Offering Details

Back

Under Review / Axiom Oil and Gas Inc.

Axiom Oil and Gas Inc.

Property Divestiture

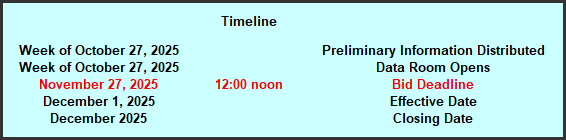

Property DivestitureBid Deadline: November 27, 2025

12:00 PM

Download Full PDF - Printable

OVERVIEW

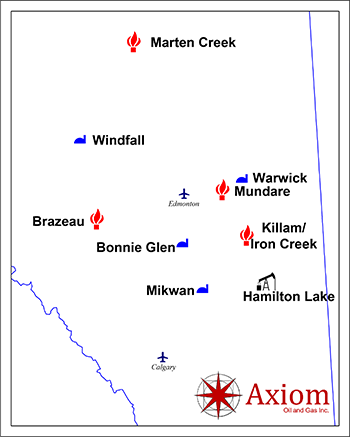

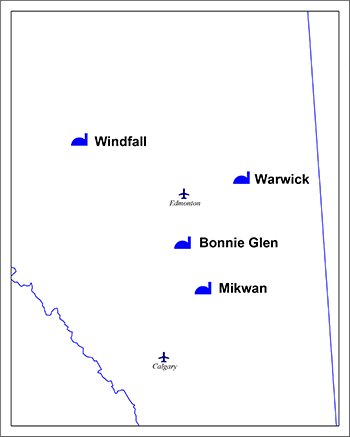

The Properties consist of operated and non-operated working interests in the Brazeau, Hamilton Lake, Killam/Iron Creek, Marten Creek and Mundare areas of Alberta.

The Properties also include Axiom’s 100% working interest facilities in the Bonnie Glen, Mikwan, Warwick and Windfall areas of Alberta which generated approximately $288,000 in processing revenue in the second quarter of 2025.

The Company has substantial operated infrastructure including roads and facilities, which provide road use and facility income, and a major trunkline at Marten Creek. The infrastructure includes natural gas plants, oil batteries, pipelines, roads and third-party processing of 900 Mcf/d of natural gas, 200 bbl/d of oil, and 100 m3/d of water disposal.

At Hamilton Lake, Axiom has identified substantial single-leg horizontal drilling locations targeting the Viking B and C sands on its lands. Axiom has also identified waterflood potential in the area with pilot areas specified.

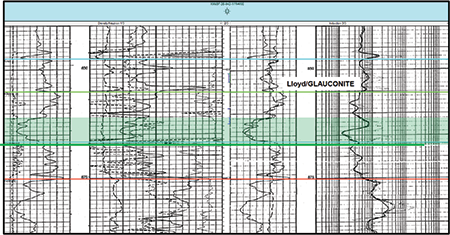

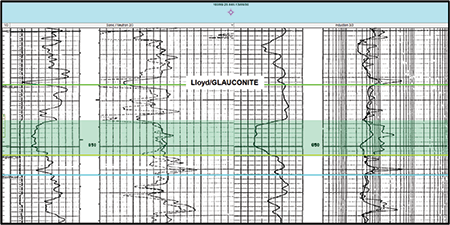

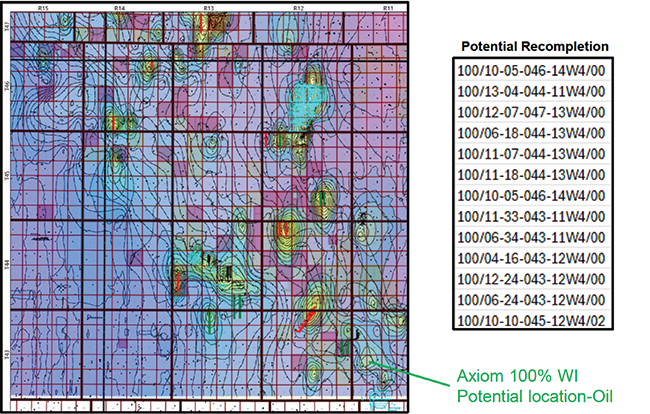

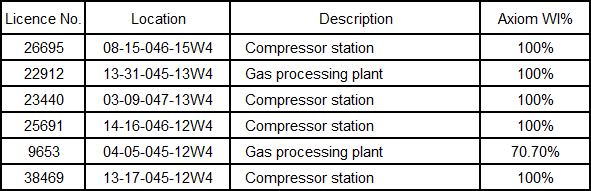

At Killam/Iron Creek, Axiom has drilling and completion upside in the Lloydminster/Glauconitic Sandstone, Ostracod and Ellerslie formations. Axiom has 100% and 70.7% working interests in natural gas processing plants located at 13-31-045-13W4 and 04-05-045-12W4, and a 100% working interest in a water disposal well located at 100/07-32-044-12W4/02 which provides third-party revenue at Killam.

