Offering Details

Back

Under Review / Robert L. McNamara Leaseholds Ltd.

Robert L. McNamara Leaseholds Ltd.

Corporate Divestiture

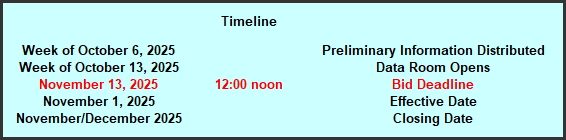

Corporate DivestitureBid Deadline: November 13, 2025

12:00 PM

Download Full PDF - Printable

OVERVIEW

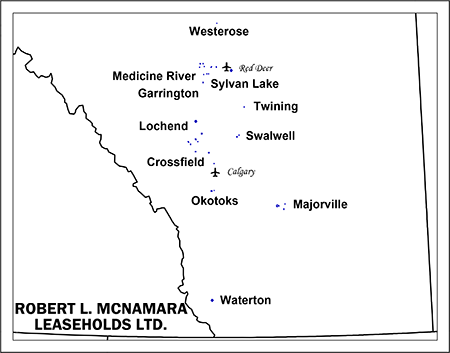

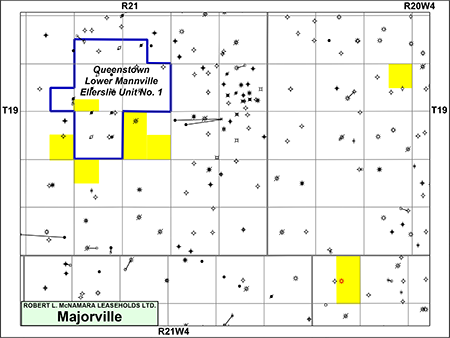

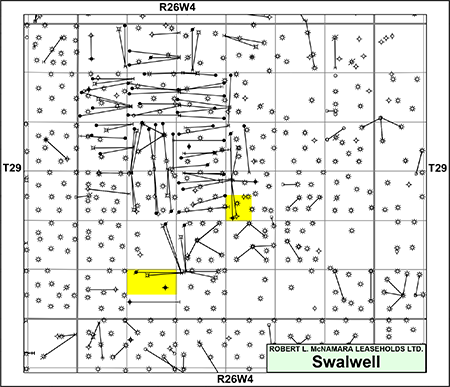

Robert L. McNamara Leaseholds Ltd. (“McNamara” or the “Company”) has engaged Sayer Energy Advisors to assist with the sale of the shares of the Company. The Company’s assets include a number of mineral title and royalty interests comprising over 1,700 net acres in the Waterton, Majorville, Okotoks, Crossfield, Lochend, Swalwell, Twining, Garrington, Sylvan Lake, Medicine River and Westerose areas of southern and central Alberta (the “Titles”), and interests in approximately 260 Gross Royalty Trusts (“GRTs”).

The Titles and GRTs generated approximately $85,000 in royalty revenue in 2024 (over $40,500 has been received in the first seven months of 2025). The majority of the revenue comes from royalties from GRTs, with the balance of the revenue coming from royalties on natural gas wells and oil units. The Company’s revenue comes from the following sources:

The Titles and GRTs generated approximately $85,000 in royalty revenue in 2024 (over $40,500 has been received in the first seven months of 2025). The majority of the revenue comes from royalties from GRTs, with the balance of the revenue coming from royalties on natural gas wells and oil units. The Company’s revenue comes from the following sources:

