Offering Details

Back

Under Review / West Lake Energy Corp.

West Lake Energy Corp.

Property Divestiture

Property DivestitureBid Deadline: November 21, 2024

12:00 PM

Download Full PDF - Printable

OVERVIEW

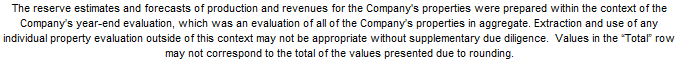

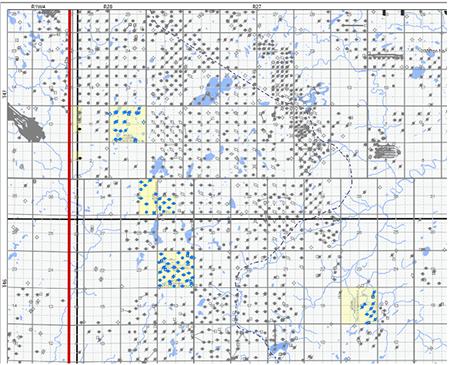

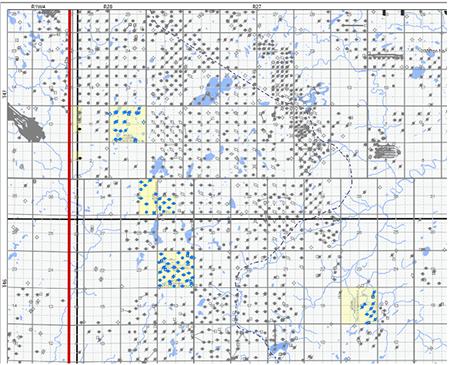

West Lake Energy Corp. (“West Lake” or the “Company”) has engaged Sayer Energy Advisors to assist with the sale of its oil and natural gas interests located in the Battle River, Epping, Freemont, Furness, Lashburn, and Tangleflags areas of Saskatchewan (the “Properties”).

West Lake operates all of the Properties, generally holding a 100% working interest including associated facilities. The Properties are generally located near Lloydminster, Saskatchewan and have minimal impending expiries. The Company has ownership in significant seismic data coverage relating to the Properties.

Total production net to West Lake from the Properties in the first half of 2024 averaged approximately 392 boe/d, consisting of 390 barrels of heavy oil per day and 13 Mcf/d of natural gas.

Net operating income from the Properties averaged approximately $150,000 per month for the first half of 2024, or $1.8 million on an annualized basis.

West Lake has mapped significant upside on the Properties which resulted in horizontal and vertical drilling locations booked on the Properties and additional unbooked drilling locations, as well as recompletion opportunities.

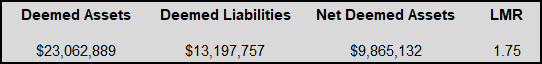

As of October 8, 2024, the Properties had a positive deemed net asset value of $9.9 million (deemed assets of $23.1 million less deemed liabilities of $13.2 million), with a pre-adjusted LMR ratio of 1.75.

West Lake’s preference is to sell all of the Properties in one transaction on a white map basis.

West Lake operates all of the Properties, generally holding a 100% working interest including associated facilities. The Properties are generally located near Lloydminster, Saskatchewan and have minimal impending expiries. The Company has ownership in significant seismic data coverage relating to the Properties.

Total production net to West Lake from the Properties in the first half of 2024 averaged approximately 392 boe/d, consisting of 390 barrels of heavy oil per day and 13 Mcf/d of natural gas.

Net operating income from the Properties averaged approximately $150,000 per month for the first half of 2024, or $1.8 million on an annualized basis.

West Lake has mapped significant upside on the Properties which resulted in horizontal and vertical drilling locations booked on the Properties and additional unbooked drilling locations, as well as recompletion opportunities.

As of October 8, 2024, the Properties had a positive deemed net asset value of $9.9 million (deemed assets of $23.1 million less deemed liabilities of $13.2 million), with a pre-adjusted LMR ratio of 1.75.

West Lake’s preference is to sell all of the Properties in one transaction on a white map basis.

Production, Reserves & NOI Overview

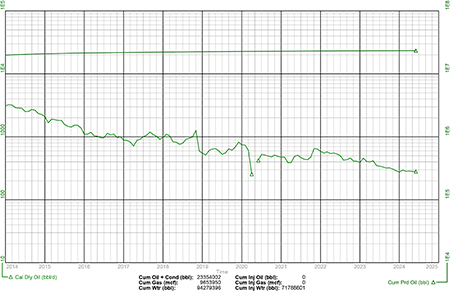

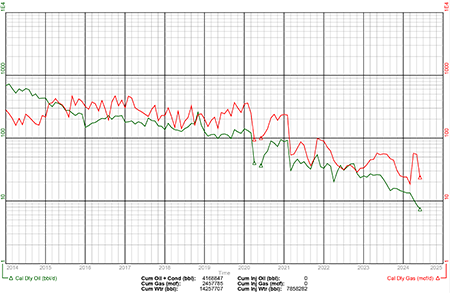

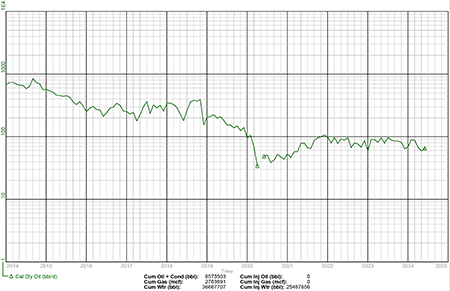

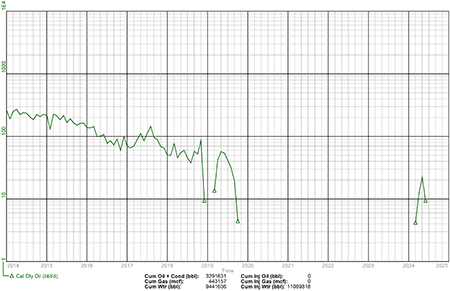

Total production net to West Lake from the Properties in the first half of 2024 averaged approximately 392 boe/d, consisting of 390 barrels of heavy oil per day and 13 Mcf/d of natural gas.

Net operating income from the Properties averaged approximately $150,000 per month for the first half of 2024, or $1.8 million on an annualized basis.

Total production net to West Lake from the Properties in the first half of 2024 averaged approximately 392 boe/d, consisting of 390 barrels of heavy oil per day and 13 Mcf/d of natural gas.

Net operating income from the Properties averaged approximately $150,000 per month for the first half of 2024, or $1.8 million on an annualized basis.

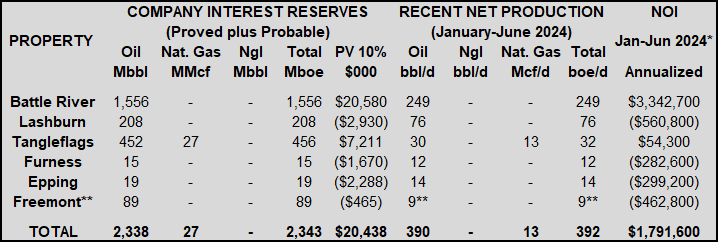

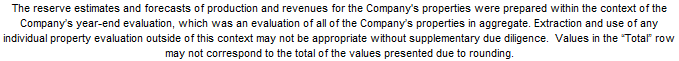

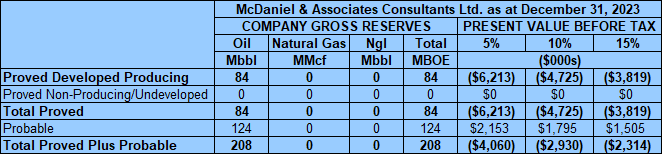

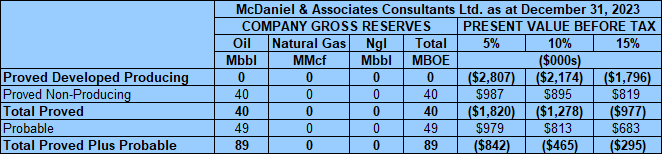

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimates that, as of December 31, 2023, the Properties contained remaining proved plus probable reserves of approximately 2.3 million barrels of oil and 27 MMcf of natural gas (2.3 million boe), with an estimated net present value of $20.4 million using forecast pricing at a 10% discount. The PV values in the chart below include asset retirement obligations for the evaluated wells.

