Offering Details

Back

Under Review / KSV Restructuring Inc.

Cabot Energy Inc.

KSV Restructuring Inc.

Cabot Energy Inc.

Insolvency Sale

Insolvency SaleBid Deadline: February 12, 2026

12:00 PM

Download Full PDF - Printable

OVERVIEW

On December 18, 2025, the Court of King’s Bench of Alberta granted an order pursuant to the Companies’ Creditors Arrangement Act, (“CCAA”) appointing KSV Restructuring Inc. (“KSV”) as the monitor (the “Monitor”) of Cabot Energy Inc. (“Cabot” or the “Company”). As part of the CCAA proceeding, the Company has engaged Sayer Energy Advisors to assist it with a Sales and Investment Solicitation Process (the “SISP”).

The SISP is intended to solicit interest in, and opportunities for a sale of, or investment in, all or part of Cabot’s oil and natural gas interests and facilities, or an investment in Cabot, which may include a restructuring, recapitalization, or other form of reorganization of the Company. All offers received at the bid deadline will be reviewed by the Monitor and the most acceptable offers may be accepted by the Company, subject to Court approval. A copy of the SISP can be found here.

The Company’s oil and natural gas interests are located in the Rainbow area of northern Alberta (the “Property”).

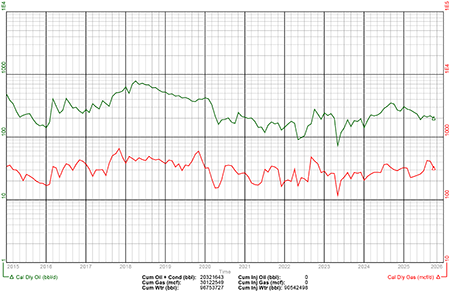

Average daily sales production net to the Company from the Property for the 12 months ended October 31, 2025 was approximately 188 bbl/d, consisting of oil and condensate.

Operating income net to the Company from the Property for the 12 months ended October 31, 2025 was approximately $47,200 per month or $566,000 on an annualized basis.

Cabot’s net production and cash flow in 2025 was lower than previous periods due in part to wildfire events during the past year. Cabot has identified current production capability in excess of 300 bbl/d of oil from fully equipped active wells.

Cabot has identified workovers and low-risk drilling opportunities that demonstrate oil production increasing to 1,000 bbl/d. Cabot has also identified potential of power generation and Bitcoin mining with the significant reserve of available natural gas from the Bluesky Formation from wells, pipeline and facility infrastructure previously on production and currently used for fuel gas.

The Property includes strategic infrastructure featuring sour oil processing batteries with sales pipeline shipping capability.

As of January 11, 2026, the Property had a deemed liability value of $27.0 million with $12.6 million of that liability associated with active assets.

The SISP is intended to solicit interest in, and opportunities for a sale of, or investment in, all or part of Cabot’s oil and natural gas interests and facilities, or an investment in Cabot, which may include a restructuring, recapitalization, or other form of reorganization of the Company. All offers received at the bid deadline will be reviewed by the Monitor and the most acceptable offers may be accepted by the Company, subject to Court approval. A copy of the SISP can be found here.

The Company’s oil and natural gas interests are located in the Rainbow area of northern Alberta (the “Property”).

Average daily sales production net to the Company from the Property for the 12 months ended October 31, 2025 was approximately 188 bbl/d, consisting of oil and condensate.

Operating income net to the Company from the Property for the 12 months ended October 31, 2025 was approximately $47,200 per month or $566,000 on an annualized basis.

Cabot’s net production and cash flow in 2025 was lower than previous periods due in part to wildfire events during the past year. Cabot has identified current production capability in excess of 300 bbl/d of oil from fully equipped active wells.

Cabot has identified workovers and low-risk drilling opportunities that demonstrate oil production increasing to 1,000 bbl/d. Cabot has also identified potential of power generation and Bitcoin mining with the significant reserve of available natural gas from the Bluesky Formation from wells, pipeline and facility infrastructure previously on production and currently used for fuel gas.

