Offering Details

Back

Under Review / City of Medicine Hat

City of Medicine Hat

Property Divestiture

Property DivestitureBid Deadline: July 3, 2025

12:00 PM

Download Full PDF - Printable

OVERVIEW

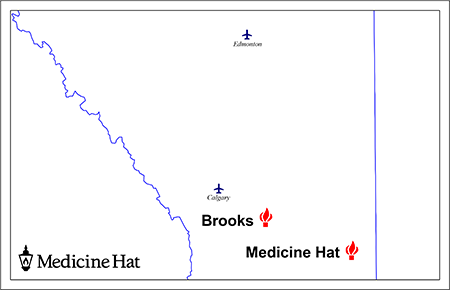

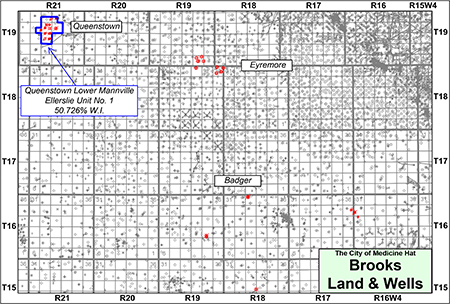

The City of Medicine Hat (the “City”) has engaged Sayer Energy Advisors to assist the City with the sale of certain of its oil and natural gas interests located in southern Alberta (the “Properties”).The Properties are located in the Brooks and Medicine Hat areas. In the Medicine Hat area, the City’s interests are located in the Crescent Heights, Delta and Northeast Medicine Hat areas. In the Brooks area, the City’s interests consist of non-operated working interests located in the Badger, Eyremore and Queenstown areas of Alberta.

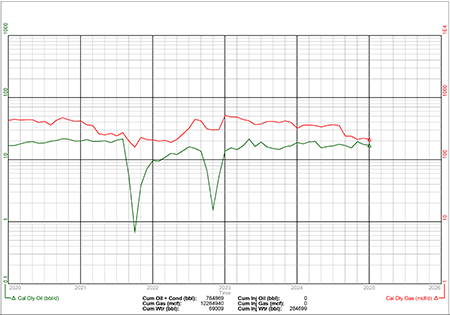

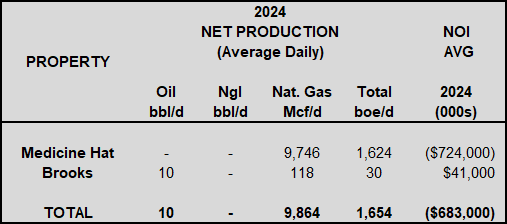

Average daily production net to the City from the Properties for the year ended December 31, 2024 was approximately 1,654 boe/d, consisting of approximately 9.9 MMcf/d of natural gas and 10 bbl/d of oil.

Operating income net to the City from the Properties for the year ended December 31, 2024 was approximately ($683,000).

As of April 1, 2025, the Properties had a deemed liability value of $52.0 million.

Overview Map Showing the Location of the Divestiture Properties

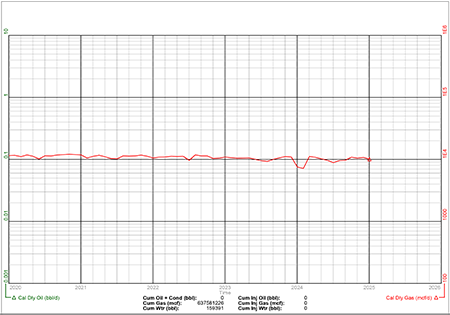

Production & NOI Overview

Average daily production net to the City from the Properties for the year ended December 31, 2024 was approximately 1,654 boe/d, consisting of approximately 9.9 MMcf/d of natural gas and 10 bbl/d of oil as outlined below.

Operating income net to the City from the Properties for the year ended December 31, 2024 was approximately ($683,000).

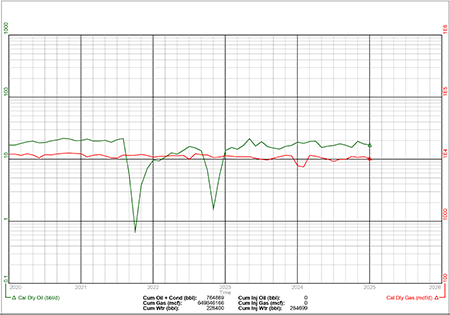

Gross Production Group Plot of the City’s Oil & Natural Gas Wells

Liability Assessment

As of April 1, 2025, the Properties had a deemed liability value of $52.0 million.

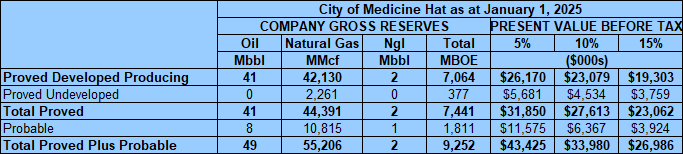

Reserves Overview

The City prepared an internal reserves evaluation of the Properties as part of its year-end reporting (the “Reserve Report”). The Reserve Report is effective January 1, 2025 using the City of Medicine Hat internal forecast pricing at January 1, 2025.

The City estimates that, as of January 1, 2025, the Properties contained remaining proved plus probable reserves of 55.2 Bcf of natural gas and 51,000 barrels of oil and natural gas liquids (9.3 million boe), with an estimated net present value of $34.0 million using forecast pricing at a 10% discount.

Seismic Overview

The City has ownership in various 2D and 3D seismic data over the Properties. Further details on the City’s seismic ownership will be available in the virtual data room for parties that execute a confidentiality agreement.