McDaniel estimates that, as of December 31, 2023, the Properties contained remaining proved plus probable reserves of approximately 2.3 million barrels of oil and 27 MMcf of natural gas (2.3 million boe), with an estimated net present value of $20.4 million using forecast pricing at a 10% discount. The PV values in the chart below include asset retirement obligations for the evaluated wells.

*January-June 2024 NOI numbers are based on lease operating statements by operating month.

**The Freemont property was re-activated in April 2024.

Drilling Location Overview

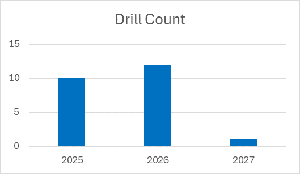

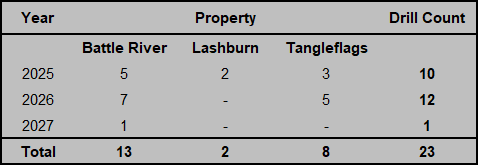

The Company has identified a total of 23 drilling locations on the Properties over the next three years.

The Company has identified a total of 23 drilling locations on the Properties over the next three years.

The following table shows a breakdown of locations per year.

LMR Overview as of October 8, 2024

As of October 8, 2024, the Properties had a positive deemed net asset value of $9.9 million (deemed assets of $23.1 million less deemed liabilities of $13.2 million), with a pre-adjusted LMR ratio of 1.75.

As of October 8, 2024, the Properties had a positive deemed net asset value of $9.9 million (deemed assets of $23.1 million less deemed liabilities of $13.2 million), with a pre-adjusted LMR ratio of 1.75.

Marketing Overview

The crude oil production volumes from the Properties are mainly sold to Gibson Energy Inc.’s Hardisty Terminal. Small volumes have been sold to Flint Hills Resources Canada LP’s Hardisty Truck Terminal. Sales are made under West Lake’s corporate marketing agreements with the purchasers. None of the Properties are dedicated to any long-term sales contract.

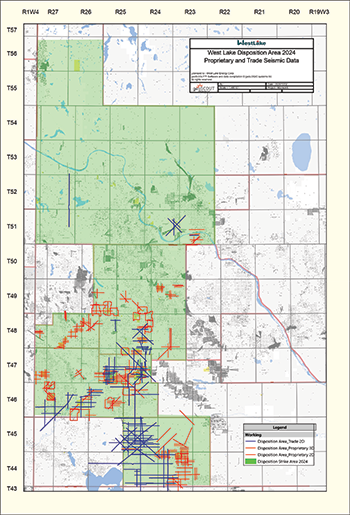

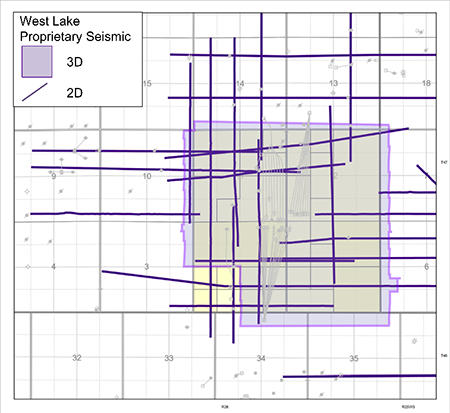

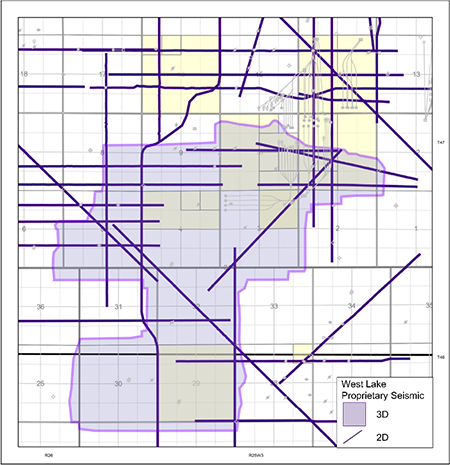

Seismic Overview

West Lake has trade and proprietary seismic over a portion of the Properties, as illustrated on the following map. The Company’s interpretations of the seismic are available for viewing on a workstation, by parties which have executed a confidentiality agreement.

The crude oil production volumes from the Properties are mainly sold to Gibson Energy Inc.’s Hardisty Terminal. Small volumes have been sold to Flint Hills Resources Canada LP’s Hardisty Truck Terminal. Sales are made under West Lake’s corporate marketing agreements with the purchasers. None of the Properties are dedicated to any long-term sales contract.

Seismic Overview

West Lake has trade and proprietary seismic over a portion of the Properties, as illustrated on the following map. The Company’s interpretations of the seismic are available for viewing on a workstation, by parties which have executed a confidentiality agreement.

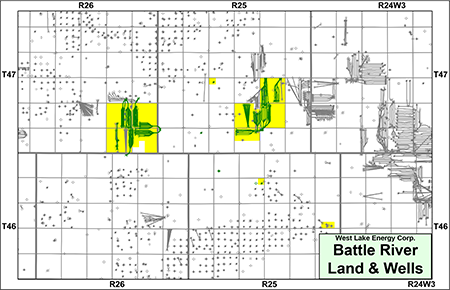

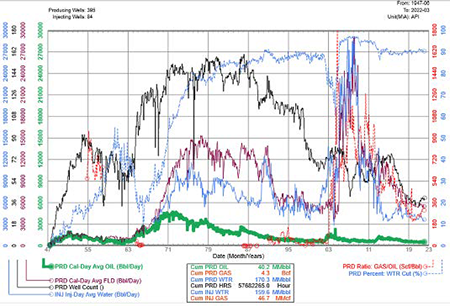

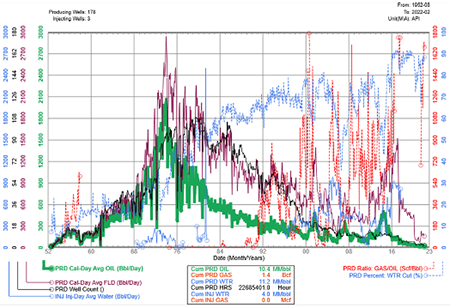

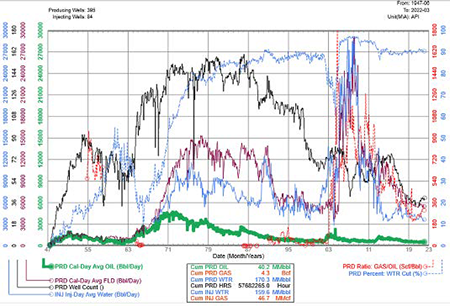

BATTLE RIVER

Township 46-47, Range 25-26 W3

At Battle River, West Lake holds a 100% working interest in 7.5 sections of land.

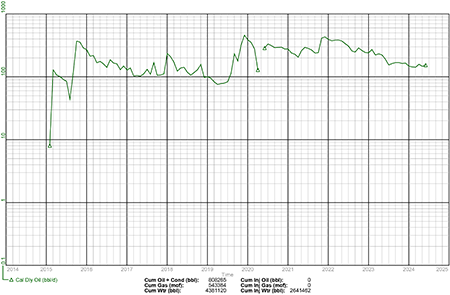

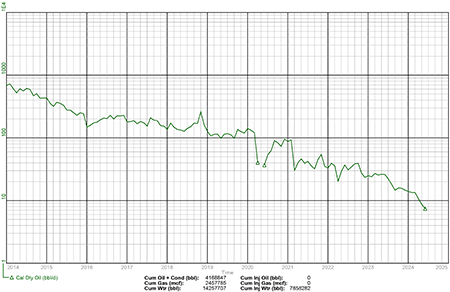

Production from Battle River net to West Lake for the first six months of 2024 averaged approximately 249 barrels of oil per day.

Net operating income from the property for the first six months of 2024 averaged approximately $281,000 per month, or $3.4 million on an annualized basis.

At Battle River, West Lake holds a 100% working interest in 7.5 sections of land.

Production from Battle River net to West Lake for the first six months of 2024 averaged approximately 249 barrels of oil per day.

Net operating income from the property for the first six months of 2024 averaged approximately $281,000 per month, or $3.4 million on an annualized basis.