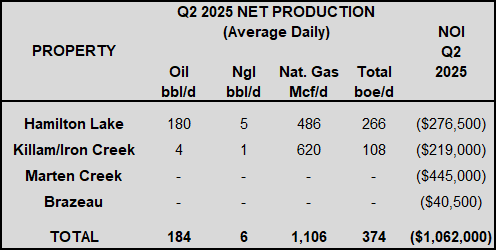

Average daily sales production net to Axiom from the Properties for the second quarter of 2025 was approximately 374 boe/d, consisting of 1.1 MMcf/d of natural gas and 190 barrels of oil and natural gas liquids per day. The Company has additional shut-in gross average daily sales production from Brazeau of over 2 MMcf/d of natural gas and approximately 200 barrels of natural gas liquids and 40 tonnes per day of sulphur (for a products total of 650 boe/d) with potential for another 100 boe/d from a planned acid stimulation, which could be restored with the required capital. At Brazeau, Axiom holds an 87.86% working interest in the Brazeau River Nisku ‘P’ Pool Unit. The remaining working interest is held in trust by Tidewater Midstream and Infrastructure Ltd. Axiom has filed a $110 million statement of claim against Tidewater that includes loss of reserves and damages. Axiom received a counter claim of $1.2 million for Tidewater corporate liabilities not specific to the property (additional details are available on the Brazeau section).

The Marten Creek property has potential to restore 3.0 MMcf/d of currently shut-in natural gas production. The Company has also identified the potential for a bitcoin mining operation at Marten Creek.

Operating income net to Axiom from the Properties for the second quarter of 2025 was approximately ($1.1 million).

As of September 1, 2025, the Properties had a deemed liability value of $36.9 million.

Average daily sales production net to Axiom from the Properties for the second quarter of 2025 was approximately 374 boe/d, consisting of 1.1 MMcf/d of natural gas and 190 barrels of oil and natural gas liquids per day. Prior to being shut-in in April 2024, gross average daily sales production from Brazeau was over 2 MMcf/d of natural gas and approximately 200 barrels of natural gas liquids and 40 tonnes per day of sulphur (for a products total of 650 boe/d) with potential for another 100 boe/d from a planned acid stimulation, which could be restored with the required capital. The Marten Creek property has potential to restore 3.0 MMcf/d of currently shut-in natural gas production.

Operating income net to Axiom from the Properties for the second quarter of 2025 was approximately ($1.1 million).

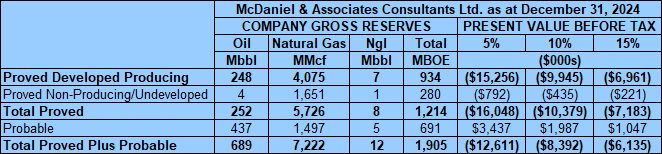

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2024 using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at January 1, 2025.

McDaniel estimated that, as at December 31, 2024, the Properties (excluding Brazeau) contained remaining proved plus probable reserves of 7.2 Bcf of natural gas and 701,000 barrels of oil and natural gas liquids (1.9 million boe), with an estimated net present value of ($8.4 million) using forecast pricing at a 10% discount.

Prior to April 2024 shut-in

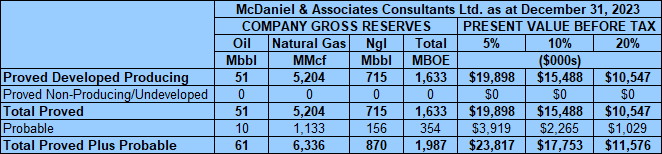

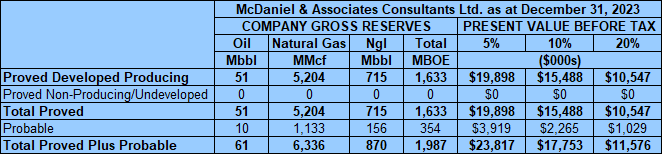

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Brazeau property as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at January 1, 2024.