- Royalties from 66 active GRTs out of 260 GRTs held by the Company,

- Royalties from 19 producing conventional natural gas wells and CBM wells, and

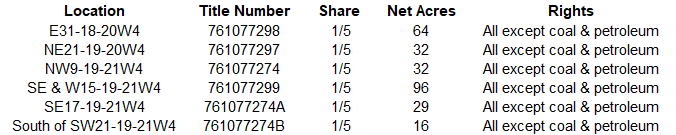

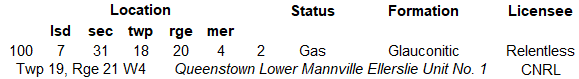

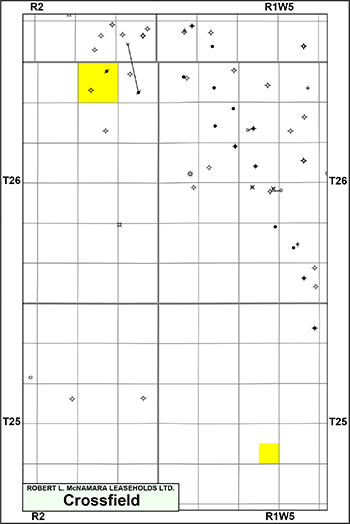

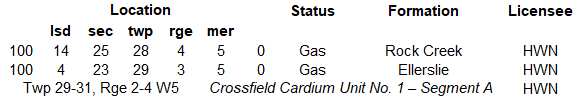

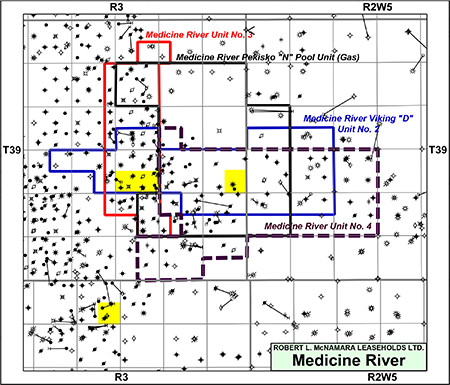

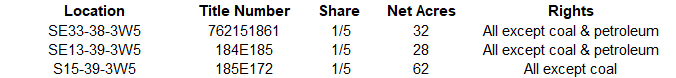

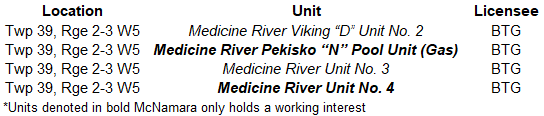

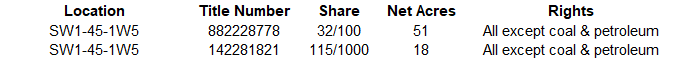

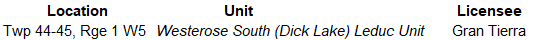

- Revenue from minor working interests (denoted in bold) and royalty interests in seven oil units (Queenstown Lower Mannville Ellerslie Unit No. 1, Crossfield Cardium Unit No. 1 – Segment A, Medicine River Viking “D” Unit No. 2, Medicine River Pekisko “N” Pool Unit (Gas), Medicine River Unit No. 3, Medicine River Unit No. 4, and Westerose South (Dick Lake) Leduc Unit).

Corporate Overview

The Company has no debt and only two shareholders. The shareholders have recently been winding down the affairs of the Company. The remaining assets include only the Titles and the GRTs. The Company has a nominal amount of tax pools.

Liability Assessment Summary

The Company does not operate in any wells or facilities.

Seismic Overview

The Company does not have ownership in any seismic data.

Reserves Overview

The Company does not have a third-party reserve report.

Gross Royalty Trust Summary

The Company has an interest in approximately 260 GRTs, of which approximately 66 GRTs are currently active. The GRTs are held in seven separate ID Accounts, six with Computershare and one with Royal Trust, as summarized below.

The Company has no debt and only two shareholders. The shareholders have recently been winding down the affairs of the Company. The remaining assets include only the Titles and the GRTs. The Company has a nominal amount of tax pools.

Liability Assessment Summary

The Company does not operate in any wells or facilities.

Seismic Overview

The Company does not have ownership in any seismic data.

Reserves Overview

The Company does not have a third-party reserve report.

Gross Royalty Trust Summary

The Company has an interest in approximately 260 GRTs, of which approximately 66 GRTs are currently active. The GRTs are held in seven separate ID Accounts, six with Computershare and one with Royal Trust, as summarized below.

Summary of GRT Interests Held by McNamara

A: GRTs Administered by Computershare

ID 1108 – 221 GRTs (19 active)

ID 1730 – 3 GRTs (1 active)

ID 101408 – 26 GRTs (4 active)

ID 102731 – 1 GRT (1 active)

ID 501621 – 5 GRTs (2active)

ID 613768 – 1 GRT (0 active)

B: GRTs Administered by Royal Trust

3 GRTs (0 active)

A: GRTs Administered by Computershare

ID 1108 – 221 GRTs (19 active)

ID 1730 – 3 GRTs (1 active)

ID 101408 – 26 GRTs (4 active)

ID 102731 – 1 GRT (1 active)

ID 501621 – 5 GRTs (2active)

ID 613768 – 1 GRT (0 active)