Battle River Geology

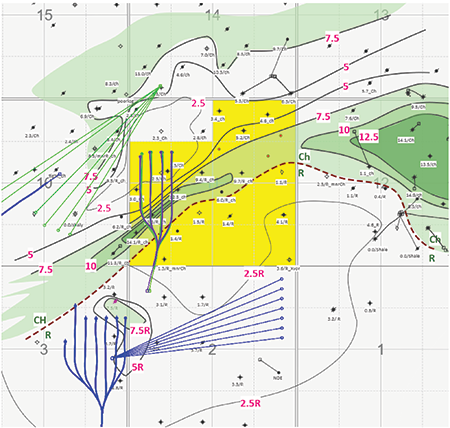

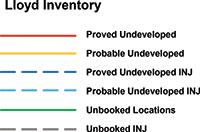

The Company has identified potential development and step out drilling in the Lloydminster and Rex formations on its lands at Battle River. West Lake has six proved undeveloped horizontal and two probable undeveloped horizontal drilling locations booked on its lands at Battle River. The unbooked inventory at Battle River is planned as open hole multi-lateral drilling.

The Company has implemented a waterflood in the Rex Formation with positive results to date. West Lake believes there is further expansion potential in the Rex, and is also planning to implement a waterflood in the Lloydminster Formation.

West Lake has also identified one multi-lateral open hole licensed drilling location targeting the Lloydminster Formation which has been deferred.

Lloydminster Formation

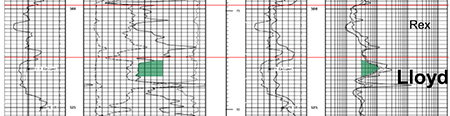

The Lloydminster Formation is found at depths of approximately 500-550 metres TVD at Battle River. Oil produced from the Lloydminster is approximately 11-13° API and Lloydminster net oil pay ranges from one to six metres thick.

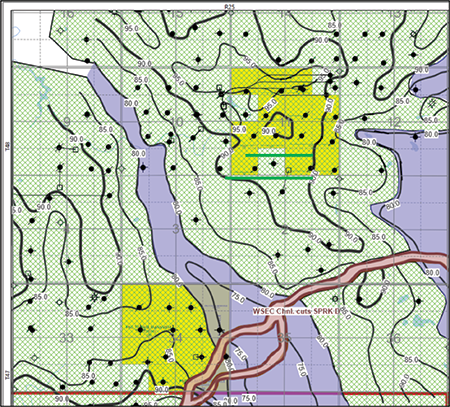

Below is an example of the Lloydminster reservoir on West Lake’s lands at Battle River. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

The Company has identified potential development and step out drilling in the Lloydminster and Rex formations on its lands at Battle River. West Lake has six proved undeveloped horizontal and two probable undeveloped horizontal drilling locations booked on its lands at Battle River. The unbooked inventory at Battle River is planned as open hole multi-lateral drilling.

The Company has implemented a waterflood in the Rex Formation with positive results to date. West Lake believes there is further expansion potential in the Rex, and is also planning to implement a waterflood in the Lloydminster Formation.

West Lake has also identified one multi-lateral open hole licensed drilling location targeting the Lloydminster Formation which has been deferred.

Lloydminster Formation

The Lloydminster Formation is found at depths of approximately 500-550 metres TVD at Battle River. Oil produced from the Lloydminster is approximately 11-13° API and Lloydminster net oil pay ranges from one to six metres thick.

Below is an example of the Lloydminster reservoir on West Lake’s lands at Battle River. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

Dome Lone Rock A7 11/07-11-047-26W3/0

Lloydminster Formation

Net Oil Pay Map (m) and Well Inventory

Net Oil Pay Map (m)

Structure Map (m SS)

Lloydminster Formation

Net Oil Pay Map (m) and Well Inventory

Net Oil Pay Map (m)

Structure Map (m SS)

West Lake has proprietary 2D and 3D seismic coverage over its Lloydminster lands at Battle River as shown on the following plat.

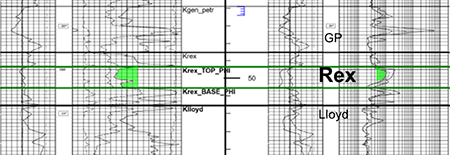

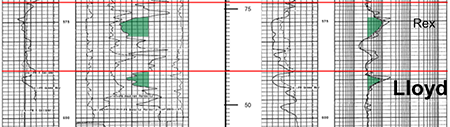

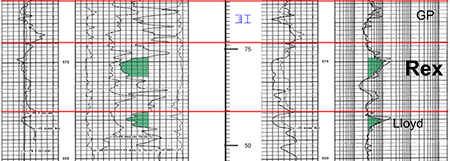

Rex Formation

The Rex Formation is found at depths of approximately 525-550 metres TVD at Battle River and Rex net oil pay ranges from two to four metres.

The Company has implemented a waterflood in the Rex Formation with positive results to date.

Below is an example of the Rex reservoir on West Lake’s lands at Battle River. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

The Rex Formation is found at depths of approximately 525-550 metres TVD at Battle River and Rex net oil pay ranges from two to four metres.

The Company has implemented a waterflood in the Rex Formation with positive results to date.

Below is an example of the Rex reservoir on West Lake’s lands at Battle River. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

As shown in red on the following map, West Lake has identified one multi-lateral open hole licensed drilling location targeting the Rex Formation which has been deferred.

West Lake has proprietary 2D and 3D seismic coverage over its Rex lands at Battle River as shown on the following plat.

Battle River Facilities

At Battle River, the Company owns a multi-well battery at 13-14-047-25W3 and an injection facility at 13-14-047-25W3. A complete description of the facilities will be found in the virtual data room for parties that execute a confidentiality agreement.

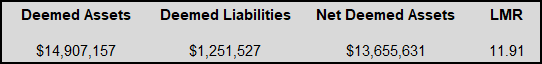

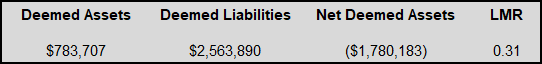

Battle River LMR as of October 8, 2024

At Battle River, the Company owns a multi-well battery at 13-14-047-25W3 and an injection facility at 13-14-047-25W3. A complete description of the facilities will be found in the virtual data room for parties that execute a confidentiality agreement.

Battle River LMR as of October 8, 2024

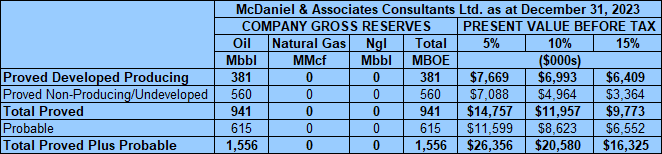

Battle River Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimates that, as of December 31, 2023, the Battle River property contained remaining proved plus probable reserves of 1.6 million barrels of oil, with an estimated net present value of $20.6 million using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimates that, as of December 31, 2023, the Battle River property contained remaining proved plus probable reserves of 1.6 million barrels of oil, with an estimated net present value of $20.6 million using forecast pricing at a 10% discount.

Battle River Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

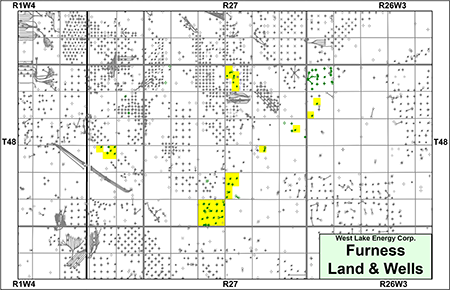

FURNESS

Township 48, Range 26-28 W3

At Furness, West Lake holds a 100% working interest in P&NG rights from surface to the base of the Mannville Group in approximately 2.25 sections of land.

Production from Furness net to West Lake for the first six months of 2024 averaged approximately 12 barrels of oil per day.

Net operating income from the property for the first six months of 2024 averaged approximately ($23,500) per month, or ($282,000) on an annualized basis.

At Furness, West Lake holds a 100% working interest in P&NG rights from surface to the base of the Mannville Group in approximately 2.25 sections of land.

Production from Furness net to West Lake for the first six months of 2024 averaged approximately 12 barrels of oil per day.

Net operating income from the property for the first six months of 2024 averaged approximately ($23,500) per month, or ($282,000) on an annualized basis.