McDaniel estimated that, as at December 31, 2023, the Brazeau property contained remaining proved plus probable reserves of 6.3 Bcf of natural gas and 931,000 barrels of oil and natural gas liquids (2.0 million boe), with an estimated net present value of $17.8 million using forecast pricing at a 10% discount.

The Company has substantial operated infrastructure including roads and facilities, which provide road use and facility income, and a major trunkline at Marten Creek. The infrastructure includes natural gas plants, oil batteries, pipelines, roads and third-party processing of 900 Mcf/d of natural gas, 200 bbl/d of oil, and 100 m3/d of water disposal. The Marten Creek property has potential to restore 3.0 MMcf/d of currently shut-in natural gas production. The Company has also identified the potential for a bitcoin mining operation at Marten Creek.

At Hamilton Lake, Axiom has identified substantial single-leg horizontal drilling locations and recompletion candidates targeting the Viking B and C sands on its lands. An independent recent waterflood study confirms major oil recovery upside.

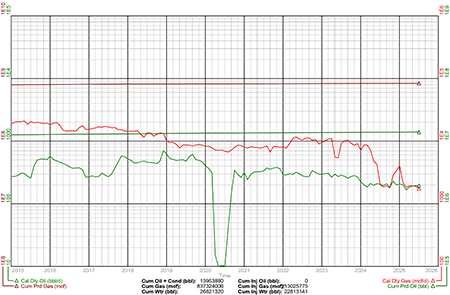

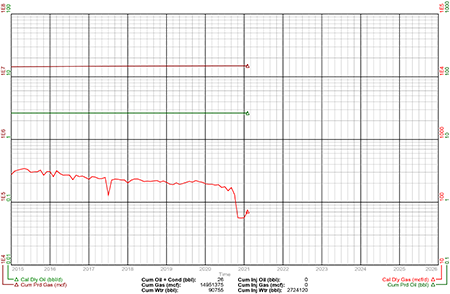

Prior to being shut-in in April 2024, gross average daily sales production from Brazeau was over 2 MMcf/d of natural gas and approximately 200 barrels of natural gas liquids and 40 tonnes per day of sulphur (for a products total of 650 boe/d) with potential for another 100 boe/d from a planned acid stimulation.

At Killam/Iron Creek, Axiom has drilling and completion upside in the Lloydminster/Glauconitic Sandstone, Ostracod and Ellerslie formations. Axiom has 100% and 70.7% working interests in natural gas processing plants located at 13-31-045-13W4 and 04-05-045-12W4, and a 100% working interest in a water disposal well located at 100/07-32-044-12W4/02 which provides third-party revenue at Killam.

Marketing Summary

Axiom has marketing contracts in place with Shell Trading Canada for oil and Suncor Energy Inc. for natural gas and liquids.

Further details of the marketing arrangements will be made available in the virtual data room for parties that execute a confidentiality agreement.

Liability Assessment as of September 1, 2025

As of September 1, 2025, the Properties had a deemed liability value of $36.9 million.

BRAZEAU

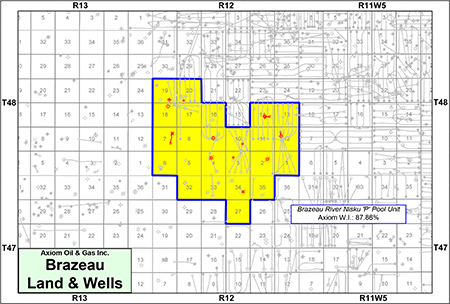

Township 47-48, Range 12-13 W5

At Brazeau, Axiom holds an 87.86% working interest in the Brazeau River Nisku ‘P’ Pool Unit. The remaining working interest is held in trust by Tidewater Midstream and Infrastructure Ltd. and Axiom receives 100% of the net revenue. There are 2 wells licensed to Tidewater and held in trust to be transferred in the future.

The Brazeau property, and various liabilities, were sold to Axiom in 2020 by Tidewater. The transaction included a separate gas handling agreement which required Tidewater to process the sour natural gas from wells located in the Brazeau property for life of the reserves. The subject wells were shut-in with the suspension of sour natural gas service in April 2024 by Tidewater at the Brazeau River Complex. Axiom has filed a $110 million statement of claim against Tidewater that includes loss of reserves and damages. Axiom received a counter claim of $1.2 million for Tidewater corporate liabilities not specific to the property.

The Brazeau property contains approximately 650 boe/d of shut-in production and contains long life reserves as at December 31, 2023 of 6.3 Bcf of natural gas and 931,000 barrels oil and natural gas liquids, with an estimated net present value of $17.8 million using forecast pricing at a 10% discount.