B: GRTs Administered by Royal Trust

3 GRTs (0 active)

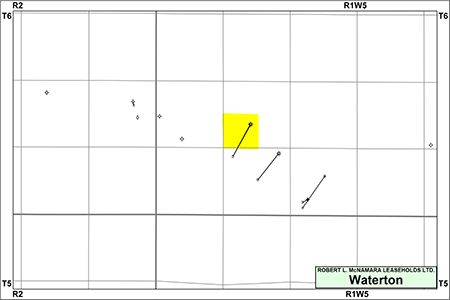

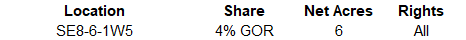

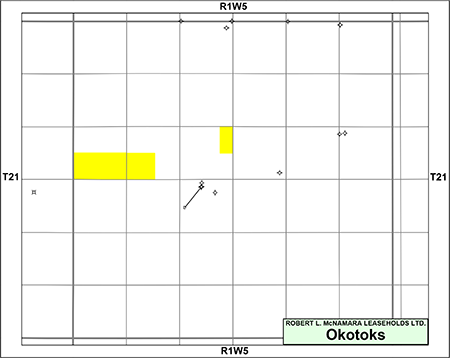

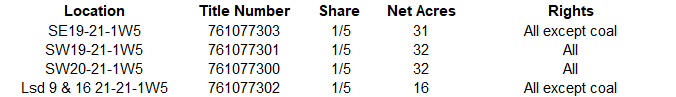

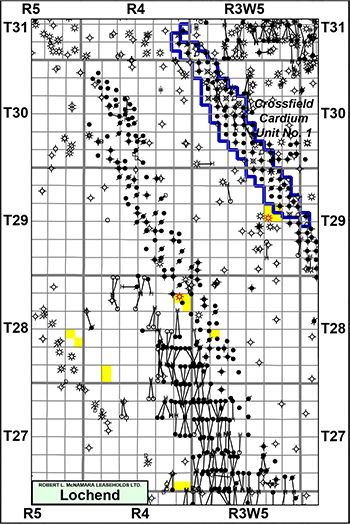

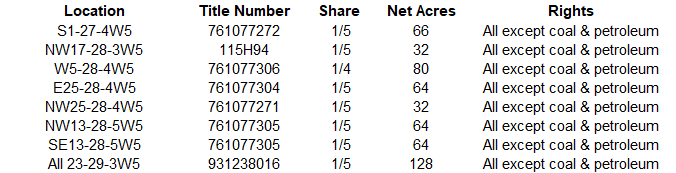

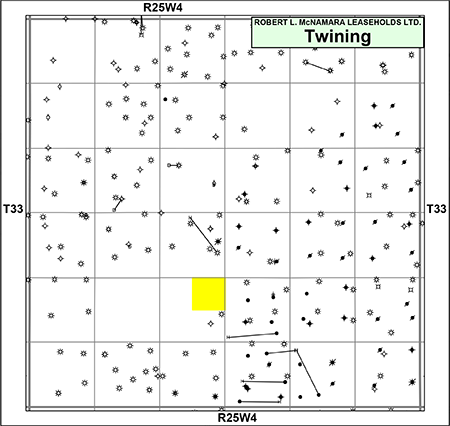

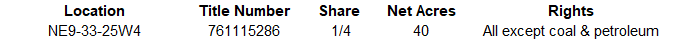

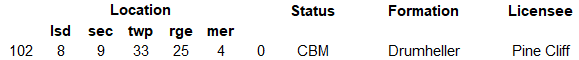

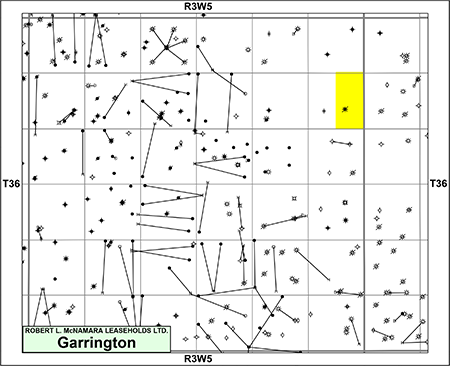

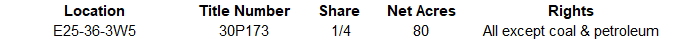

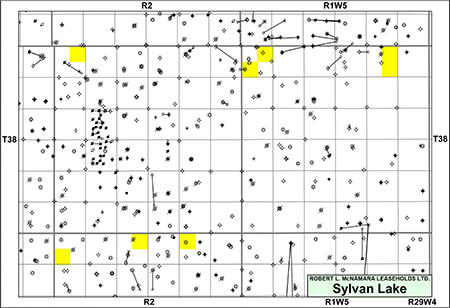

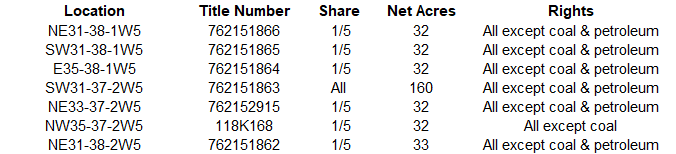

Title Summary

The Company holds a number of mineral title and royalty interests comprising over 1,700 net acres in the Waterton, Majorville, Okotoks, Crossfield, Lochend, Swalwell, Twining, Garrington, Sylvan Lake, Joffre, Medicine River and Westerose areas of southern and central Alberta.

Revenue Summary

The Titles and GRTs generated approximately $85,000 in royalty revenue in 2024 (over $40,500 has been received in the first seven months of 2025). The majority of the revenue comes from royalties from GRTs, with the balance of the revenue coming from royalties on natural gas wells and oil units.

Production Summary

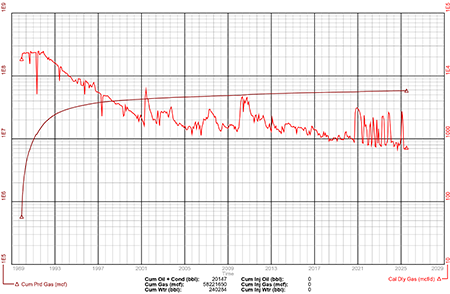

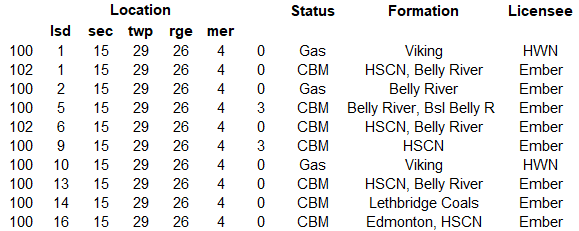

The 19 producing natural gas wells on the Titles which McNamara currently receives royalty revenue from include natural gas wells and CBM wells. Total gross production from the natural gas wells has recently averaged over 1.0 MMcf/d, as shown on the following group production plot.

The Company holds a number of mineral title and royalty interests comprising over 1,700 net acres in the Waterton, Majorville, Okotoks, Crossfield, Lochend, Swalwell, Twining, Garrington, Sylvan Lake, Joffre, Medicine River and Westerose areas of southern and central Alberta.

Revenue Summary