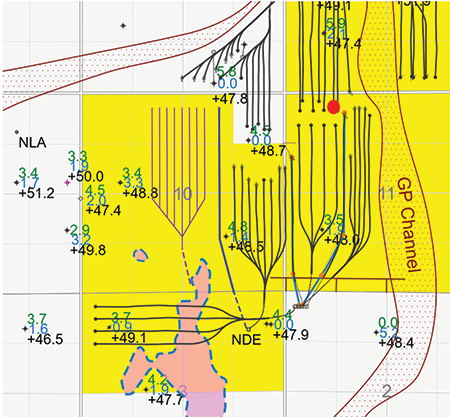

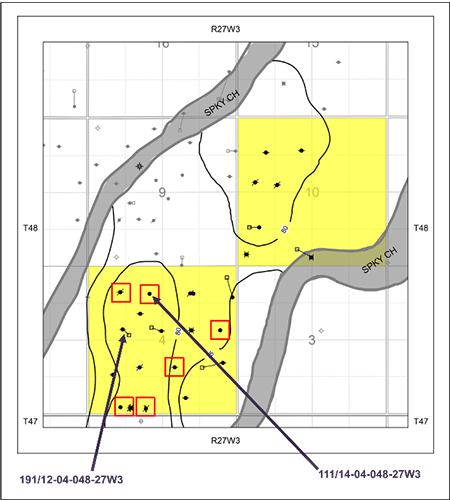

Furness Geology

The Company has identified drilling upside and recompletion potential in the Sparky and GP formations on its lands at Furness. West Lake has identified six unbooked recompletion opportunities.

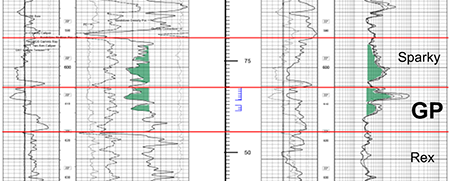

GP Formation

The GP Formation is found at depths of approximately 600-615 metres TVD at Furness. Oil produced from the GP is approximately 13-16° API and GP net oil pay ranges from one to four metres.

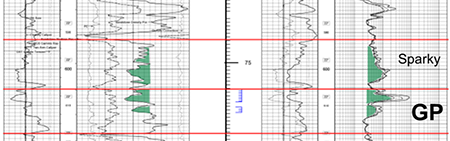

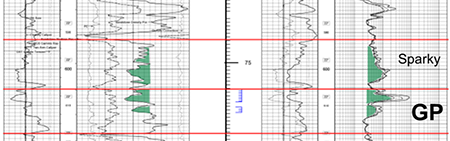

Below is an example of the GP reservoir on West Lake’s lands at Furness. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

The Company has identified drilling upside and recompletion potential in the Sparky and GP formations on its lands at Furness. West Lake has identified six unbooked recompletion opportunities.

GP Formation

The GP Formation is found at depths of approximately 600-615 metres TVD at Furness. Oil produced from the GP is approximately 13-16° API and GP net oil pay ranges from one to four metres.

Below is an example of the GP reservoir on West Lake’s lands at Furness. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

Emerge Furness 111/14/04-048-27W3/0

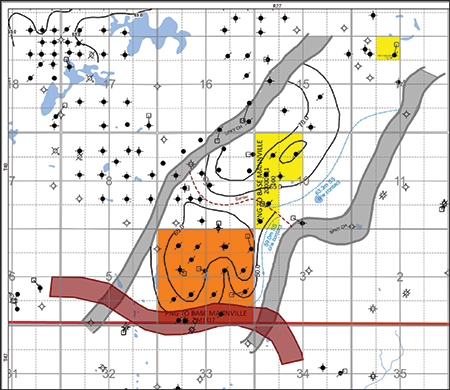

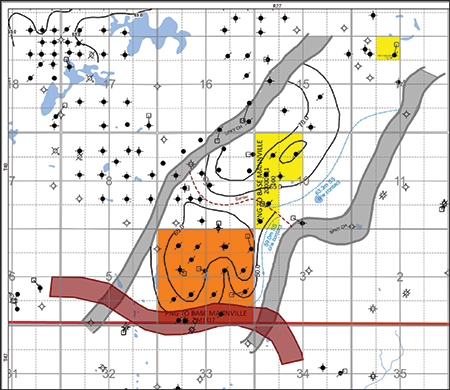

GP Formation

Furness

GP Formation Structure Map

Furness

GP Formation Net Pay Map

GP Formation

Furness

GP Formation Structure Map

Furness

GP Formation Net Pay Map

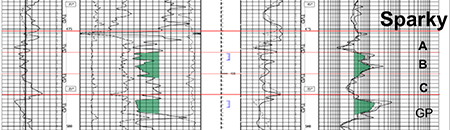

Sparky Formation

The Sparky Formation is found at depths of approximately 590-605 metres TVD at Furness. Oil produced from the Sparky is approximately 14-16° API and Sparky net oil pay ranges from one to four metres.

Below is an example of the Sparky reservoir on West Lake’s lands at Furness. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

The Sparky Formation is found at depths of approximately 590-605 metres TVD at Furness. Oil produced from the Sparky is approximately 14-16° API and Sparky net oil pay ranges from one to four metres.

Below is an example of the Sparky reservoir on West Lake’s lands at Furness. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

Furness Facilities

At Furness, the Company owns multiple single well batteries and two disposal facilities at 03-04-048-27W3 and 13-27-048-27W3. A complete description of the facilities will be found in the virtual data room for parties that execute a confidentiality agreement.

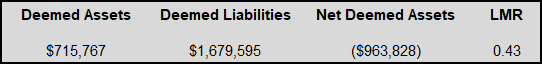

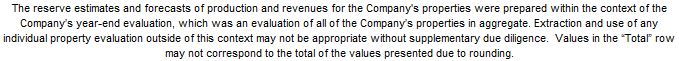

Furness LMR as of October 8, 2024

At Furness, the Company owns multiple single well batteries and two disposal facilities at 03-04-048-27W3 and 13-27-048-27W3. A complete description of the facilities will be found in the virtual data room for parties that execute a confidentiality agreement.

Furness LMR as of October 8, 2024

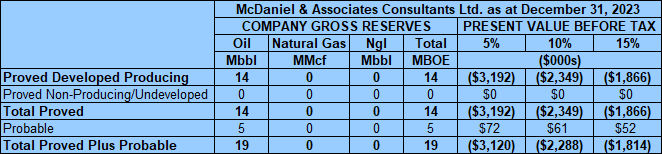

Furness Reserves

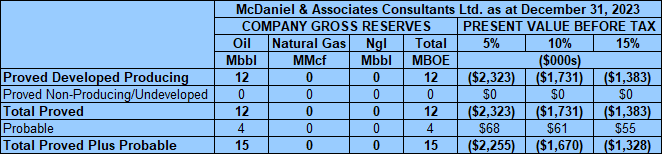

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimates that, as of December 31, 2023, the Furness property contained remaining proved plus probable reserves of 15,000 barrels of oil, with an estimated net present value of ($1.7 million) using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimates that, as of December 31, 2023, the Furness property contained remaining proved plus probable reserves of 15,000 barrels of oil, with an estimated net present value of ($1.7 million) using forecast pricing at a 10% discount.

Furness Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

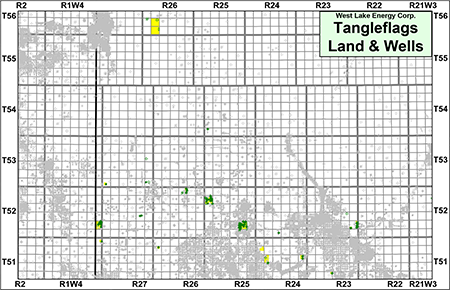

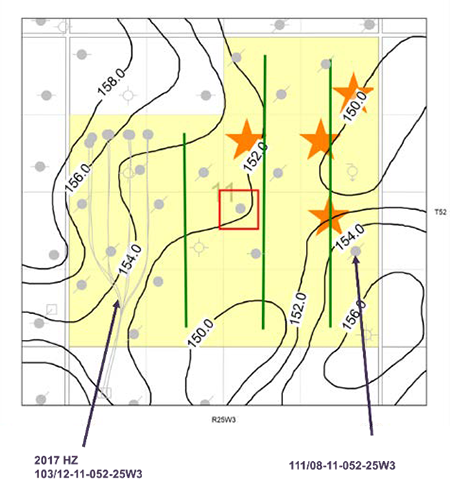

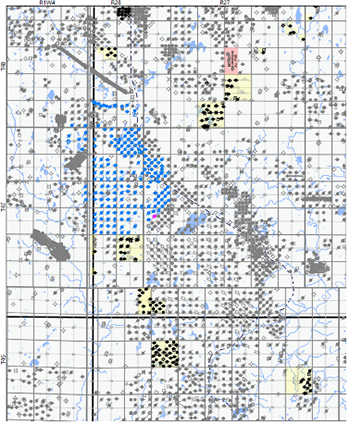

TANGLEFLAGS

Township 51-56, Range 23-28 W3

At Tangleflags, West Lake holds a 100% working interest in seven sections and a 50% working interest in one half section of land.