Prior to being shut-in in April 2024, gross average daily sales production from Brazeau was over 2 MMcf/d of natural gas and approximately 200 barrels of natural gas liquids and 40 tonnes per day of sulphur (for a products total of 650 boe/d) with potential for another 100 boe/d from a planned acid stimulation. Brazeau was historically under cyclical gas injection, making the 15 metre-thick Nisku P Pool an ideal candidate for future CO2 disposal.

Axiom has identified alternative processing opportunities through the use of facilities owned and operated by Keyera Corp. but would require cooperation from Tidewater in terms of granting access and/or use to existing pipeline infrastructure.

At Brazeau, Axiom generated approximately $11,000 in road use revenue in the second quarter of 2025.

The Gas Handling Agreement (“GHA”), which Axiom maintains was improperly terminated by Tidewater, includes area dedication, a commitment to process for life of the reserves and highest priority (P1) service.

As disclosed in Tidewater’s financial statements, Tidewater received a $20 million government grant and Alberta Energy Regulator approval in December 2023 for a cogeneration project, a few months prior to shut-in in early 2024. Sour service would be required for the long-term heat supply source for a future constructed cogeneration plant at Brazeau for the project to proceed.

Details of the statement of claim include the following:

Axiom’s claim arises from Tidewater’s termination of the GHA and its subsequent change to the H2S specification from 300,000 ppm to 9 ppm. Axiom’s position is that the termination and specification change were not undertaken “acting reasonably” as required by the GHA , amount to an unreasonable refusal to process Axiom’s sour gas which in turn amounts to an improper termination of the GHA. As a result, Axiom seeks damages related to, among other things, loss of production and the recovery of approximately $4.5 million in turnaround fees paid for the period 2020–2024 that remain outstanding despite Tidewater’s decision not to proceed with the turnaround at the Brazeau River Complex.

Initially, Axiom sought the extraordinary remedy of a mandatory injunction to compel Tidewater to restart sour production. While the injunction was not granted, Axiom maintains the validity of its legal position based on the wording of the GHA and the available evidence, including evidence that was not available at the time of the injunction. Currently, the parties are engaged in ordinary course litigation arising from and related to the GHA.

Further information including the statement of claim will be made available in the virtual data room for parties that execute a confidentiality agreement.

Brazeau, Alberta

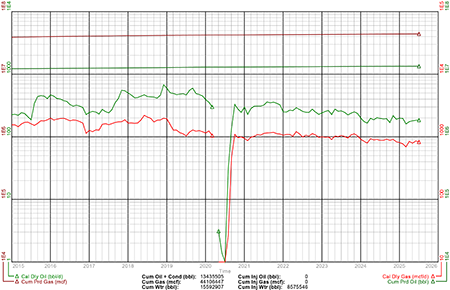

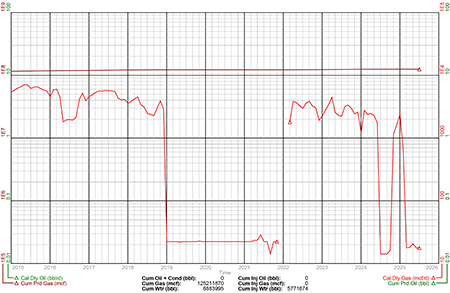

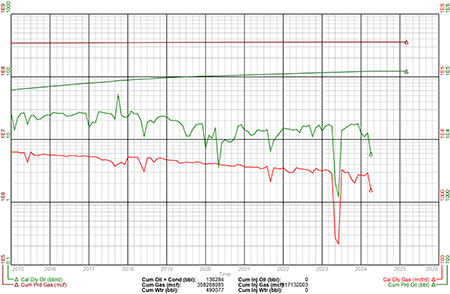

Gross Production Group Plot of Axiom's Natural Gas Wells

Prior to being shut-in in April 2024, gross average daily sales production from Brazeau was over 2 MMcf/d of natural gas and approximately 200 barrels of natural gas liquids and 40 tonnes per day of sulphur (for a products total of 650 boe/d) with potential for another 100 boe/d from a planned acid stimulation.

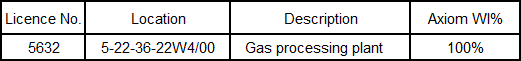

Brazeau Facilities

At Brazeau, the Company holds a 100% working interest in four single well natural gas batteries at 11-12-048-12W5, 07-14-048-12W5, 11-09-048-12W5 and 15-18-048-12W5.