The Titles and GRTs generated approximately $85,000 in royalty revenue in 2024 (over $40,500 has been received in the first seven months of 2025). The majority of the revenue comes from royalties from GRTs, with the balance of the revenue coming from royalties on natural gas wells and oil units.

Production Summary

The 19 producing natural gas wells on the Titles which McNamara currently receives royalty revenue from include natural gas wells and CBM wells. Total gross production from the natural gas wells has recently averaged over 1.0 MMcf/d, as shown on the following group production plot.

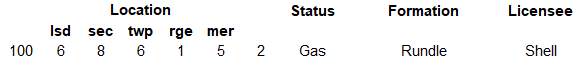

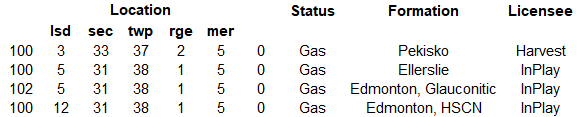

Producing Wells

The 19 producing natural gas wells which McNamara currently receives royalty revenue from include natural gas wells and CBM wells. In addition to the listed wells, the Company receives royalty and minor working interest revenue from seven oil units.

Click here to download the complete well list in Excel.

The 19 producing natural gas wells which McNamara currently receives royalty revenue from include natural gas wells and CBM wells. In addition to the listed wells, the Company receives royalty and minor working interest revenue from seven oil units.

Click here to download the complete well list in Excel.

PROCESS & TIMELINE

Sayer Energy Advisors is accepting offers relating to this process until 12:00 pm on Thursday November 13, 2025.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude a

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

Sayer Energy Advisors is accepting proposals from interested parties until

noon on Thursday November 13, 2025.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Company with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, copies of the GRT certificates, most recent revenue statements and other relevant corporate information.

Download Confidentiality Agreement

To receive further information on the Company please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.