Production from Tangleflags net to West Lake for the first six months of 2024 averaged approximately 32 boe/d, consisting of 30 barrels of oil per day and 13 Mcf/d of natural gas.

Net operating income from the property for the first six months of 2024 averaged approximately $4,500 per month, or $54,000 on an annualized basis.

At Tangleflags, West Lake holds a 100% working interest in seven sections and a 50% working interest in one half section of land.

Production from Tangleflags net to West Lake for the first six months of 2024 averaged approximately 32 boe/d, consisting of 30 barrels of oil per day and 13 Mcf/d of natural gas.

Net operating income from the property for the first six months of 2024 averaged approximately $4,500 per month, or $54,000 on an annualized basis.

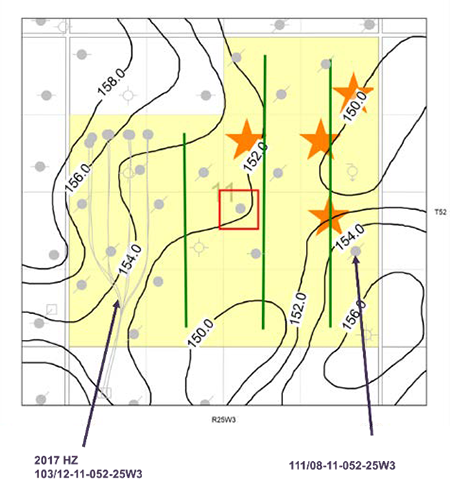

Tangleflags Geology

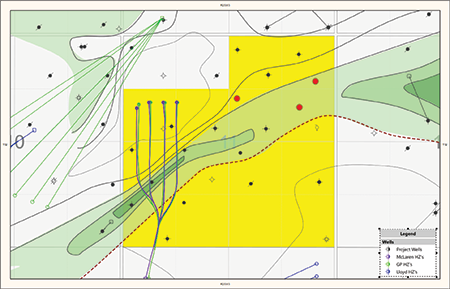

The Company has identified drilling upside and recompletion potential in the Sparky, GP, Lloydminster and McLaren formations on its lands at Tangleflags. The Company has eight probable undeveloped vertical drilling locations booked at Tangleflags.

West Lake has also planned three licensed vertical drilling locations targeting the Lloydminster Formation which have been deferred.

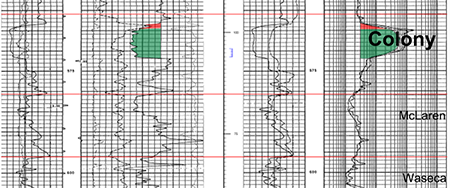

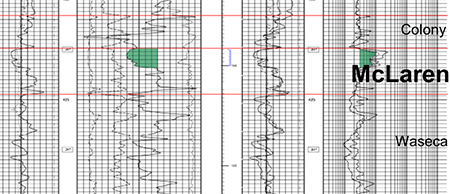

McLaren Formation

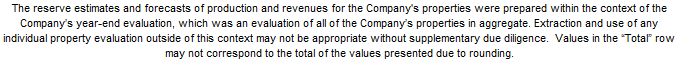

The McLaren Formation is found at depths of approximately 400-440 metres TVD at Tangleflags. Oil produced from the McLaren is approximately 12-15° API and McLaren net oil pay ranges from one to five metres thick.

Below is an example of the McLaren reservoir on West Lake’s lands at Tangleflags. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

The Company has identified drilling upside and recompletion potential in the Sparky, GP, Lloydminster and McLaren formations on its lands at Tangleflags. The Company has eight probable undeveloped vertical drilling locations booked at Tangleflags.

West Lake has also planned three licensed vertical drilling locations targeting the Lloydminster Formation which have been deferred.

McLaren Formation

The McLaren Formation is found at depths of approximately 400-440 metres TVD at Tangleflags. Oil produced from the McLaren is approximately 12-15° API and McLaren net oil pay ranges from one to five metres thick.

Below is an example of the McLaren reservoir on West Lake’s lands at Tangleflags. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

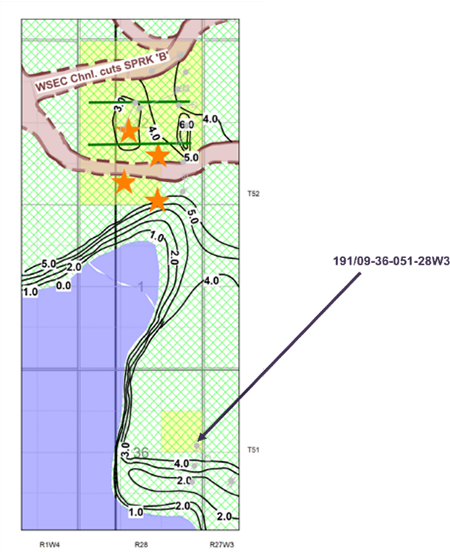

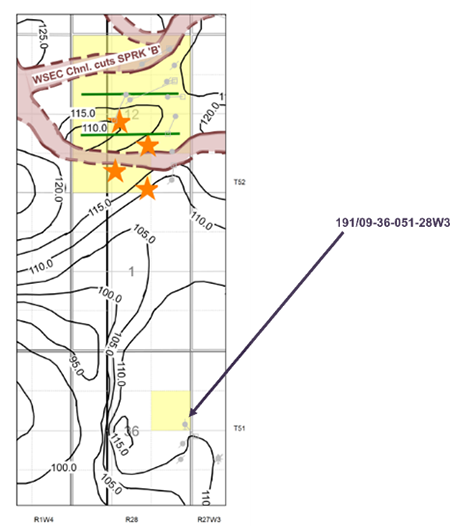

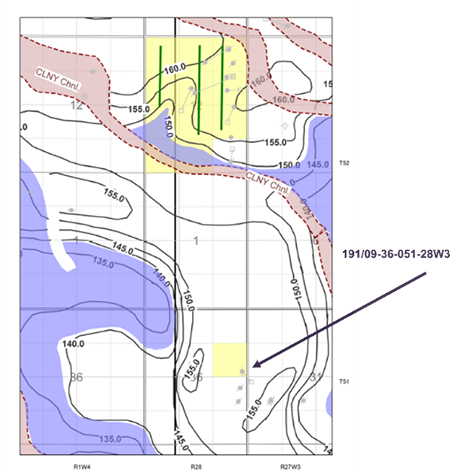

Waseca Rex DD 191/09-36-051-28W3/0

McLaren Formation

Net Pay (m)

Structure Map (m SS)

Net Pay Map (m)

Structure Map (m SS)

McLaren Formation

Net Pay (m)

Structure Map (m SS)

Net Pay Map (m)

Structure Map (m SS)

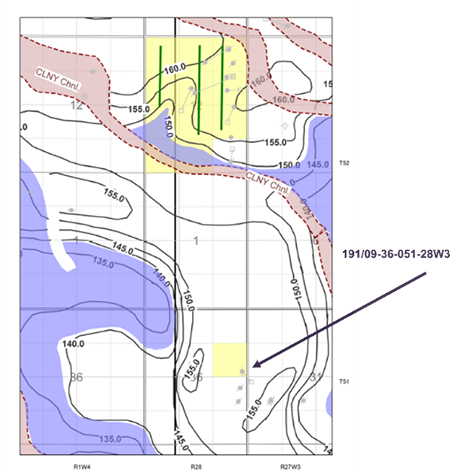

Lloydminster Formation

The Lloydminster Formation is found at depths of approximately 500-515 metres TVD at Tangleflags. Oil produced from the Lloydminster is approximately 12-15° API and Lloydminster net oil pay ranges from one to eight metres thick.