Brazeau Reserves

Prior to April 2024 shut-in

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Brazeau property as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023 using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at January 1, 2024.

McDaniel estimated that, as at December 31, 2023, the Brazeau property contained remaining proved plus probable reserves of 6.3 Bcf of natural gas and 931,000 barrels of oil and natural gas liquids (2.0 million boe), with an estimated net present value of $17.8 million using forecast pricing at a 10% discount.

Brazeau Liability Assessment

As of September 1, 2025, the Brazeau property had a deemed liability value of $1.1 million.

Brazeau Well List

Click here to download the complete well list in Excel.

HAMILTON LAKE

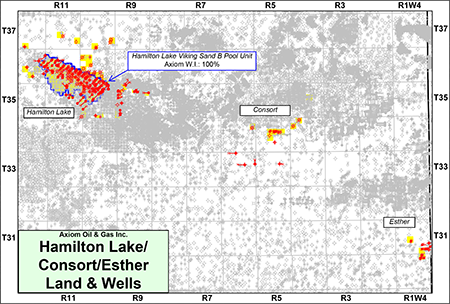

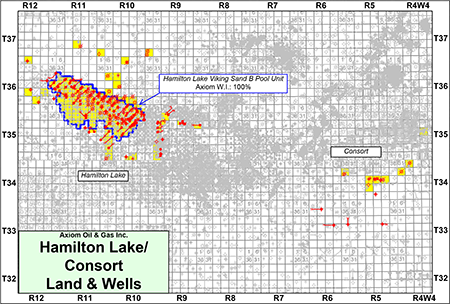

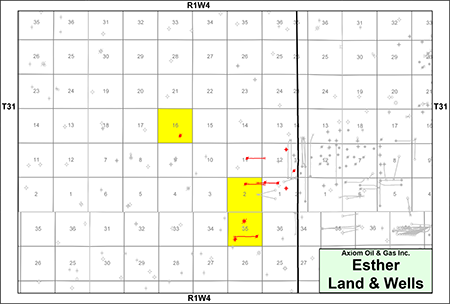

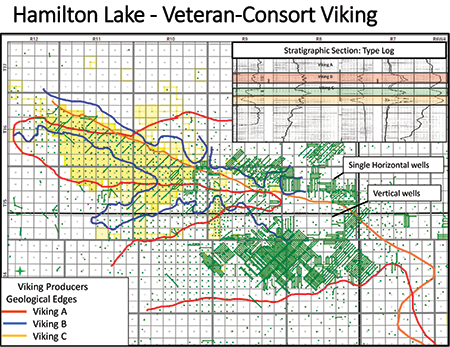

At Hamilton Lake, Axiom holds various working interests in the Consort, Esther and Hamilton Lake areas including a 100% working interest in the Hamilton Lake Viking Oil Sand B Pool Unit.

Average daily sales production net to Axiom from Hamilton Lake for the second quarter of 2025 was approximately 266 boe/d, consisting of 185 barrels of oil and natural gas liquids per day and 486 Mcf/d of natural gas. There is currently no production from Consort or Esther.

Operating income net to Axiom from Hamilton Lake for the second quarter of 2025 was approximately ($276,500). At Hamilton Lake, Axiom collected approximately $5,000 in road use revenue in the second quarter of 2025.

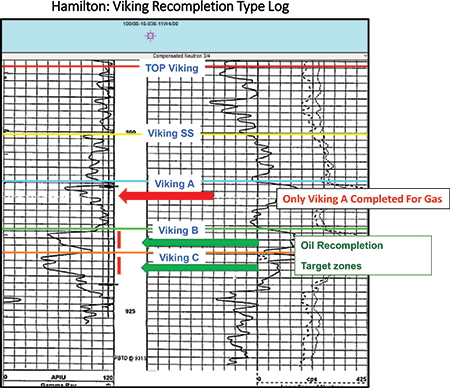

Axiom acquired the property in 2022 and has identified substantial single-leg horizontal drilling locations and recompletion candidates targeting the Viking B and C sands on its lands.

The Company recently commissioned a waterflood feasibility study by Proven Reserves Exploitation Ltd. at Hamilton Lake, which confirms that a waterflood would increase recoveries from the current 5% recovery factor (23 million barrels) to 9% (upwards of 40 million barrels additional) in incremental recovery. This is also seen in the offsetting Karve and Tamarack waterfloods in the same Viking pool.

Axiom has a royalty in place with Source Rock Royalties Ltd. which will drop from 70 bbl/d in 2025 to 39 bbl/d in 2026 and a further 20% per year until 2034.