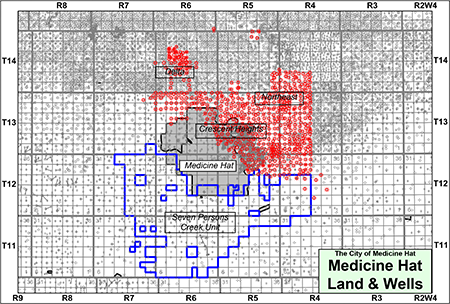

MEDICINE HAT

Township 11-15, Range 4-8 W4In the Medicine Hat area, the City holds a 100% working interest in the Crescent Heights, Delta and Northeast areas as well as a 100% working interest in the Seven Persons Creek Unit which the City is currently in the process of dissolving.

Average daily production net to the City from Medicine Hat for the year ended December 31, 2024 was approximately 1,624 boe/d, consisting of 9.7 MMcf/d of natural gas.

Operating income net to the City from Medicine Hat for the year ended December 31, 2024 was approximately ($724,000).

Medicine Hat Upside

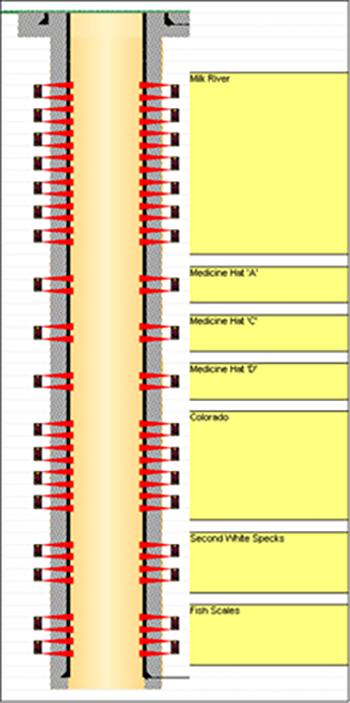

In addition to the productive zones of the Milk River and Medicine Hat, the City has identified secondary potential in the Colorado Shale, Second White Specks and Base Fish Scales zones, as well as potential in the Bow Island and Viking formations. As shown in the following stratigraphic chart. There are 7 distinct layers within the Milk River, and three separate zones in the Medicine Hat Formation.

The City believes there is potential to drill four wells into the Colorado Shale, four wells into the Second White Speckled Shale and four wells into the Base Fish Scales.

The City has identified 15 well recompletions in Townships 013-04W4 to 013-06W4.

At Medicine Hat, the Milk River Formation was deposited in a sand and silt rich open marine shelf depositional setting. The Milk River Formation has high quality reservoir quality, which supports a strong likelihood of a successful results from a recompletion program.

The Medicine Hat field is a mature field. Adding newly completed intervals to existing wells could utilize the current pipeline and facility infrastructure. By increasing the field production as projected, the overall cost per Mcf will continue to stay low and allow the field to economically produce well into the future.

Further geological details will be available in the virtual data room for parties that execute a confidentiality agreement.

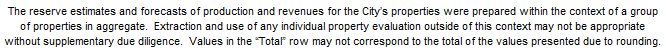

Medicine Hat Facilities

At Medicine Hat, The City has a working interest in the following facilities. Further details on the facilities are available in the virtual data room for parties which execute a confidentiality agreement.

Medicine Hat Marketing

Natural gas produced from Medicine Hat is processed and sold into the City’s natural gas distribution network. Natural gas is compressed at the Crescent Heights, Delta and North East compressor stations and is either consumed by natural gas distributions customers or taken off at Cousins West and sold to TC Energy or to the City of Medicine Hat’s Electric Generation department.

Medicine Hat Liability Assessment

As of April 1, 2025, the Medicine Hat property had a deemed liability value of $51.6 million.

Medicine Hat Well List

Click here to download the complete well list in Excel.

BROOKS

Township 15-19, Range 16-21 W4At Brooks, the City holds various non-operated working interests in several wells located in the Badger, Eyremore and Queenstown areas of Alberta.

Average daily production net to the City from Brooks for the year ended December 31, 2024 was approximately 30 boe/d, consisting of approximately 118 Mcf/d of natural gas and 10 bbl/d of oil.

Operating income net to the City from Brooks for the year ended December 31, 2024 was approximately $41,000.

In the Queenstown area, the City holds a 50.726% working interest in the Queenstown Lower Mannville Ellerslie Unit No.1 which produces oil and natural gas from the Ellerslie Formation. The Unit is operated by Canadian Natural Resources Limited.

The City’s interests at Badger are producing natural gas from the Base Fish Scales, Bow Island and Mannville formations.

At Eyremore, the City’s interests produce commingled natural gas primarily from the Milk River and Medicine Hat formations.

Brooks Facilities

The City does not have a working interest in any facilities at Brooks.

Brooks Marketing

Natural gas from Brooks is take-in-kind and is sold at NGX pricing at various third-party processing plants.

Brooks Liability Assessment

As of April 1, 2025, the Brooks property had a deemed liability value of $365,094.

Brooks Well List

Click there to download the complete well list in Excel.

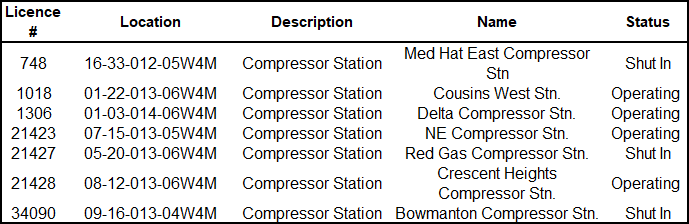

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Properties until 12:00 pm on Thursday July 3, 2025.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude a

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday July 3, 2025.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Properties with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, the Reserve Report, deemed liability information, most recent net operations summary and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.