Below is an example of the Lloydminster reservoir on West Lake’s lands at Tangleflags. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

The Lloydminster Formation is found at depths of approximately 500-515 metres TVD at Tangleflags. Oil produced from the Lloydminster is approximately 12-15° API and Lloydminster net oil pay ranges from one to eight metres thick.

Below is an example of the Lloydminster reservoir on West Lake’s lands at Tangleflags. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

As shown in red on the following map, West Lake has identified three licensed vertical drilling locations targeting the Lloydminster Formation which have been deferred.

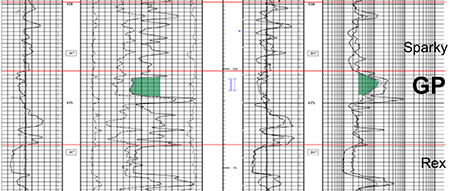

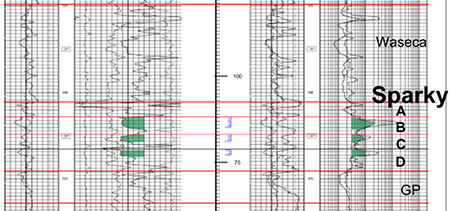

Sparky Formation

The Sparky Formation is found at depths of approximately 470-480 metres TVD at Tangleflags. Oil produced from the Sparky is approximately 12-15° API and Sparky net oil pay ranges from one to six metres.

Below is an example of the Sparky reservoir on West Lake’s lands at Tangleflags. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

The Sparky Formation is found at depths of approximately 470-480 metres TVD at Tangleflags. Oil produced from the Sparky is approximately 12-15° API and Sparky net oil pay ranges from one to six metres.

Below is an example of the Sparky reservoir on West Lake’s lands at Tangleflags. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

GP Formation

The GP Formation is found at depths of approximately 465-500 metres TVD at Tangleflags. Oil produced from the GP is approximately 12-15° API and GP net oil pay ranges from one to five metres thick.

Below is an example of the GP reservoir on West Lake’s lands at Tangleflags. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

The GP Formation is found at depths of approximately 465-500 metres TVD at Tangleflags. Oil produced from the GP is approximately 12-15° API and GP net oil pay ranges from one to five metres thick.

Below is an example of the GP reservoir on West Lake’s lands at Tangleflags. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

Tangleflags Facilities

At Tangleflags, the Company owns multiple single well batteries and two disposal plants at 09-11-052-25W3 and 12-30-052-25W3. A complete description of the facilities will be found in the virtual data room for parties that execute a confidentiality agreement.

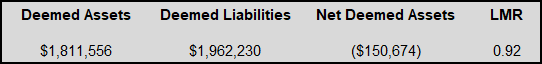

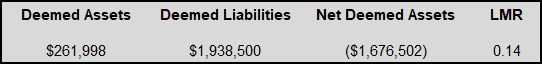

Tangleflags LMR as of October 8, 2024

At Tangleflags, the Company owns multiple single well batteries and two disposal plants at 09-11-052-25W3 and 12-30-052-25W3. A complete description of the facilities will be found in the virtual data room for parties that execute a confidentiality agreement.

Tangleflags LMR as of October 8, 2024

Tangleflags Reserves

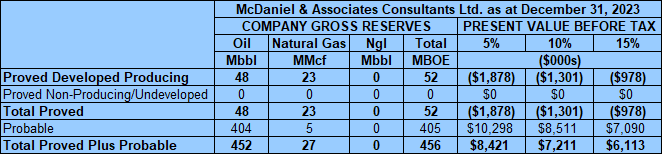

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimates that, as of December 31, 2023, the Tangleflags property contained remaining proved plus probable reserves of 452,000 barrels of oil and 27 MMcf of natural gas (456,000 boe), with an estimated net present value of $7.2 million using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimates that, as of December 31, 2023, the Tangleflags property contained remaining proved plus probable reserves of 452,000 barrels of oil and 27 MMcf of natural gas (456,000 boe), with an estimated net present value of $7.2 million using forecast pricing at a 10% discount.

Tangleflags Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

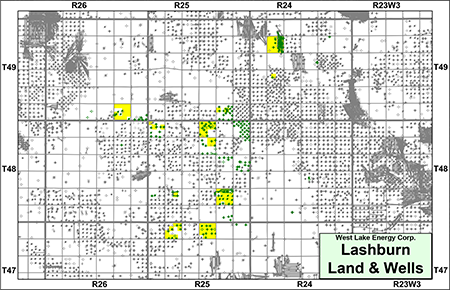

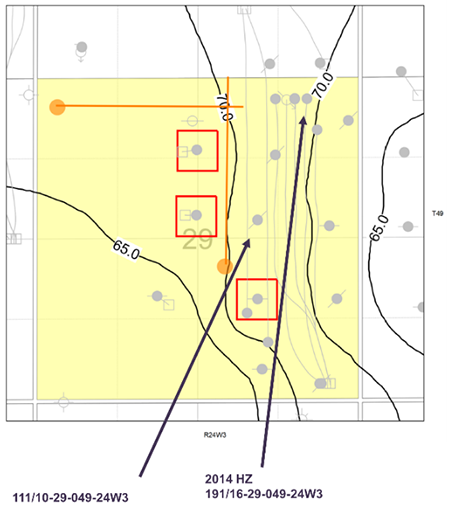

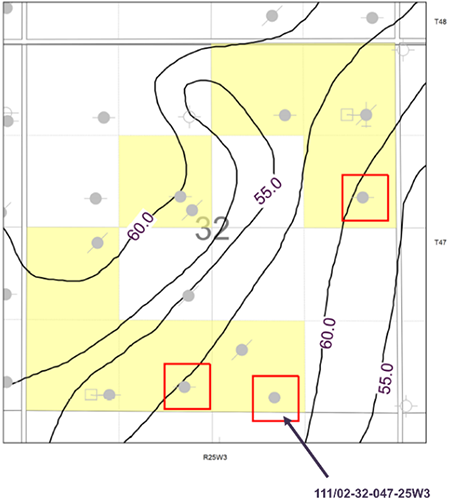

LASHBURN

Township 47-49, Range 24-26 W3

At Lashburn, West Lake holds an average 91% working interest in approximately 5.5 sections of land and royalty interests in three quarter sections of land.

Production from Lashburn net to West Lake for the first six months of 2024 averaged approximately 76 barrels of oil per day.

Net operating income from the property for the first six months of 2024 averaged approximately ($47,000) per month, or ($564,000) on an annualized basis.

At Lashburn, West Lake holds an average 91% working interest in approximately 5.5 sections of land and royalty interests in three quarter sections of land.

Production from Lashburn net to West Lake for the first six months of 2024 averaged approximately 76 barrels of oil per day.

Net operating income from the property for the first six months of 2024 averaged approximately ($47,000) per month, or ($564,000) on an annualized basis.

Lashburn Geology

The Company has identified upside drilling and recompletion potential in the Rex, Lloydminster, Colony, McLaren and Sparky formations on its lands at Lashburn. The Company has two probable undeveloped horizontal drilling locations booked at Lashburn. West Lake has also identified five unbooked horizontal drilling locations as well as 11 recompletion opportunities.

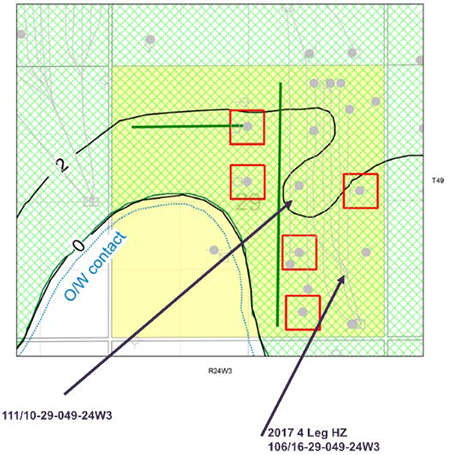

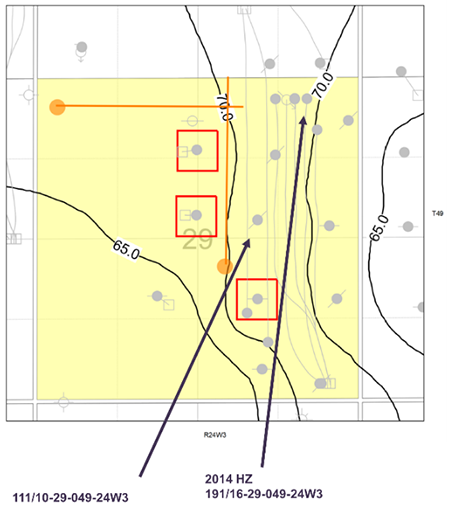

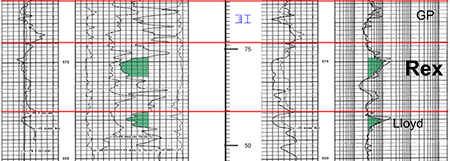

Rex Formation

The Rex Formation is found at depths of approximately 565-570 metres TVD at Lashburn. Oil produced from the Rex is approximately 11-13° API and Rex net oil pay ranges from one to five metres thick.