The Property includes strategic infrastructure featuring sour oil processing batteries with sales pipeline shipping capability.

As of January 11, 2026, the Property had a deemed liability value of $27.0 million with $12.6 million of that liability associated with active assets.

RAINBOW

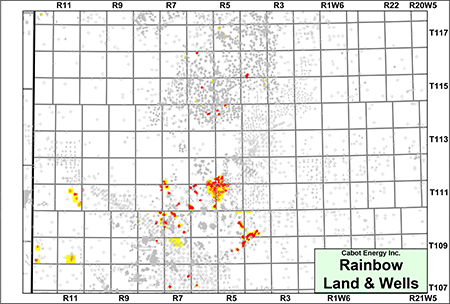

Township 108-118, Range 4-12 W6

At Rainbow, the Company holds largely a 100% working interest in approximately 30 sections of land. The Company produces light oil from the Keg River and Muskeg formations. There is no natural gas sales as the natural gas pipeline infrastructure in the region has been suspended. Sweet natural gas from a Bluesky pool is still consumed for battery fuel gas.

Average daily sales production net to the Company from the Property for the 12 months ended October 31, 2025 was approximately 188 boe/d, consisting of oil and condensate. The Company believes production volumes are able to be readily restored to previous levels in excess of 300 bbl/d of oil.

Operating income net to the Company from the Property for the 12 months ended October 31, 2025 was approximately $47,200 per month or $566,000 on an annualized basis.

The Property includes strategic sour infrastructure ownership that features 3 oil processing batteries with shipping capability via sales pipeline.

At Rainbow, the Company holds largely a 100% working interest in approximately 30 sections of land. The Company produces light oil from the Keg River and Muskeg formations. There is no natural gas sales as the natural gas pipeline infrastructure in the region has been suspended. Sweet natural gas from a Bluesky pool is still consumed for battery fuel gas.

Average daily sales production net to the Company from the Property for the 12 months ended October 31, 2025 was approximately 188 boe/d, consisting of oil and condensate. The Company believes production volumes are able to be readily restored to previous levels in excess of 300 bbl/d of oil.

Operating income net to the Company from the Property for the 12 months ended October 31, 2025 was approximately $47,200 per month or $566,000 on an annualized basis.

The Property includes strategic sour infrastructure ownership that features 3 oil processing batteries with shipping capability via sales pipeline.

Cabot has identified workovers including pump and tubing repairs, recompletions and reactivations which would increase production to 500 bbl/d of oil. Additionally, drilling opportunities have been identified for oil in the pinnacle reefs of the Keg River Formation. There are also many tuck-in acquisition opportunities of shut-in wells and pipelines in the area that are synergistic to the Company’s operations. Cabot believes that production could be increased and maintained at 1,000 bbl/d through low-risk drilling and prudent acquisitions.

Regionally, the Keg River and Muskeg formations are a laterally extensive Middle Devonian carbonite build-up. The target reservoirs at Rainbow consist of built up thick, porous pinnacle reefs within the Keg River and overlying Muskeg, which are charged with hydrocarbons to form several distinct pools on the Company’s lands.

The Company has also identified potential for Bitcoin mining with the large volumes of available natural gas from the Bluesky Formation.

Regionally, the Keg River and Muskeg formations are a laterally extensive Middle Devonian carbonite build-up. The target reservoirs at Rainbow consist of built up thick, porous pinnacle reefs within the Keg River and overlying Muskeg, which are charged with hydrocarbons to form several distinct pools on the Company’s lands.

The Company has also identified potential for Bitcoin mining with the large volumes of available natural gas from the Bluesky Formation.

Rainbow Facilities

At Rainbow, the Company has ownership in numerous facilities including single well batteries, satellites and oil processing batteries equipped with salt water disposal. The Company’s main facilities are the multi-well batteries at 09-25-109-05W6, 13-06-111-06W6 and 13-36-111-06W6.