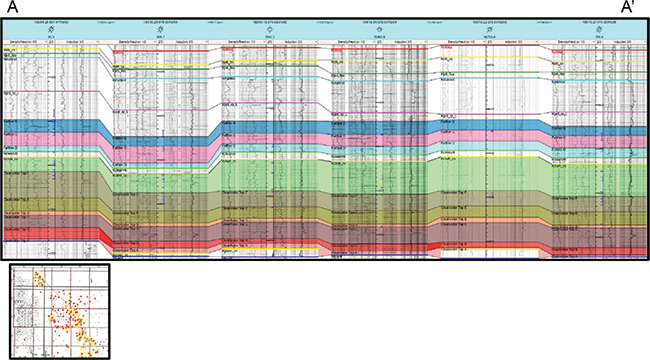

The Early Cretaceous Viking Formation is a member of the Colorado Group which overlies by the marine shales of the Joli Fou Formation and is overlain by the Lower Colorado Shale. Deposition is thought to have been in a shallow marine environment.

At Hamilton Lake, sands were deposited as northwest-southeast trending transgressive bars which pinch out up-dip to form the stratigraphic trapping mechanism. The reservoir consists of several coarsening upward sequences of fine to medium-grained sandstones with, conglomerates, silt and shale laminations.

The following image shows the different sands within the Viking reservoir at Hamilton Lake.

The oil in place is 34° API with a current recovery factor of approximately 8%. The reservoir permeability is approximately 80 mD average and porosity of 25%.

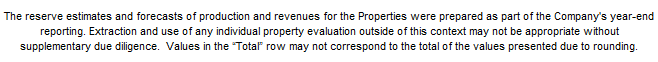

Hamilton Lake Facilities

The Company holds working interests in the following facilities at Hamilton Lake.

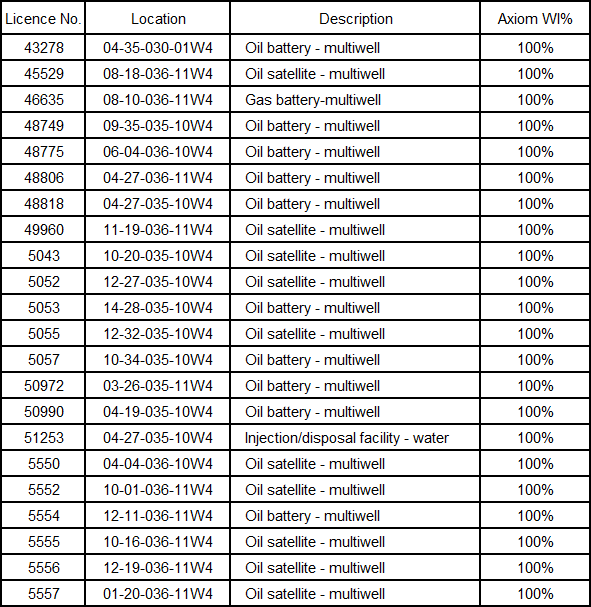

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2024 using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at January 1, 2025.

McDaniel estimated that, as at December 31, 2024, the Hamilton Lake property contained remaining proved plus probable reserves of 701,000 barrels of oil and natural gas liquids and 1.3 Bcf of natural gas (914,000 boe), with an estimated net present value of ($1.3 million) using forecast pricing at a 10% discount.

As of September 1, 2025, the Hamilton Lake property had a deemed liability value of $12.4 million.

Hamilton Lake Well List

Click here to download the complete well list in Excel.