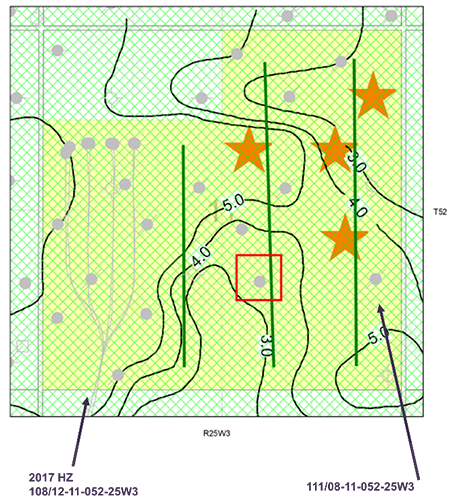

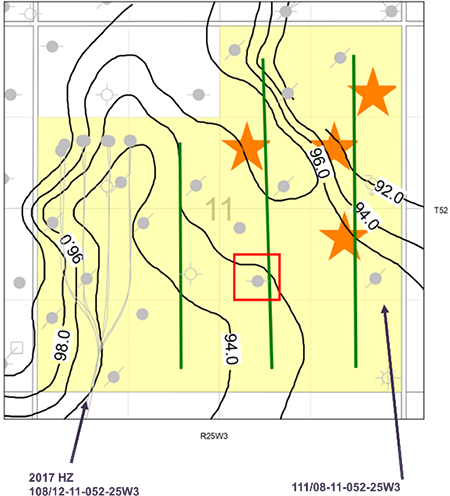

Below is an example of the Rex reservoir on West Lake’s lands at Lashburn. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

The Company has identified upside drilling and recompletion potential in the Rex, Lloydminster, Colony, McLaren and Sparky formations on its lands at Lashburn. The Company has two probable undeveloped horizontal drilling locations booked at Lashburn. West Lake has also identified five unbooked horizontal drilling locations as well as 11 recompletion opportunities.

Rex Formation

The Rex Formation is found at depths of approximately 565-570 metres TVD at Lashburn. Oil produced from the Rex is approximately 11-13° API and Rex net oil pay ranges from one to five metres thick.

Below is an example of the Rex reservoir on West Lake’s lands at Lashburn. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

Emergo Forest Bank 111/10-29-049-24W3/0

Rex Formation

Net Pay Map (m)

Structure Map (m SS)

Net Pay Map (m)

Structure Map (m SS)

Rex Formation

Net Pay Map (m)

Structure Map (m SS)

Net Pay Map (m)

Structure Map (m SS)

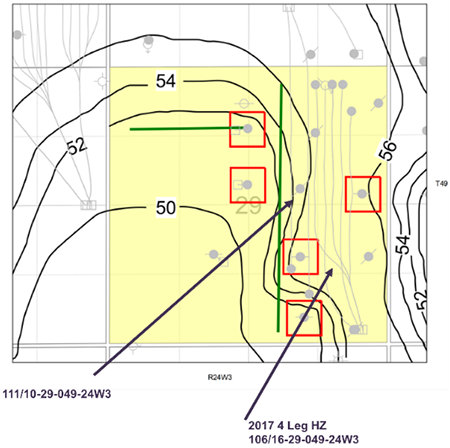

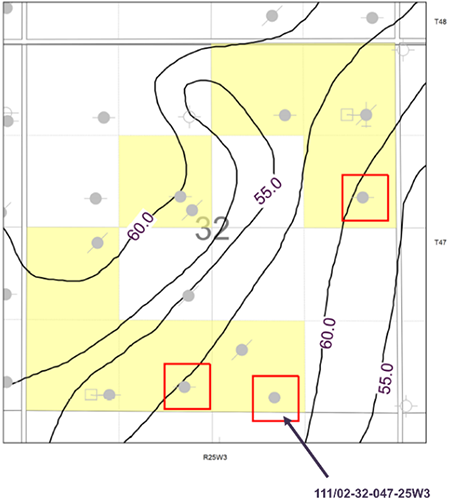

Lloydminster Formation

The Lloydminster Formation is found at depths of approximately 590-600 metres TVD at Lashburn. Oil produced from the Lloydminster is approximately 14-16° API and Lloydminster net oil pay ranges from one to three metres thick.

Below is an example of the Lloydminster reservoir on West Lake’s lands at Lashburn. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

The Lloydminster Formation is found at depths of approximately 590-600 metres TVD at Lashburn. Oil produced from the Lloydminster is approximately 14-16° API and Lloydminster net oil pay ranges from one to three metres thick.

Below is an example of the Lloydminster reservoir on West Lake’s lands at Lashburn. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

Sparky Formation

The Sparky Formation is found at depths of approximately 550-560 metres TVD at Lashburn. Oil produced from the Sparky is approximately 10-12° API and Sparky net oil pay ranges from one to four metres thick.

Below is an example of the Sparky reservoir on West Lake’s lands at Lashburn. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

The Sparky Formation is found at depths of approximately 550-560 metres TVD at Lashburn. Oil produced from the Sparky is approximately 10-12° API and Sparky net oil pay ranges from one to four metres thick.

Below is an example of the Sparky reservoir on West Lake’s lands at Lashburn. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

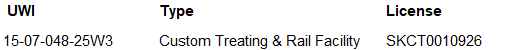

Lashburn Facilities

At Lashburn, the Company owns multiple single well batteries and a central treating and rail facility at 15-07-048-25W3. A complete description of the facilities will be found in the virtual data room for parties that execute a confidentiality agreement.

At Lashburn, the Company owns multiple single well batteries and a central treating and rail facility at 15-07-048-25W3. A complete description of the facilities will be found in the virtual data room for parties that execute a confidentiality agreement.

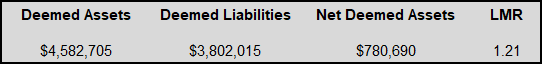

Lashburn LMR as of October 8, 2024

Lashburn Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimates that, as of December 31, 2023, the Lashburn property contained remaining proved plus probable reserves of 208,000 barrels of oil, with an estimated net present value of ($2.9 million) using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimates that, as of December 31, 2023, the Lashburn property contained remaining proved plus probable reserves of 208,000 barrels of oil, with an estimated net present value of ($2.9 million) using forecast pricing at a 10% discount.

Lashburn Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

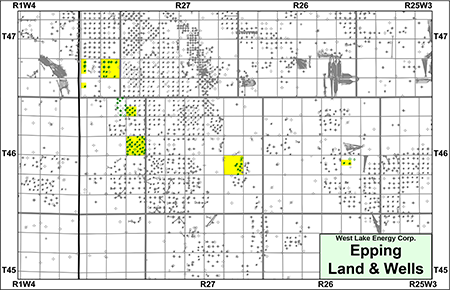

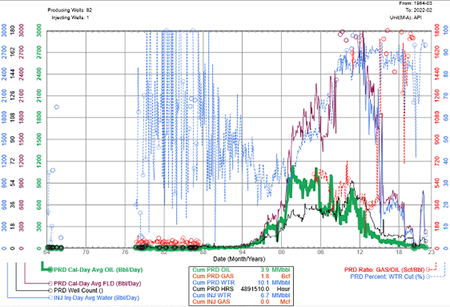

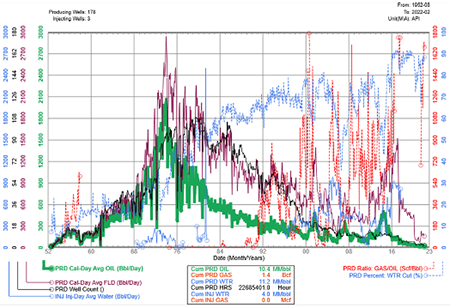

EPPING

Township 46-47, Range 26-28 W3

At Epping, West Lake holds an average 97% working interest in 4.25 sections of land.