Further details on the Company’s facilities are available in the virtual data room for parties that sign a confidentiality agreement.

Rainbow Marketing

Summary information and details on Cabot’s marketing and transportation contracts are available in the virtual data room for parties that execute a confidentiality agreement.

Rainbow Seismic

Further details will be available in the virtual data room for parties that execute a confidentiality agreement.

Rainbow Reserves

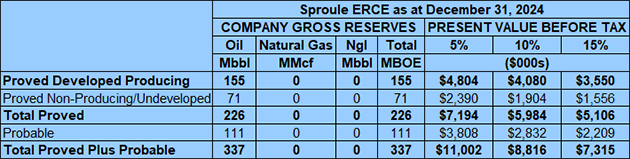

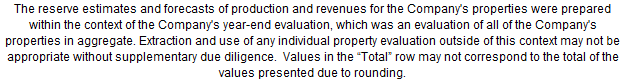

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Property as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2021, using an average of GLJ Ltd., McDaniel and Sproule ERCE’s January 1, 2022 forecast pricing.

McDaniel estimated that as at December 31, 2021 the Property contained remaining proved plus probable reserves of 1.9 million barrels of oil (1.9 million boe), with an estimated net present value of approximately $19.9 million using forecast pricing at a 10% discount.

At Rainbow, the Company has ownership in numerous facilities including single well batteries, satellites and oil processing batteries equipped with salt water disposal. The Company’s main facilities are the multi-well batteries at 09-25-109-05W6, 13-06-111-06W6 and 13-36-111-06W6.

Further details on the Company’s facilities are available in the virtual data room for parties that sign a confidentiality agreement.

Rainbow Marketing

Summary information and details on Cabot’s marketing and transportation contracts are available in the virtual data room for parties that execute a confidentiality agreement.

Rainbow Seismic

Further details will be available in the virtual data room for parties that execute a confidentiality agreement.

Rainbow Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Property as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2021, using an average of GLJ Ltd., McDaniel and Sproule ERCE’s January 1, 2022 forecast pricing.

McDaniel estimated that as at December 31, 2021 the Property contained remaining proved plus probable reserves of 1.9 million barrels of oil (1.9 million boe), with an estimated net present value of approximately $19.9 million using forecast pricing at a 10% discount.

Rainbow Liability Assessment

As of January 11, 2026, the Rainbow property had a deemed liability value of $27.0 million with $12.6 million of that liability associated with active assets.

Rainbow Well List

Click here to download the complete well list in Excel.

As of January 11, 2026, the Rainbow property had a deemed liability value of $27.0 million with $12.6 million of that liability associated with active assets.

Rainbow Well List

Click here to download the complete well list in Excel.

PROCESS & TIMELINE

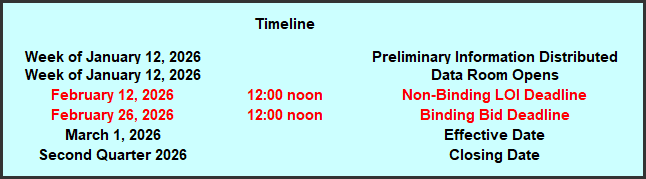

Sayer Energy Advisors is accepting offers, as outlined in the SISP, relating to this process until 12:00 pm on Thursday February 12, 2026.

Sayer Energy Advisors does not typically conduct a "second-round" bidding process; the intention is to attempt to conclude a transaction(s) with the

party(ies) submitting the most acceptable proposal(s) at the conclusion of the process, subject to the terms outlined in the SISP.

party(ies) submitting the most acceptable proposal(s) at the conclusion of the process, subject to the terms outlined in the SISP.

Sayer Energy Advisors is accepting offers, as outlined in the SISP, from interested parties until

noon on Thursday February 12, 2026.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Company with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, deemed liability information, the McDaniel Report, most recent net operations summary, detailed facilities information and other relevant corporate, financial and technical information.

Download Confidentiality Agreement

To receive further information on the Company please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.