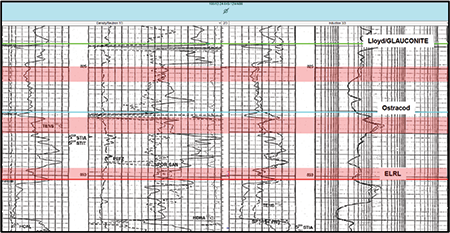

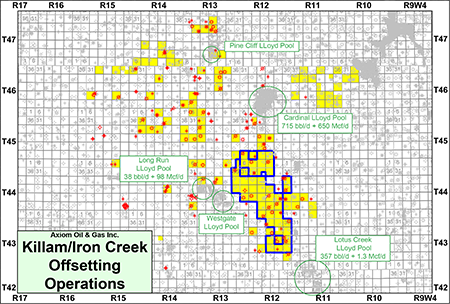

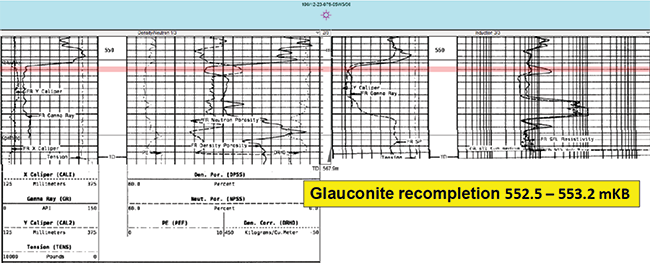

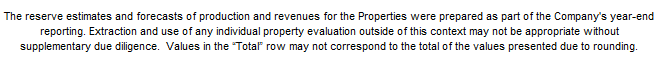

KILLAM / IRON CREEK

At Killam/Iron Creek, Axiom holds various, primarily operated, working interests including a 43.07% working interest in the Killam North Gas Unit No. 2 and a 50% working interest in the Killam North Upper Viking Gas Sand Unit. In addition, Axiom holds minor working interests in certain non-producing wells. Natural gas production at Killam/Iron Creek is from the Viking Formation. Oil production is from the Mannville Group. The Company believes there is significant Mannville substack potential at Killam.

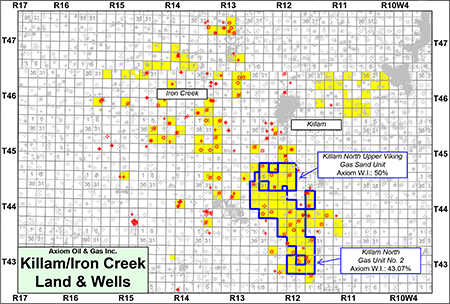

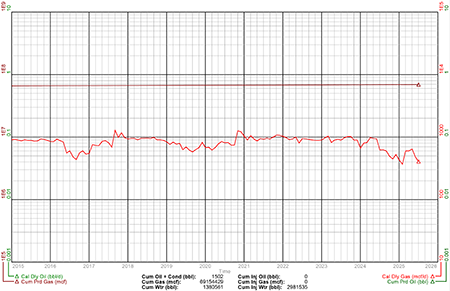

Average daily sales production net to Axiom from Killam/Iron Creek for the second quarter of 2025 was approximately 108 boe/d, consisting of 620 Mcf/d of natural gas and 5 barrels of oil and natural gas liquids per day.

Axiom has 100% and 70.7% working interests in natural gas processing plants located at 13-31-045-13W4 and 04-05-045-12W4, and a 100% working interest in a water disposal well located at 100/07-32-044-12W4/02. At Killam, Axiom generated approximately $85,000 in processing revenue and $25,000 in disposal revenue in the second quarter of 2025.

Operating income net to Axiom from Killam/Iron Creek for the second quarter of 2025 was approximately ($219,000).

Killam North, Alberta

Gross Production Group Plot of Axiom's Natural Gas Wells

Iron Creek, Alberta

Gross Production Group Plot of Axiom's Natural Gas Wells

Axiom has identified drilling and completion upside in the Lloydminster/Glauconitic Sandstone, Ostracod and Ellerslie formations.

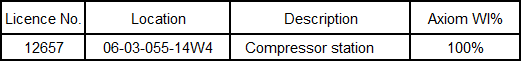

Killam Facilities

The Company holds working interests in the following facilities at Killam.

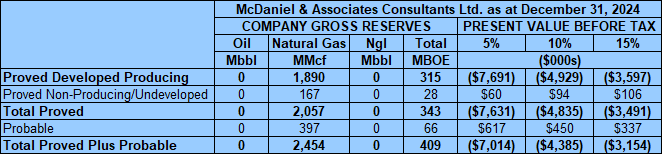

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2024 using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at January 1, 2025.

McDaniel estimated that, as at December 31, 2024, the Killam property contained remaining proved plus probable reserves of 2.5 Bcf of natural gas (409,000 boe), with an estimated net present value of ($4.4 million) using forecast pricing at a 10% discount.

As of September 1, 2025, the Killam property had a deemed liability value of $12.9 million.

Killam Well List

Click here to download the complete well list in Excel.