Production from Epping net to West Lake for the first six months of 2024 averaged approximately 14 barrels of oil per day.

Net operating income from the property for the first six months of 2024 averaged approximately ($25,000) per month, or ($300,000) on an annualized basis.

At Epping, West Lake holds an average 97% working interest in 4.25 sections of land.

Production from Epping net to West Lake for the first six months of 2024 averaged approximately 14 barrels of oil per day.

Net operating income from the property for the first six months of 2024 averaged approximately ($25,000) per month, or ($300,000) on an annualized basis.

Epping Geology

The Company has identified drilling upside and recompletion potential in the Sparky Formation on its lands at Epping. West Lake has also identified waterflood potential in the Sparky Formation.

Sparky Formation

The following maps show the Sparky pool at Epping. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

The Company has identified drilling upside and recompletion potential in the Sparky Formation on its lands at Epping. West Lake has also identified waterflood potential in the Sparky Formation.

Sparky Formation

The following maps show the Sparky pool at Epping. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

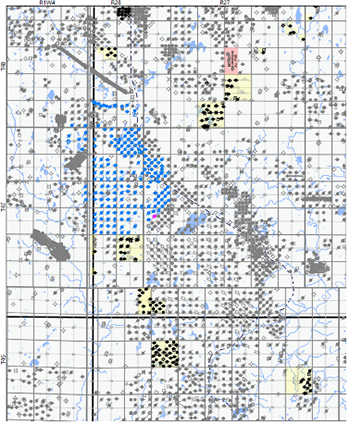

North Part of Pool (Primary Only)

395 wells, 40.2 MMbbl (101 Mbbl/well EUR)

Improvement of 1.75x vs primary

South Part of Pool (Water Flood)

178 wells, 10.4 MMbbl (58 Mbbl/well EUR)

West Lake Sections

82 wells, 3.9 MMbbl (47.5 Mbbl EUR)

Current Production of 150 bpd

395 wells, 40.2 MMbbl (101 Mbbl/well EUR)

Improvement of 1.75x vs primary

South Part of Pool (Water Flood)

178 wells, 10.4 MMbbl (58 Mbbl/well EUR)

West Lake Sections

82 wells, 3.9 MMbbl (47.5 Mbbl EUR)

Current Production of 150 bpd

Epping Facilities

At Epping, the Company owns multiple single well batteries and one disposal plant at 01-24-046-28W3. A complete description of the facilities will be found in the virtual data room for parties that execute a confidentiality agreement.

Epping LMR as of October 8, 2024

At Epping, the Company owns multiple single well batteries and one disposal plant at 01-24-046-28W3. A complete description of the facilities will be found in the virtual data room for parties that execute a confidentiality agreement.

Epping LMR as of October 8, 2024

Epping Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimates that, as of December 31, 2023, the Epping property contained remaining proved plus probable reserves of 19,000 barrels of oil, with an estimated net present value of ($2.3 million) using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimates that, as of December 31, 2023, the Epping property contained remaining proved plus probable reserves of 19,000 barrels of oil, with an estimated net present value of ($2.3 million) using forecast pricing at a 10% discount.

Epping Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

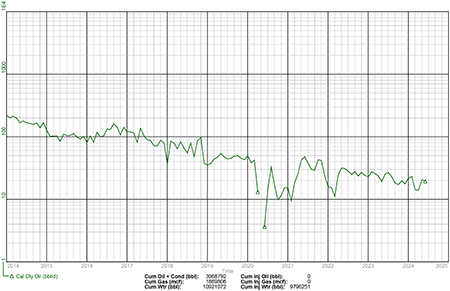

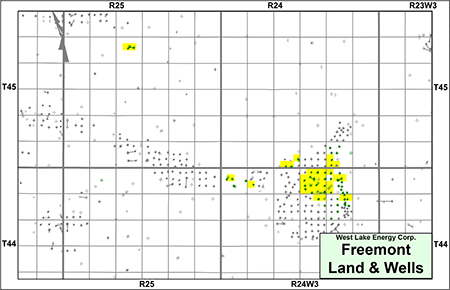

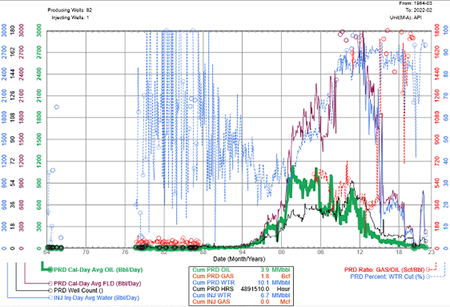

FREEMONT

Township 44-45, Range 24-25 W3

At Freemont, West Lake holds an average 99% working interest in approximately 2.25 sections of land, as well as a minor royalty interest.

The Freemont property was re-activated in April 2024 after being shut-in since October 2019. Production from Freemont net to West Lake for the three months ended June 30, 2024 averaged approximately nine barrels of oil per day.

Net operating income from the property for the three months ended June 30, 2024 averaged approximately ($39,000) per month, or ($468,000) on an annualized basis.

At Freemont, West Lake holds an average 99% working interest in approximately 2.25 sections of land, as well as a minor royalty interest.

The Freemont property was re-activated in April 2024 after being shut-in since October 2019. Production from Freemont net to West Lake for the three months ended June 30, 2024 averaged approximately nine barrels of oil per day.

Net operating income from the property for the three months ended June 30, 2024 averaged approximately ($39,000) per month, or ($468,000) on an annualized basis.

Freemont Geology

Lower Colony Formation

The Lower Colony Formation is found at depths of approximately 605-615 metres TVD at Freemont. Oil produced from the Lower Colony is approximately 12-15° API and Lower Colony net oil pay ranges from one to two metres.

Colony Formation

The Colony Formation is found at depths of approximately 605-615 metres TVD at Freemont. Oil produced from the Colony is approximately 13-15° API and Colony net oil pay ranges from five to ten metres thick.

Below is an example of the Colony reservoir on West Lake’s lands at Freemont. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

Lower Colony Formation

The Lower Colony Formation is found at depths of approximately 605-615 metres TVD at Freemont. Oil produced from the Lower Colony is approximately 12-15° API and Lower Colony net oil pay ranges from one to two metres.

Colony Formation

The Colony Formation is found at depths of approximately 605-615 metres TVD at Freemont. Oil produced from the Colony is approximately 13-15° API and Colony net oil pay ranges from five to ten metres thick.

Below is an example of the Colony reservoir on West Lake’s lands at Freemont. Further technical details will be found in the virtual data room for parties that execute a confidentiality agreement.

Freemont Facilities

At Freemont, the Company owns an injection plant at 01-34-044-24W3, consisting of six 200 m3/d injector wells and two 600 m3/d disposal wells. A complete description of the facilities will be found in the virtual data room for parties that execute a confidentiality agreement.

Freemont LMR as of October 8, 2024

At Freemont, the Company owns an injection plant at 01-34-044-24W3, consisting of six 200 m3/d injector wells and two 600 m3/d disposal wells. A complete description of the facilities will be found in the virtual data room for parties that execute a confidentiality agreement.

Freemont LMR as of October 8, 2024

Freemont Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimates that, as of December 31, 2023, the Freemont property contained remaining proved plus probable reserves of 89,000 barrels of oil, with an estimated net present value of ($465,000) using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimates that, as of December 31, 2023, the Freemont property contained remaining proved plus probable reserves of 89,000 barrels of oil, with an estimated net present value of ($465,000) using forecast pricing at a 10% discount.

Freemont Well List

Click here to download the complete well list.

Click here to download the complete well list.

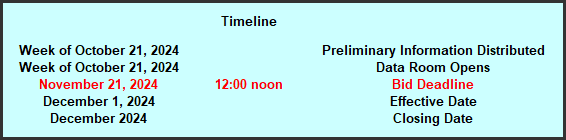

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Properties until 12:00 pm on Thursday November 21, 2024. West Lake's preference is to sell all of the Properties in one transaction on a white map basis.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

Sayer Energy Advisors is accepting offers from interested parties until

noon on Thursday November 21, 2024.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Properties with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, mail (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: most recent net lease operating statements, the McDaniel Report, summary land information, LMR information and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.