Spirit Marketing

Canadian Spirit has a natural gas purchase agreement in place with BP Canada Energy Group ULC for its operated production where the Company sells its natural gas into the Westcoast Energy Inc. (Enbridge) pipeline at the T-North delivery point.

Canadian Spirit Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of Canadian Spirit (the “McDaniel Report”) as part of the Company’s year-end reporting. The McDaniel Report is effective December 31, 2022 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2023 forecast pricing (“3C Average”).

McDaniel estimated that, as of December 31, 2022, Canadian Spirit had remaining proved plus probable reserves of 1.4 Bcf of natural gas (228,000 boe), with an estimated net present value of $746,000 using forecast pricing at a 10% discount.

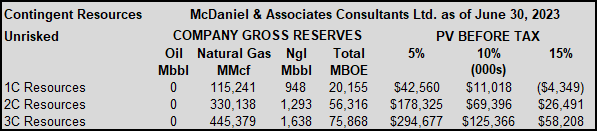

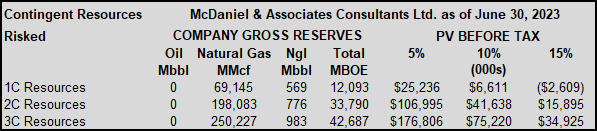

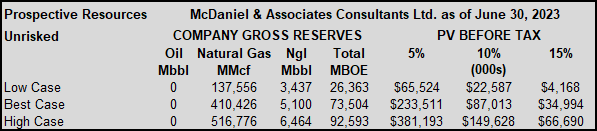

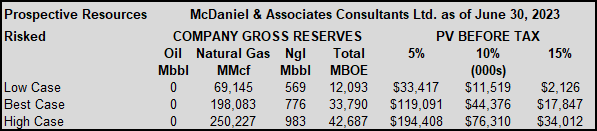

Canadian Spirit Reserves Assessments

McDaniel prepared an independent resource assessment of the prospective and contingent resources associated with the Montney Formation held by Canadian Spirit (the “Resources Study”). The Resource Study has been mechanically updated by McDaniel to June 30, 2023 using 3C Average forecast pricing at January 1, 2023 forecast pricing.

McDaniel estimated that, as of June 30, 2023, Canadian Spirit had best case (3C) contingent unrisked resources of 445.4 Bcf of natural gas and 1.6 million barrels of natural gas liquids (75.9 million boe), with an estimated net present value of $125.4 million using forecast pricing at a 10% discount.

McDaniel prepared an independent resource assessment of the prospective and contingent resources associated with the Montney Formation held by Canadian Spirit (the “Resources Study”). The Resource Study has been mechanically updated by McDaniel to June 30, 2023 using 3C Average forecast pricing at January 1, 2023 forecast pricing.

McDaniel estimated that, as of June 30, 2023, Canadian Spirit had best case (3C) contingent unrisked resources of 445.4 Bcf of natural gas and 1.6 million barrels of natural gas liquids (75.9 million boe), with an estimated net present value of $125.4 million using forecast pricing at a 10% discount.

Royalty Credits

The Company has total royalty credits of approximately $3.5 million.

Canadian Spirit Undeveloped Land

Seaton-Jordan & Associates Ltd. (“Seaton-Jordan”) prepared an independent evaluation of the undeveloped, non-reserve Montney lands held by Canadian Spirit (the “Seaton-Jordan Report”). The Seaton-Jordan Report is effective June 30, 2023.

Seaton-Jordan estimated that, as of June 30, 2023, the non-reserve properties held by the Company consisting of 10,399 net hectares (approximately 25,696 net acres) were assessed a value of $40,282,969.

PCA Score as of December 6, 2023

On April 1, 2022, the BC Energy Regulator (“BCER”) implemented its requirements for the Permittee Capability Assessment (“PCA”) program as a replacement to the Liability Management Rating program. The PCA assesses each permit holder’s corporate health against the liability associated with their Dormant, Inactive, and Marginal sites (referred to as DIM Liability) to determine corrective action requirements.

As of December 6, 2023, Canadian Spirit’s PCA score was calculated to be 35.04.

The Company also has a cash deposit of approximately $1.5 million with the BCER.

Further details on the Company’s PCA score and asset retirement obligations will be available in the virtual data room for parties that execute a confidentiality agreement.

Canadian Spirit Well List

Click here to download the complete well list in Excel.

The Company has total royalty credits of approximately $3.5 million.

Canadian Spirit Undeveloped Land

Seaton-Jordan & Associates Ltd. (“Seaton-Jordan”) prepared an independent evaluation of the undeveloped, non-reserve Montney lands held by Canadian Spirit (the “Seaton-Jordan Report”). The Seaton-Jordan Report is effective June 30, 2023.

Seaton-Jordan estimated that, as of June 30, 2023, the non-reserve properties held by the Company consisting of 10,399 net hectares (approximately 25,696 net acres) were assessed a value of $40,282,969.

PCA Score as of December 6, 2023

On April 1, 2022, the BC Energy Regulator (“BCER”) implemented its requirements for the Permittee Capability Assessment (“PCA”) program as a replacement to the Liability Management Rating program. The PCA assesses each permit holder’s corporate health against the liability associated with their Dormant, Inactive, and Marginal sites (referred to as DIM Liability) to determine corrective action requirements.

As of December 6, 2023, Canadian Spirit’s PCA score was calculated to be 35.04.

The Company also has a cash deposit of approximately $1.5 million with the BCER.

Further details on the Company’s PCA score and asset retirement obligations will be available in the virtual data room for parties that execute a confidentiality agreement.

Canadian Spirit Well List

Click here to download the complete well list in Excel.

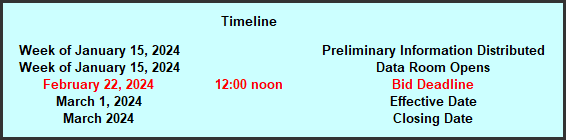

PROCESS & TIMELINE

Sayer Energy Advisors is accepting proposals relating to this process until 12:00 pm on Thursday February 22, 2024.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

Sayer Energy Advisors is accepting proposals from interested parties until

noon on Thursday February 22, 2024.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Company with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).Included in the confidential information is the following: most recent net lease operating statements, the McDaniel Report, summary land information, PCA score and other relevant corporate and technical information.

Download Confidentiality Agreement

To receive further information on the Company please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.