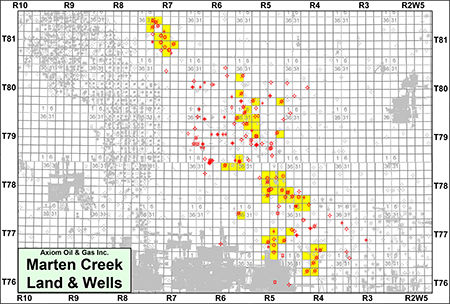

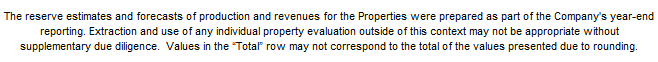

MARTEN CREEK

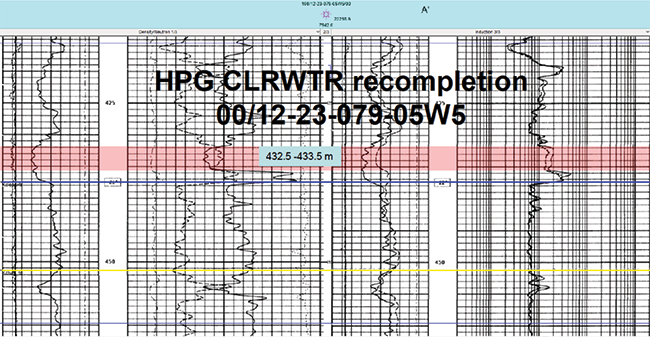

At Marten Creek, Axiom holds working interests ranging from 50%-100% in 58 sections of land. Axiom’s production at Marten Creek is primarily from the Clearwater Formation. The Company holds natural gas rights only in the Clearwater Formation.

Axiom holds a 100% working interest in a major trunkline at Marten Creek, as well as additional significant pipeline and road infrastructure in the area. The Company has also identified the potential for a bitcoin mining operation at Marten Creek.

The Marten Creek property is currently shut-in. The property has potential for 3 MMcf/d of natural gas production. Axiom believes that if it installs a compressor for a cost of approximately $500,000 to get compression it could bring the natural gas production back online to sales.

Operating income net to Axiom from Marten Creek for the second quarter of 2025 was approximately ($445,000). At Marten Creek, Axiom has approximately $11,000 per month in billable road use revenue.

Offsetting operators actively drilling include Spur Petroleum Ltd., Tamarack Valley Energy Ltd. and Headwater Exploration Inc. targeting the Clearwater Formation and Gran Tierra Energy Inc. (formerly i3 Energy Canada Ltd.).

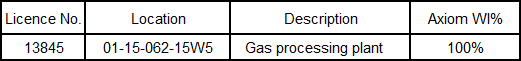

Marten Creek Facilities

The Company holds working interests in the following facilities at Marten Creek.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2024 using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at January 1, 2025.

McDaniel estimated that, as at December 31, 2024, the Marten Creek property contained remaining proved plus probable reserves of 3.5 Bcf of natural gas (581,000 boe), with an estimated net present value of ($2.7 million) using forecast pricing at a 10% discount.

As of September 1, 2025, the Marten Creek property had a deemed liability value of $6.0 million.

Marten Creek Well List

Click here to download the complete well list in Excel.

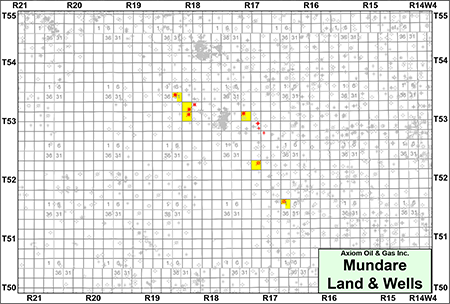

MUNDARE

At Mundare, Axiom holds various non-operated working interests ranging from 17.096%-50% in 6 sections of land with natural gas wells operated by Pine Cliff Energy Ltd. In addition, Axiom holds a 100% working interest in a water disposal well at 11-28-053-18W4 and a natural gas processing plant at 09-28-053-18W4 which is close to ongoing Clearwater development.

The Mundare property is currently shut-in.

Operating income net to Axiom from Mundare for the second quarter of 2025 was approximately ($81,000).

The Company holds working interests in the following facilities at Mundare.

The Company does not have any reserves assigned to Mundare.

Mundare Liability Assessment

As of September 1, 2025, the Mundare property had a deemed liability value of $1.4 million.

Mundare Well List

Click here to download the complete well list in Excel.

MIDSTREAM FACILITIES

Midstream Facilities Liability Assessment

As of September 1, 2025, the Midstream Facilities had a deemed liability value of $3.0 million.

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Properties until 12:00 pm on Thursday November 27, 2025.

transactions with the parties submitting the most acceptable proposals at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday November 27, 2025.

NOTE REGARDING A SAYER PROCESS

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, the McDaniel Report, deemed liability information, most recent net operations summary, detailed facilities information and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.